Artificial Intelligence (AI) is revolutionising the workforce by enhancing productivity, but it also inadvertently aids those with nefarious intentions. The rise of advanced digital technologies has equipped criminals with tools that make their operations more effective, posing significant risks to both consumers and financial institutions.

As technology evolves, so too do the tactics employed by fraudsters. They now leverage sophisticated AI applications, from hyper-realistic deepfakes to intricate schemes involving counterfeit checks, making it all too easy for them to exploit unsuspecting individuals. “The integration of digital services with rapid payment systems allows wrongdoers to transfer stolen funds across borders swiftly,” explains Jason Lane-Sellers, who oversees Fraud & Identity at LexisNexis Risk Solutions. “This swift movement of money complicates efforts to halt illicit transactions without proactive monitoring.”

Lane-Sellers highlights a disturbing trend: an increase in scams specifically targeting U.S. bank customers who rely heavily on digital financial services. As individuals attempt to navigate this labyrinth of financial trickery, it is essential to stay informed about emerging scams and take steps to safeguard oneself against becoming a victim.

The surge in fraudulent activities is alarming. Recent statistics reveal the extent of the issue—consumers reported losses exceeding $10 billion due to fraud in 2023 alone, representing a staggering 14% rise from the previous year. This marks an unprecedented milestone in fraud losses, underscoring the growing sophistication and effectiveness of scammers.

While there are various forms of fraud, specific types have become particularly notorious. Investment scams lead the pack, racking up an astonishing $4.6 billion in losses, followed closely by imposter scams, which accounted for another $2.7 billion. The banking sector is feeling the repercussions as well; a study conducted by J.D. Power indicates that over a quarter of bank customers encountered fraudulent activity within the past year.

As these threats evolve, one cannot ignore the role of AI in shaping the landscape of crime. With its dual capacity to enhance productivity and facilitate deception, AI stands at the centre of this complex web of challenges faced by consumers and institutions alike. Understanding these dynamics is critical for anyone hoping to navigate the increasingly treacherous waters of modern finance.

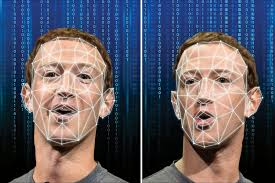

The Rise of New Threats: AI and Deepfakes in Banking

In recent times, the banking industry has found itself grappling with a rising tide of alarming threats posed by artificial intelligence and deepfake technology. A particularly unsettling incident occurred in January 2024 when an employee at a financial firm in Hong Kong was deceived into transferring a staggering $25 million to con artists. This unfortunate event unfolded during what she believed was a legitimate video conference involving her colleagues, including the company’s Chief Financial Officer. Unbeknownst to her, the entire interaction was orchestrated through an intricate deepfake, expertly crafted by scammers.

Adam Ennamli, the chief risk officer at General Bank of Canada, reflects on the shifting landscape of financial fraud. “Last year marked a pivotal moment as we witnessed the widespread adoption of AI as a tool for enhancing productivity. However, this same technology has paved the way for a new breed of scams, which now account for almost half of all fraudulent activities,” he explains. “The lines between cybercrime and traditional fraud have become increasingly indistinct. We’re encountering scenarios where deepfake CEOs solicit wire transfers and criminals employ cloned voices to mislead customer service representatives at banks.”

Looking ahead, experts are sounding alarms about the potential impact of generative AI on financial crime. Predictions indicate that, by 2027, fraud losses in the United States could soar to an astounding $40 billion, with an annual growth rate of 32%.

“Generative AI empowers fraudsters to expand their operations exponentially while keeping costs low,” Ennamli elaborates. “They can produce vast quantities of phishing emails and create authentic-looking social media profiles that easily evade conventional fraud detection mechanisms, thanks to their enhanced sophistication and quality. Each message can be meticulously customised for its intended victim, weaving in personal information harvested from publicly accessible data to craft persuasive social engineering tactics.”

This swift rise in deceptive practices presents a formidable challenge for banks and regulators. The existing risk management frameworks may prove insufficient in countering these sophisticated new threats, leaving financial institutions scrambling to adapt to an ever-evolving landscape of digital deception.

As the banking sector confronts these emerging dangers, vigilance and innovation will be crucial in safeguarding against the potent combination of AI and deepfake technology that threatens the very foundations of trust in financial transactions.

Deceptive Practices Aimed at Bank Clients

In a world where high-tech scams frequently steal the spotlight, it’s important to remember that many fraudsters still rely on age-old tactics to deceive bank customers. These familiar schemes continue to proliferate, preying on unsuspecting individuals.

One prevalent tactic involves creating fake bank fraud alerts. Here, scammers masquerade as representatives of financial institutions, claiming they are investigating unusual activity in the victim’s account. This ruse not only raises alarm but also encourages victims to divulge personal information under the guise of protecting their finances.

Another common scam is the check overpayment scheme, where victims receive counterfeit checks and are instructed to return a portion of the funds before the check inevitably bounces. The emotional manipulation involved can leave individuals feeling embarrassed and financially strained.

Then there are online lending scams, which mainly target those with less-than-stellar credit histories. Fraudsters entice these individuals with promises of easy loans, but the catch often involves surrendering sensitive personal information or paying upfront fees that lead nowhere.

Imposter scams present another layer of deception. In these, criminals impersonate trusted figures—government officials, tech support agents, or other reputable sources—to gain access to bank accounts. This breach of trust can have devastating consequences for victims.

Investment scams also circulate, luring potential investors with promises of returns that seem too good to be true. Often propagated through social media or unsolicited emails, these scams exploit individuals’ desires for financial gain.

The Psychological Aspect: Why People Fall Victim

To effectively combat these deceptive practices, it is essential to understand the psychological factors that lead individuals into their traps. Research conducted by YouGov reveals that a staggering 61% of victims believe they fell prey due to data security breaches. Additionally, 60% acknowledged their lack of awareness regarding the various types of scams in circulation. Other contributing factors include an overly trusting nature when making purchases—cited by 57%—and inadequate protection of personal information, as noted by 52%.

“Trust serves as the bedrock for these scams,” cautions Lane-Sellers. “Fraudsters meticulously build that trust over time, only to leverage it with urgent or emotionally charged requests for money.”

A particularly poignant example of this manipulation is found in romance scams. In these cases, scammers cultivate online relationships with lonely individuals over extended periods. As trust deepens, they fabricate heart-wrenching scenarios—perhaps a medical emergency or a crisis—imploring their victims to take immediate action by sending money, purchasing gift cards, or buying airline tickets.

The intricate web of deception woven by these fraudsters underscores the importance of vigilance and education in safeguarding against such manipulative schemes. Understanding how these tactics operate can empower individuals to protect themselves and their finances in an increasingly complex world.

It’s fascinating to observe how age influences vulnerability to various forms of fraud. In striking contrast, a significant 37% of seniors aged 65 and above have fallen prey to bank and credit account scams. In contrast, a mere 15% of younger adults, those in the 18-29 age bracket, report similar experiences. Yet, it’s the younger generation that finds themselves ensnared by employment scams and fraudulent schemes related to digital payment platforms, showcasing a different kind of risk they face in the modern world.

In response to the increasing threat of fraud, financial institutions and regulatory agencies are stepping up their efforts to safeguard consumers. Banks are pouring substantial resources into advanced technologies like artificial intelligence to identify and thwart fraudulent behaviour. Despite these proactive measures, the swift advancement of scam strategies continues to pose a persistent challenge for these institutions.

As Ennamli explains, “Banks are tirelessly seeking innovative solutions to tackle this issue, ranging from sophisticated behavioural analysis techniques to testing blockchain verification methods.” However, he warns that the landscape is constantly shifting: “We’re perpetually trying to keep pace with emerging threats such as authorised push payment scams and ownership takeovers, where fraudsters hijack legitimate businesses to exploit their suppliers and partners—often including banks themselves.”

While banks’ and regulators’ efforts are essential in fighting fraud, personal vigilance remains an individual’s most effective defence mechanism. Lane-Sellers emphasises the importance of caution: “Consumers need to approach any unexpected and urgent requests for money with serious scepticism. It’s wise to take a step back from your device and consider whether the person asking for funds is genuinely who they claim to be or if the offer sounds too good to be true.”

In this evolving fraud landscape, staying informed and alert can make all the difference in protecting oneself from deceitful schemes.

Here’s the first step: Always confirm any offers, deals, or urgent money requests through an independent source. Reach out directly to your bank or consult with a trusted friend for their insights before proceeding. Follow these precautions to safeguard yourself from scams:

– Do not disclose personal or financial details in response to unexpected phone calls, emails, or text messages.

– Be cautious of demands for immediate action or threats regarding account suspension.

– Utilize strong, unique passwords for all financial accounts and activate two-factor authentication whenever possible.

– Routinely check your bank statements and credit reports for any unusual transactions.

– Approach investment opportunities promising extraordinary returns with scepticism.

– Confirm the legitimacy of any entity requesting financial information by reaching out through official channels.

– Ensure your computer and mobile devices have the latest security updates.

The future of banking fraud

Looking ahead, the realm of bank fraud is expected to grow increasingly intricate. The emergence of cryptocurrencies, decentralised finance, and advanced AI technologies will pose new hurdles for consumers and financial institutions alike.

Nonetheless, technological advancements also bring promise for improved fraud detection and prevention. Banks are investigating the application of biometrics, blockchain technology, and machine learning to bolster security measures and safeguard customer assets.

According to Lane-Sellers, “The newest artificial intelligence and machine learning innovations can uncover hidden behavioural patterns and anomalies in interactions, allowing for the early identification of high-risk scenarios. Organisations should implement these technologies throughout the entire customer experience, not just during payment processing or onboarding, since fraudsters exploit every point of contact.”

Ennamli concurs: “AI certainly contributes to the problem, but it is also emerging as a crucial part of the solution—provided banks can utilise it effectively. This means it won’t resolve the issue on its own, but it may assist in accelerating the resolution process.”

In this continuously evolving struggle against financial fraud, education and vigilance are crucial. By staying updated on the latest scams and approaching unsolicited financial proposals with a healthy dose of scepticism, we can all contribute to protecting our financial security as we navigate the digital era of banking.

In this era of digital banking, where convenience often dances hand in hand with risk, it’s crucial to stay alert. Imagine yourself walking through a bustling marketplace filled with enticing offers and alluring deals. Among the vibrant stalls, some vendors may promise treasures that seem almost magical—too good to be true, perhaps. In such moments, it’s wise to pause and listen to that inner voice guiding you toward caution.

As you navigate this complex landscape, remember that your instincts are powerful allies. If something raises a red flag or feels off-kilter, don’t hesitate to dig deeper before making any commitments. Your financial well-being hinges on this careful approach, ensuring that you protect what matters most in a world filled with both opportunities and potential pitfalls.

Speaking of navigating the future, the latest edition of our magazine unveils insights into the 50 companies poised for success and five investment trends that could shape 2025 and beyond. Join us on this journey as we explore the possibilities that lie ahead.

Maxthon

In the whirlwind of today’s online interactions, where the digital realm is in a constant state of flux, safeguarding oneself while navigating the internet has become increasingly vital. The choice of a web browser that prioritises security and privacy has never been more essential. Among the vast selection of browsers vying for attention, Maxthon Browser emerges as a remarkable contender, addressing these crucial concerns without charging its users a penny. This sophisticated browser is equipped with an impressive suite of built-in features, including an Adblocker and various anti-tracking tools—essential elements for enhancing your online privacy.

Maxthon has successfully established a distinct identity by focusing on crafting a browsing experience that values user safety and confidentiality above all else. With an unwavering commitment to protecting personal information and online activities from numerous potential threats, Maxthon employs a range of robust strategies designed to safeguard user data. By utilising advanced encryption techniques, this browser ensures that sensitive information remains confidential and secure throughout your digital excursions.

When it comes to fortifying privacy during online endeavours, Maxthon truly excels. Every facet of the browser has been meticulously designed with a host of features aimed specifically at elevating your privacy. From its effective ad blockers to comprehensive anti-tracking capabilities and a dedicated incognito mode, these tools work seamlessly together to banish intrusive advertisements and thwart tracking scripts that could disrupt your online experience. As a result, users are free to traverse the internet with an enhanced sense of security. The incognito mode further amplifies this feeling of safety, allowing users to explore the web without leaving behind any digital breadcrumbs or traces on their devices.

Maxthon’s unwavering commitment to user privacy and protection is reflected in its regular updates and continuous enhancements. This dedication to improving user experience not only showcases their resolve but also underscores their mission to create a secure online environment for all. As the digital landscape evolves, Maxthon remains a beacon of hope for those who prioritise their privacy and seek a safe harbour amidst the tumultuous seas of the internet. With each update and new feature, they reaffirm their promise to guard the sanctity of personal information, ensuring that users can navigate the vast expanse of the online world with confidence and peace of mind.