I’ve just reviewed the article about Singapore’s efforts to combat scams. Here are the key points:

Singapore is seeing a significant rise in scam cases, with losses reaching $1.1 billion in 2024, a 70% increase from 2023. The government is implementing several strategies to address this issue:

- Protection from Scam Bills (introduced January 2025) allows police to temporarily restrict banking transactions as a last resort for scammed individuals who refuse to believe they’re victims.

- Banking security improvements being developed:

- FIDO-compliant hardware tokens for stronger authentication

- Cooling-off periods for high-risk transactions

- Enhanced fraud analytics

- Tackling phone-based scams and money mules:

- Limiting how many post-paid SIM cards a person can own

- Making it an offense to register and resell SIM cards

- Imposing penalties for SIM card abuse

- Expanding information sharing with banks on known mule accounts

- Addressing cryptocurrency scams:

- Working with licensed digital payment providers

- Warning the public about cryptocurrency risks

- Online platform regulation:

- The Online Criminal Harms Act requires designated services to implement anti-scam measures

- Telegram is highlighted as a platform of concern, with scam reports nearly doubling in 2024

- Public education initiatives:

- The ScamShield Suite launched in September 2024

- The public can call the ScamShield hotline (1799) for assistance

- Monthly media campaigns targeting vulnerable population segments

The article emphasizes that most scams now involve “self-effected transfers”, where victims are manipulated into willingly transferring money to scammers, often by exploiting emotions like desire for companionship, respect for authority, or greed.

Analysis of Scam Types and Prevention in Singapore

Based on the document, here’s an analysis of the scam types prevalent in Singapore and the prevention strategies being implemented:

Main Scam Types

- Self-Effecting Transfer Scams

- Most common type where victims willingly transfer money to scammers

- Psychological tactics target emotions like desire for companionship, respect for authority, and greed

- Victims often refuse to believe they’re being scammed

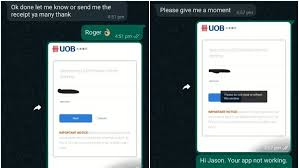

- Malware and Phishing Attacks

- Target bank accounts and online credentials

- Often involve sophisticated technical deception

- Phone/SIM-Based Scams

- Scammers using local phone numbers to make calls and send SMS

- Creates a false sense of legitimacy

- Cryptocurrency Scams

- Fake crypto trading interfaces that simulate profits

- Malware/phishing to drain crypto wallets

- Requesting victims convert money to cryptocurrency to evade banking safeguards

- Social Media and Messaging App Scams

- 60% of scams occur through these platforms

- Telegram specifically mentioned as a platform of concern (scam reports doubled in 2024)

Prevention Strategies

Government Regulatory Measures

- Protection from Scam Bills (January 2025)

- Empowering police to temporarily restrict banking transactions as a last resort

- Target cases where victims refuse to believe they’re being scammed

- SIM Card Regulations

- Limits on post-paid SIM card ownership

- Criminalization of SIM card misuse and transfer

- Penalties for SIM card abuse in scams

- Online Criminal Harms Act

- Requires online services to implement anti-scam measures

- Encourages robust user verification against government-issued IDs

- Potential for additional legislative action against platforms like Telegram

Banking/Financial Protection

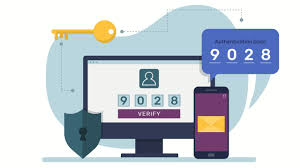

- Enhanced Authentication

- FIDO-compliant hardware tokens being studied

- Requires physical proximity for transaction authentication

- Transaction Safeguards

- Cooling-off periods for high-risk transactions

- Enhanced fraud analytics

- Information sharing on money mule accounts

- Cryptocurrency Protection

- Working with MAS-licensed digital payment token providers

- Strengthening operational links with law enforcement

Public Education and Empowerment

- ScamShield Suite

- Launched September 2024

- Allows the public to check, report, and stay updated on scams

- ScamShield hotline (1799) for assistance

- Targeted Awareness Campaigns

- Monthly media campaigns

- Tailored to vulnerable population segments for specific scam types

Key Challenges and Trends

- Rising Financial Impact

- Total losses reached $1.1 billion in 2024 (a 70% increase from 2023)

- Evolving Tactics

- Scammers pivoting to local phone numbers

- Increased use of cryptocurrency to evade banking safeguards

- Exploitation of anonymity on messaging platforms

- Cross-Platform Nature

- Requires collaboration between government, tech companies, and financial institutions

- International dimension (implied by sophisticated criminal syndicates)

The Singapore approach appears multifaceted. It combines regulatory powers, technological solutions, industry collaboration, and public education to create a comprehensive anti-scam ecosystem. The emphasis on both preventive measures and empowering individuals to recognize scams suggests a balanced strategy to address this growing threat.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

Maxthon private browser for online privacyThis meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.