Ms. Lee, a 48-year-old saleswoman in Singapore, lost over $78,000 (nearly 90% of her life savings) to a job scam in February 2025.

The scam began when someone with a foreign number contacted her on WhatsApp in late 2024 offering a part-time online job. Later, a man calling himself “Charles Khoo” began communicating with her daily. Despite initially suspecting it was a scam, Ms. Lee decided to “play along” because she felt her life lacked excitement and thought she could outwit the scammers.

Over several months, “Charles” built rapport by sending encouraging messages daily. Eventually, he convinced her to try an online job that required:

- Depositing money in cryptocurrency

- Completing brand surveys

- Supposedly getting her deposit back with commission

At first, Ms. Lee invested about $600 and received $700 back. Encouraged by this initial success, she invested increasingly more significant amounts. Even when a cryptocurrency platform warned her about a potential scam during an $11,000 transfer, she trusted “Charles” and sent the money via PayNow instead.

She finally realized she was being scammed when asked to invest $120,000. By then, she had already lost $78,000 and couldn’t withdraw her money.

The article includes insights from mental health professionals who explain that scammers operate as syndicates and are skilled at exploiting psychological vulnerabilities. Dr. Geraldine Tan calls them “the best psychologists” who use techniques like “mirror neurons” to establish similarities with victims and create emotional safety.

According to police statistics, job scams were among the top scams in Singapore in 2024, with over 9,000 cases reported and $156.2 million lost.

Psychology of Manipulation in Ms. Lee’s Case

Ms. Lee’s experience demonstrates classic manipulation tactics used in investment scams:

- Progressive Trust Building: “Charles” spent months sending daily messages before introducing the scam, creating a foundation of trust and emotional connection.

- Small Wins First: The initial $600 investment that returned $700 is a common tactic called “prime and hook,” which gives victims a small win to encourage larger investments.

- Social Engineering: The scammer created a relatable persona (“Malaysian working in Singapore, married with a newborn”) to establish common ground with Ms. Lee.

- Emotional Exploitation: The scammer preyed on Ms. Lee’s boredom and desire for excitement, offering both friendship and financial opportunity.

- Urgency and Escalation: Once engaged, scammers rapidly escalate the required investment amounts before the victim has time to assess the situation properly.

- Bypassing Warning Signs: When the cryptocurrency platform flagged the transaction, the scammer had built enough trust to convince Ms. Lee to ignore this crucial warning and use an alternative payment method.

Common Investment Scam Patterns

Investment scams typically follow these patterns:

- Guaranteed High Returns: Promises of unrealistically high profits with minimal risk

- Exclusive Opportunities: Creating a sense of privilege or limited-time access

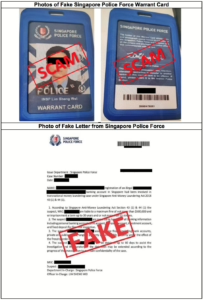

- Manufactured Credibility: Using fake websites, testimonials, or impersonating legitimate companies

- Complex Explanations: Using technical jargon to confuse victims and discourage questions

- Isolation: Encouraging victims to keep the “opportunity” secret from friends and family who might raise concerns

Anti-Scam Measures in Singapore

Singapore has implemented comprehensive measures to combat scams:

- Institutional Frameworks:

- Anti-Scam Centre established by the Singapore Police Force

- Inter-Ministry Committee on Scams coordinates government-wide responses

- ScamShield app to block known scam calls and messages

- Financial Safeguards:

- Bank transaction delays for suspicious transfers

- Cryptocurrency platform warnings (as seen in Ms. Lee’s case)

- SMS alerts for outgoing transfers exceeding specific amounts

- Public Education:

- National Crime Prevention Council’s “Spot the Signs, Stop the Crimes” campaign

- Regular public advisories about emerging scam trends

- ScamAlert website provides up-to-date information on scam tactics

- Legislative Approaches:

- Stringent penalties for scam-related crimes

- Consideration of expanded punishments (the article mentions possible caning for scam offenses)

- Prosecution of money mules who facilitate scams

- Technology Solutions:

- AI-based detection systems in banking platforms

- Phone number verification systems

- Cross-border cooperation to tackle international scam syndicates

Protective Measures for Individuals

To avoid falling victim to similar scams:

- Verify independently: Research investment opportunities through official channels, not just through contacts made online.

- Adopt skepticism: Be wary of opportunities promising above-market returns with minimal risk.

- Consult others: Discuss potential investments with trusted family members or financial advisors.

- Respect warning signs: Take platform warnings seriously, as they often have sophisticated detection systems.

- Remember the rule: If an opportunity seems too good to be true, it probably is.

Singapore’s comprehensive approach combines technological solutions, public education, and enforcement, but as Ms. Lee’s case shows, scammers’ psychological sophistication continues to make these crimes effective despite protective measures.

Investment Scam Prevention Through Singapore’s Ecosystem

Legal Framework in Singapore

Singapore’s legal approach to investment scams includes several key statutes:

- Computer Misuse Act: Addresses technology-facilitated fraud, including impersonation and unauthorized access to financial systems.

- Penal Code Section 415: Defines and penalizes cheating and dishonestly inducing delivery of property, directly applicable to investment scams.

- Securities and Futures Act: Regulates investment solicitations and prohibits false or misleading statements about investment products.

- Organized Crime Act: Provides tools to combat syndicates operating scam networks across borders.

- Payment Services Act: This regulates digital payment services and cryptocurrency exchanges, adding safeguards for transactions.

Recent amendments have strengthened these laws, with courts routinely imposing substantial jail terms for scam-related offenses. The article mentions the consideration of caning, which represents a potential escalation in punitive measures, reflecting the severity with which Singapore views these crimes.

Educational Institutions’ Role

Singapore’s educational system plays a crucial preventative role:

- Financial Literacy Programs: The Ministry of Education has integrated financial literacy into the curriculum, teaching students to evaluate investment opportunities critically.

- Media Literacy Education: Schools teach students to identify misinformation and suspicious online content.

- Tertiary Education Initiatives: Polytechnics and universities offer courses on cybersecurity and fraud prevention.

- School-Based Anti-Scam Campaigns: Student-led initiatives like “Spot the Scam” competitions increase awareness among youth.

- Parent Education Programs: Schools conduct workshops for parents on discussing scam awareness with children, creating multigenerational protection.

Civil Society Engagement

Singapore’s civil society organizations actively combat investment scams through:

- Consumer Association of Singapore (CASE): Provides resources for verifying legitimate investments and reporting suspicious schemes.

- Silver Ribbon Singapore: Focuses on protecting elderly Singaporeans, who are often targeted by scammers.

- Association of Banks in Singapore: Coordinates industry-wide responses to emerging financial scams.

- Community Centers: Conduct grassroots education through RC and CC networks, vital for reaching older residents.

- Professional Bodies: Organizations like the Institute of Singapore Chartered Accountants provide public education on financial fraud.

- Volunteer Initiatives: Programs like SG Cares mobilize volunteers to conduct anti-scam education in HDB estates.

Integrated Community Response

Singapore’s most effective anti-scam measures come from coordination between legal frameworks, educational institutions, and civil society:

- Neighborhood Watch Groups: Trained to recognize and report potential scam activities within housing estates.

- Community Alert Systems: WhatsApp groups and Telegram channels operated by grassroots organizations rapidly disseminate information about new scam tactics.

- Multi-Agency Roadshows: Combine efforts of police, financial institutions, and civil organizations to provide comprehensive education.

- Helplines and Reporting Infrastructure: Easy-access channels for reporting and seeking assistance when encountering potential scams.

Singapore’s distinctive approach leverages its tight social fabric and high institutional trust to create multiple layers of protection against investment scams. This integrated strategy is increasingly necessary as scammers, like those who targeted Ms. Lee, continue to develop sophisticated psychological manipulation tactics.

Comprehensive Prevention Strategies

Individual-level Protection

- Verify independently:

- Never call numbers provided in suspicious messages

- Look up official contact information separately

- Call your bank directly using the number on your card

- Implement technical safeguards:

- Enable multi-factor authentication on all accounts

- Set up transaction notifications for all amounts

- Use bank apps instead of following links

- Set reasonable transaction limits that match your spending patterns

- Practice critical skepticism:

- Be suspicious of unexpected contacts about financial matters

- Question urgent requests for information or money

- Be wary of grammatical errors or generic greetings

- Remember that legitimate institutions never ask for passwords or OTPs

- Follow the “pause principle”:

- Take time before responding to urgent-seeming requests

- Consult with trusted friends or family before large transactions

- Research investment opportunities thoroughly before committing

Red Flags to Watch For

- Unsolicited communications about financial or technical issues

- Requests for remote access to your devices

- Promises of unusually high investment returns

- Pressure to act immediately

- Requests for personal financial information or passwords

- Instructions to transfer money to overseas accounts

- Threats of legal consequences if you don’t comply

By understanding these patterns and implementing these preventive measures, individuals can significantly reduce their vulnerability to common scams. The most effective defense combines technical safeguards with heightened awareness and a healthy skepticism toward unexpected financial communications.

Analysis of Singapore’s Scam Prevention Approach

Government and Institutional Measures

Based on the article, Singapore has implemented several institutional approaches to combat scams:

- Monetary Authority of Singapore (MAS) Initiatives:

- Working directly with banks to enhance digital banking security

- Implementing new protective measures like eliminating clickable links in official emails/SMSes

- Requiring a minimum 12-hour delay before activating new soft tokens on mobile devices

- Providing specific guidance to banking customers on safe practices

- Police Force Involvement:

- The Singapore Police Force (SPF) actively tracks and reports on scam statistics

- Conducts investigations of scammers and money mules (as evidenced by the case involving 170 men and 89 women)

- Shares examples and screenshots of scams to raise public awareness

- Banking Sector Protections (specifically highlighted for DBS):

- Stopping non-essential SMSes with links

- Sending only essential communications like security notifications and OTP authentication

- Implementing default transaction notification thresholds (S$100)

- Providing in-app security features like card locking and customizable spending limits

- Offering digital tokens with enhanced encryption

Effectiveness Analysis

The approach appears to be multi-faceted, combining:

- Technical barriers: Implementing security features that make scamming more difficult

- Public education: Raising awareness about standard scam techniques

- Enforcement: Actively investigating scam cases

However, the rising scam statistics mentioned (16% increase in cases, with amounts cheated rising from S$63.5M to S$168M) suggest these measures may be struggling to keep pace with evolving scam techniques.

Strengths of Singapore’s Approach

- Coordinated response: Collaboration between regulatory bodies (MAS), law enforcement (SPF), and financial institutions

- Customer-focused solutions: Tools that give customers more control over their security

- Practical implementation: Specific, actionable measures rather than just general advice

Potential Gaps and Recommendations

- Technology gap: The article doesn’t mention advanced detection technologies like AI for identifying unusual transaction patterns

- Demographic considerations: No specific mention of tailored approaches for vulnerable groups like seniors

- Private sector cooperation: Limited discussion of how businesses beyond banks are involved in prevention

- International coordination: No mention of cooperation with other countries to address overseas-based scammers

Singapore’s approach appears to be comprehensive but could potentially benefit from more advanced technological solutions and broader cooperation across sectors and borders to address the evolving nature of scams.

Social Engineering: Anatomy of Manipulation and Defense

Social Engineering Techniques

Psychological Manipulation Strategies

- Authority Impersonation

- Scammers pose as official representatives (e.g., bank officers, government officials)

- Exploit victims’ respect for authority and tendency to comply with perceived authoritative figures.

- Use official-sounding language, titles, and fabricated credentials.

- Fear and Urgency Tactics

- Create artificial time pressures to prevent critical thinking

- Trigger emotional responses like panic or anxiety

- Common threats include:

- Legal consequences

- Financial penalties

- Account suspension

- Potential criminal investigations

- Trust Building and Rapport

- Develop a seemingly genuine conversational flow

- Use personal details to appear credible

- Gradually escalate requests, starting with minor, seemingly innocuous asks

- Exploit human tendency to be helpful and avoid confrontation

- Information Harvesting

- Collect fragmentary personal information from multiple sources

- Use social media, public databases, and previous data breaches

- Craft highly personalized, convincing narratives

Technical Manipulation Methods

- Phishing Techniques

- Spoofed communication channels

- Lookalike websites and email addresses

- Malicious links and attachments

- Screen sharing and remote access exploitation

- Multi-Stage Scam Progression

- Complex narratives involving multiple fake personas

- Gradual erosion of victim’s skepticism

- Continuous redirection and technical jargon

Prevention Strategies

Personal Awareness and Education

- Critical Thinking Development

- Always verify unsolicited communications independently

- Use official contact methods from verified sources

- Never click links or download attachments from unknown sources

- Recognize and resist emotional manipulation

- Communication Red Flags

- Unsolicited contact requesting personal information

- Pressure to act immediately

- Requests for financial transfers

- Communication via unofficial channels

- Threats or aggressive language

Technical Protective Measures

- Digital Security Practices

- Use multi-factor authentication

- Regularly update software and security systems

- Install reputable antivirus and anti-malware solutions

- Use dedicated communication and banking apps

- Enable transaction notifications

- Information Protection

- Minimize public personal information sharing

- Use privacy settings on social platforms

- Create complex, unique passwords

- Regularly monitor financial statements

- Use virtual credit cards for online transactions

Institutional and Technological Interventions

- Technological Defenses

- Implement AI-driven fraud detection systems

- Develop advanced caller ID and communication verification tools

- Create comprehensive scam reporting mechanisms

- Educational Initiatives

- Regular public awareness campaigns

- School and workplace training programs

- Clear, accessible resources on emerging scam techniques

- Collaborative efforts between government, tech companies, and financial institutions

Psychological Resilience

- Emotional Intelligence

- Recognize personal emotional triggers

- Practice calm, methodical responses to unexpected communications

- Develop healthy skepticism without becoming paranoid

- Community Awareness

- Share scam experiences

- Supporting vulnerable community members

- Create support networks for scam victims

Emerging Trends

- Increasing sophistication of AI in social engineering

- Cross-platform information integration

- More personalized, contextually relevant scam attempts

Conclusion

Social engineering exploits fundamental human psychological vulnerabilities. Comprehensive defense requires a multi-layered approach combining technological solutions, personal awareness, and continuous education.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

Maxthon private browser for online privacyThis meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.