Singapore as “Blue Zone 2.0”

The article discusses how Singapore has been recognized as a “Blue Zone 2.0” by National Geographic journalist Dan Buettner, who coined the term “Blue Zone” to describe places where people live exceptionally long lives due to naturally healthy lifestyles. Singapore joins five original Blue Zones (Okinawa, Ikaria, Loma Linda, Sardinia, and Nicoya).

Key Health Statistics

- Singapore’s life expectancy increased from 65 years in 1965 to 83 years in 2023

- People in Singapore live about three years longer every decade

- Singapore’s life expectancy exceeds the global average by more than a decade

- Singapore has over 1,500 centenarians

Healthier SG Program

- Launched in 2023

- Encourages people aged 40+ to choose a doctor for ongoing care

- Promotes preventive healthcare through annual check-ups and physical examinations every three years

- Provides 100% subsidies for various vaccinations (flu, pneumococcal, hepatitis B, varicella)

- Aims to prevent or delay health conditions before they develop

Government “Nudges” for Health

- Healthier Choice symbols and Nutri-Grade ratings for food

- Strategic placement of parks and connectors near residential areas

- Encouraging hawkers and restaurants to offer healthier meal options

- Health Minister Ong Ye Kung believes these nudges have become part of Singapore’s culture

Long-Term Vision

- Deputy Prime Minister Gan Kim Yong notes that Healthier SG is critical for managing healthcare costs.

- The goal is to keep more people healthy longer, reducing their need for healthcare services.

- DPM Gan acknowledges the results “will not be shown in our lifetime” but will benefit future generations

Analysis of Singapore’s Blue Zone Status: Health and Economic Implications

How Singapore Became a Blue Zone

Unlike traditional Blue Zones that developed organically, Singapore represents what Dan Buettner called an “engineered longevity hot spot” through deliberate policy interventions:

- Policy-Driven Approach: Singapore achieved Blue Zone status through systematic government policies rather than through traditional cultural practices or geographical advantages.

- Strategic “Nudges”: The government implemented various nudges that gradually changed behavior:

- Food labeling systems (Healthier Choice symbols, Nutri-Grade ratings)

- Urban planning centered around physical activity (parks and connectors near residences)

- Encouraging food establishments to offer healthier options

- The recent Healthier SG program targeting preventive care

- Results-Oriented Planning: These interventions yielded remarkable results – life expectancy increased from 65 years in 1965 to 83 years in 2023, representing a consistent gain of approximately three years per decade.

Implications for Healthcare Funding and Costs

Current Challenges

- Aging Population Pressure: With one of the world’s longest life expectancies and over 1,500 centenarians, Singapore faces increased healthcare demand from its aging population.

- Rising Healthcare Expenditure: As noted in the article, healthcare spending could reach $30 billion annually by 2030 – a substantial economic burden for a nation of Singapore’s size.

- Extended Care Periods: Longer lifespans mean longer periods requiring healthcare support, potentially straining existing systems.

Economic Shifts

- Preventive vs. Reactive Spending: Healthier SG represents a fundamental shift from treating illnesses to preventing them – a potentially more cost-effective approach in the long term.

- Subsidization Strategy: The government’s decision to fully subsidize preventive measures (vaccinations, screenings) reflects an economic calculation that prevention costs less than treatment.

- Payment System Restructuring: As DPM Gan Kim Yong noted, Singapore is restructuring “the entire payment and health financing system” to align with the Healthier SG concept – a significant economic transformation.

Future Economic Needs and Challenges

- Long-Term Investment Horizon: The preventive approach requires substantial upfront investment with delayed economic returns. DPM Gan acknowledged that results “will not be shown in our lifetime.”

- Healthcare Workforce Adaptation: Singapore’s healthcare system must evolve from an acute care focus to preventive and primary care expertise, requiring workforce retraining and restructuring.

- Insurance Model Evolution: Insurance systems may need to be recalibrated to better reward preventive behaviors and primary care engagement rather than simply covering treatments.

- Sustainability Concerns: While preventive care may reduce costs per individual, population aging may still increase overall healthcare spending, requiring ongoing funding solutions.

- Equity Challenges: Ensuring equal access to preventive resources across socioeconomic groups will be crucial to maintain Singapore’s longevity gains.

Analysis of Success Factors and Limitations

Success Factors

- Governance Continuity: Singapore’s ability to maintain policy direction across leadership changes (as seen in the handoff from DPM Gan to Minister Ong) enables long-term health strategies.

- Integrated Approach: Singapore’s Blue Zone success comes from simultaneously addressing multiple health determinants—diet, activity, healthcare access, and environmental design.

- Data-Driven Policy: Singapore’s extensive health data collection allows for targeted interventions and cost-effectiveness analysis.

Limitations and Challenges

- Economic Trade-offs: Resources allocated to preventive healthcare represent opportunity costs in other sectors.

- Cultural Sustainability: Singapore’s Blue Zone status is “engineered,” raising questions about its sustainability without continued policy reinforcement.

- Global Economic Factors: External economic shocks could challenge Singapore’s ability to maintain current subsidy levels for preventive care.

Singapore’s evolution into a Blue Zone represents a case study in how deliberate policy can transform population health outcomes with significant economic implications. The nation’s experience suggests that while the upfront costs of preventive healthcare are substantial, they may offer a path to more sustainable healthcare financing in the face of population aging.

MediShield Life in Singapore: A Comprehensive Overview

Background and Purpose

MediShield Life is Singapore’s universal health insurance scheme administered by the Central Provident Fund (CPF) Board. Introduced in 2015, it replaced the previous MediShield program and represents a core component of Singapore’s healthcare financing strategy. Unlike its predecessor, MediShield Life provides universal coverage for all Singapore citizens and Permanent Residents, regardless of age or pre-existing conditions.

Key Features of MediShield Life

1. Universal and Mandatory Coverage

- Universal Protection: Covers all Singapore citizens and Permanent Residents for life

- No Opt-Out Option: Participation is mandatory to ensure a vast risk pool

- Lifelong Coverage: Unlike the previous MediShield, which had an age limit, MediShield Life provides coverage from birth to death

2. Coverage Scope

MediShield Life primarily covers:

- Hospitalization expenses in B2/C wards of public hospitals

- Selected outpatient treatments, including:

- Chemotherapy and radiotherapy for cancer

- Kidney dialysis

- Immunosuppressants for organ transplants

- Certain costly outpatient treatments

3. Financial Structure

- Premiums: Age-based premiums that increase with age

- Premium Payment: Typically paid through Medisave accounts (part of CPF)

- Government Subsidies: Premium subsidies are available for lower and middle-income households

- Additional Support: Pioneer Generation and Merdeka Generation seniors receive additional subsidies

4. Cost-Sharing Components

MediShield Life incorporates several cost-sharing mechanisms:

- Deductibles: An initial amount patients must pay before insurance coverage kicks in (ranges from $1,500 to $3,000 per policy year depending on ward class and age)

- Co-insurance: After the deductible, patients pay a percentage of the bill (ranges from 3% to 10%, decreasing for larger bills)

- Claim Limits: There are limits on daily ward charges, surgical procedures, and other treatments

- Annual Claim Limit: Cap on the maximum amount claimable per year

- Lifetime Claim Limit: Removed in the 2015 upgrade from MediShield to MediShield Life

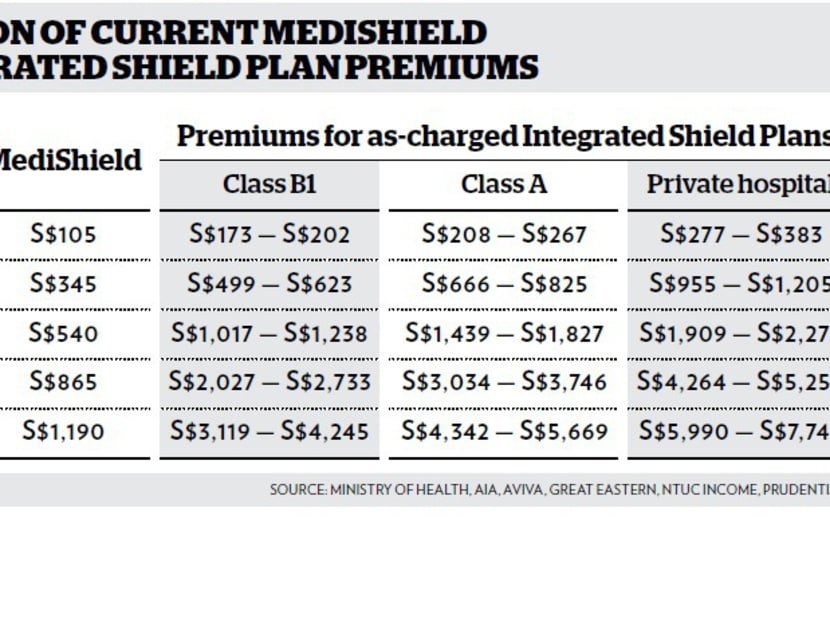

Relationship with Integrated Shield Plans (IPs)

Many Singaporeans supplement MediShield Life with Integrated Shield Plans:

- What They Are: Private insurance plans that build upon the base MediShield Life coverage

- Additional Coverage: Typically provide coverage for higher-class wards (B1, A, or private hospitals) and enhanced benefits

- Structure: Consist of two components – the fundamental MediShield Life component administered by CPF and the additional private insurance component

- Payment Options: The additional component can be paid through Medisave (subject to withdrawal limits) or cash

MediShield Life in the Context of Singapore’s Healthcare Financing

MediShield Life works in conjunction with other healthcare financing pillars:

- Medisave: A mandatory medical savings account that’s part of the CPF system

- MediFund: An endowment fund that acts as a safety net for those who cannot afford their medical bills

- Government Subsidies: Direct subsidies at public healthcare institutions

- Private Insurance: Including Integrated Shield Plans and other private health insurance

Recent Enhancements and Future Direction

MediShield Life undergoes periodic reviews to ensure it remains relevant:

- 2021 Major Review: Implemented higher claim limits, extended coverage to include more outpatient treatments, and raised premiums to maintain long-term sustainability

- Alignment with Healthier SG: In line with the article, MediShield Life complements the Healthier SG initiative by focusing on the treatment aspect, while Healthier SG emphasizes prevention

Strengths and Limitations

Strengths

- Universal coverage regardless of health status

- Lower premiums compared to fully private insurance

- Government subsidies to ensure affordability

- No lifetime claim limits

Limitations

- Designed primarily for subsidized care (B2/C wards)

- Significant out-of-pocket costs through deductibles and co-insurance

- Does not fully cover all medical conditions or treatments

- Limited coverage for outpatient care

MediShield Life exemplifies Singapore’s approach to healthcare financing – combining individual responsibility (through premiums and cost-sharing) with government support (through subsidies and universal coverage guarantees). As Singapore continues to develop its Blue Zone status through initiatives like Healthier SG, MediShield Life provides a financial safety net that enables the healthcare system to focus increasingly on preventive approaches while maintaining protection against major

The Complexities of Integrated Shield Plan Riders in Singapore

Integrated Shield Plan (IP) riders in Singapore’s healthcare system introduce several layers of complexity to the basic MediShield Life framework. These riders have evolved significantly over time and present both benefits and challenges for policyholders, insurers, and the broader healthcare ecosystem.

Evolution of IP Riders

Originally, IP riders were designed to cover the deductible and co-insurance portions of Integrated Shield Plans, effectively allowing “as-charged” or “full coverage” with little to no out-of-pocket expenses. However, this model created several systemic issues:

- Moral Hazard: With zero or minimal out-of-pocket costs, patients and healthcare providers had reduced incentives to control healthcare costs, potentially leading to overutilization of services and treatments.

- Premium Inflation: The resulting increase in claims drove substantial premium increases, making riders increasingly unaffordable, especially for older policyholders.

- Unsustainable Model: In 2018, the Ministry of Health (MOH) expressed concerns about the sustainability of the “full rider” model, noting its contribution to rising healthcare costs.

The 2018 Regulatory Intervention

In March 2018, MOH implemented significant reforms requiring all new IP riders to incorporate a minimum co-payment of 5% for policyholders. This move aimed to:

- Restore patient “skin in the game” to encourage more prudent healthcare decisions

- Slow the rate of medical inflation

- Improve the long-term sustainability of health insurance

Existing policyholders with full riders were generally allowed to retain their coverage, creating a two-tier system with grandfathered plans and new co-payment rider plans.

Current Rider Landscape

Today’s IP rider market features several types:

- Co-payment Riders: Require at least 5% co-payment (up to an annual cap) but cover most of the deductible and remaining co-insurance

- Critical Illness Riders: Provide additional coverage specifically for critical illnesses

- Cash Benefit Riders: Offer daily cash benefits during hospitalization

- Pre/Post-Hospitalization Riders: Extend coverage to medical expenses before and after hospitalization

- Legacy “Full” Riders: Grandfathered plans from before 2018 that may still offer “as-charged” coverage

Key Complications and Challenges

For Policyholders

- Premium Volatility: Riders often experience steeper premium increases than the base IP, particularly at older ages

- Complexity and Confusion: Many policyholders do not fully understand the coverage limits, exclusions, and benefits of their riders

- Affordability Concerns: As policyholders age, rider premiums can become prohibitively expensive, sometimes forcing them to drop coverage when they’re most likely to need it

- Medisave Limitations: Riders generally must be paid using cash rather than Medisave, creating budget strain for many households

For the Healthcare System

- Induced Demand: Despite co-payment requirements, riders still subsidize much of the cost-sharing, potentially driving overutilization

- Provider Behavior: Knowledge that patients have riders may influence provider recommendations toward more expensive treatments or private facilities

- Class Stratification: This creates a multi-tier healthcare system where rider policyholders may receive different levels of care or access

- Cost Spiral: The interaction between insurance coverage, provider charges, and utilization can create a self-reinforcing cycle of medical inflation

For Insurers

- Anti-Selection: People who expect to use more healthcare services are more likely to purchase and maintain riders

- Pricing Challenges: Difficult to accurately price riders in an environment of rapidly changing medical technology and costs

- Balance Sheet Pressure: Rising claims costs in rider portfolios require either premium increases (risking customer dissatisfaction) or absorbing losses

- Regulatory Constraints: Insurers must navigate MOH regulations while maintaining competitive offerings

Recent Developments

Several newer trends are reshaping the rider landscape:

- Panel Restrictions: Many insurers now offer lower premiums for riders that restrict coverage to specific doctor panels

- Tiered Co-payment: Some newer riders implement higher co-payments for non-panel doctors to encourage network utilization

- Pre-authorization Requirements: Increasingly common conditions requiring approval before specific procedures

- Wellness Integration: Some riders now incorporate wellness benefits or premium discounts for healthy behaviors, aligning with Singapore’s Healthier SG initiative

Future Outlook

The rider market in Singapore continues to evolve in response to cost pressures, regulatory guidance, and consumer expectations. Looking ahead:

- The distinction between pre-2018 full riders and newer co-payment riders will eventually diminish as grandfathered policyholders age out of the system

- Panel-based approaches will likely become more prevalent as insurers seek to control costs through network management

- Greater integration with preventive care initiatives like Healthier SG may emerge as insurers seek to reduce long-term claims costs.

- Further regulatory refinements may be necessary if current measures prove insufficient to control medical inflation.

The rider system presents both opportunities and challenges in the context of Singapore’s Blue Zone ambitions. While comprehensive coverage can provide financial security during illness, the system must be carefully balanced to avoid undermining the cost-consciousness and preventive focus that are essential to the Healthier SG vision.

As reported by GlobalData, the general insurance sector in Singapore is anticipated to experience a compound annual growth rate (CAGR) of 6.2%, potentially reaching S$8.1 billion (approximately $5.9 billion) in gross written premiums (GWP) by 2029, an increase from S$6.0 billion ($4.4 billion) in 2024.

Growth is expected to be around 6.4% in 2025, driven by regulatory advancements, economic growth, and a rising interest in private health insurance.

According to Swarup Kumar Sahoo, a senior insurance analyst at GlobalData, the industry’s profitability is projected to remain robust, with a combined ratio of 86% in 2024, reflecting effective management of claims and expenses.

The Monetary Authority of Singapore (MAS) has implemented various regulatory initiatives aimed at enhancing market growth, including a streamlined process for insurance product approvals set to begin in November 2024 and the introduction of the Cybersecurity (Amendment) Bill in May 2024.

Additionally, in July 2024, MAS released Fit and Proper Criteria guidelines to ensure that insurance sector professionals meet standards of competence and integrity.

In the evolving insurance landscape, Personal Accident and Health (PA&H) insurance is poised to maintain its status as the largest segment within the industry. By the year 2025, it is anticipated to represent a substantial 23.8% of the Gross Written Premium (GWP), with a robust growth rate of 7.6%. This surge can be attributed to several factors, notably the escalating costs associated with healthcare and the burgeoning tourism sector that continues to attract visitors from around the globe.

Furthermore, the country’s demographic shift plays a crucial role in this narrative. With projections indicating that individuals aged 65 and older will constitute 24.1% of the population by 2030, the demand for PA&H insurance is expected to witness a compound annual growth rate (CAGR) of 6.8% from 2025 through 2029. This ageing demographic underscores the importance of health-related coverage as more individuals seek protection against unforeseen medical expenses.

In contrast, motor insurance is the second-largest segment in this dynamic market. By 2025, it is expected to account for approximately 19.8% of GWP, with an anticipated growth rate of 6.2%. This increase is primarily driven by a notable rise in vehicle sales, reflecting a society that is increasingly reliant on personal transportation.

As we delve deeper into these statistics, it becomes clear that the interplay between an ageing population, rising healthcare costs, and evolving consumer behaviours is profoundly shaping the future of insurance. Each segment not only reflects current trends but also sets the stage for what lies ahead in a rapidly changing world.

Between January and October of 2024, the landscape of vehicle registrations saw a remarkable surge, climbing by an impressive 30% compared to the same timeframe in 2023. This increase is not merely a coincidence; it reflects the ongoing evolution of the automotive industry, particularly in the realms of electric and autonomous vehicles. As these innovative technologies gain traction, they are supported by government policies aimed at phasing out diesel buses by 2040. This shift is expected to have far-reaching implications, including a notable expansion in the motor insurance market, which analysts predict will grow at a compound annual growth rate (CAGR) of 3.6% from 2025 to 2029.

Meanwhile, another segment of the insurance landscape is also poised for growth. Property insurance, currently the third-largest sector within this domain, is forecasted to represent 17.9% of gross written premium (GWP) by 2025. This growth, anticipated at a robust rate of 5.1%, is driven by a burgeoning demand for construction and the emergence of new public infrastructure projects. Looking ahead, property insurance is set to experience a CAGR of 7% over the next five years, highlighting its vital role in supporting the economic development and urbanisation that our society continues to pursue.

Thus, as we navigate through these transformative times, both the motor and property insurance sectors stand to benefit significantly from technological advancements and infrastructural demands, setting the stage for a dynamic future filled with opportunities.

Between January and October of 2024, the landscape of vehicle registrations saw a remarkable surge, climbing by an impressive 30% compared to the same timeframe in 2023. This increase is not merely a coincidence; it reflects the ongoing evolution of the automotive industry, particularly in the realms of electric and autonomous vehicles. As these innovative technologies gain traction, they are supported by government policies aimed at phasing out diesel buses by 2040. This shift is expected to have far-reaching implications, including a notable expansion in the motor insurance market, which analysts predict will grow at a compound annual growth rate (CAGR) of 3.6% from 2025 to 2029.

Meanwhile, another segment of the insurance landscape is also poised for growth. Property insurance, currently the third-largest sector within this domain, is forecasted to represent 17.9% of gross written premium (GWP) by 2025. This growth, anticipated at a robust rate of 5.1%, is driven by a burgeoning demand for construction and the emergence of new public infrastructure projects. Looking ahead, property insurance is set to experience a CAGR of 7% over the next five years, highlighting its vital role in supporting the economic development and urbanisation that our society continues to pursue.

Thus, as we navigate through these transformative times, both the motor and property insurance sectors stand to benefit significantly from technological advancements and infrastructural demands, setting the stage for a dynamic future filled with opportunities

Navigating Safely Through the Digital Frontier

In a time when the internet has woven itself into the very fabric of our daily lives, protecting our online identity has never been more crucial. Imagine setting out on an exhilarating expedition across the boundless landscapes of cyberspace, where every click reveals new knowledge and thrilling adventures. However, within this vast digital expanse, hidden threats loom—perils that could compromise your personal information and overall security. To journey through this complex web with confidence, selecting a browser that emphasises your protection is essential. Enter Maxthon Browser, your reliable ally in this quest, available to you at no cost.

What Sets Maxthon Apart on Windows 11

Maxthon stands out from conventional web browsers due to its unwavering commitment to safeguarding your digital privacy. Imagine it as a diligent sentinel, perpetually alert to the numerous risks that inhabit the online world. Equipped with a robust arsenal of built-in features—including Adblock and anti-tracking capabilities—Maxthon tirelessly strives to protect your browsing identity. With Maxthon on Windows 11, these protective measures form a powerful barrier against unwelcome advertisements and prevent websites from prying into your online activities.

Maxthon Browser’s Flawless Harmony with Windows 11

As you navigate the vast internet landscape on your Windows 11 device, Maxthon’s commitment to your privacy becomes increasingly evident. The browser employs cutting-edge encryption methods to shield your sensitive data during your digital journeys. This ensures that as you explore the uncharted realms of the web, you can feel confident that your information remains secure from those who might seek to invade your privacy.

But this journey through the digital frontier offers more than just safety; it opens up a treasure chest of opportunities waiting to be discovered.