This is a news report about a Singaporean woman who was arrested in Taiwan for suspected involvement in scam and money laundering activities. Here are the key details:

- A 27-year-old Singaporean woman (identified only as KHT) was arrested in Taiwan’s Yunlin county.

- She has been in detention since March 9, 2025

- She entered Taiwan on February 21, 2025

- She was discovered withdrawing large sums from an ATM on March 7

- Authorities prevented her from leaving Taiwan on March 8

- She’s suspected of withdrawing approximately NT$7.46 million (S$302,000)

- A 54-year-old local Taiwanese man had been driving her around after her arrival

- Three more locals (two men and one woman) were arrested on April 9 in connection with the case

- All suspects are being investigated for fraud, money laundering, and organised crime

- If convicted of fraud involving at least NT$5 million, the penalty can include up to 10 years in prison and a fine of up to NT$30 million

The Taiwanese authorities have issued a warning to foreigners that even being driven to withdraw illicit funds may make them complicit in criminal activity and subject to prosecution.

Analysis of the Bank Scam in Taiwan Case

Based on the news article, I’ll analyse the apparent scam operation, though many specific details about the mechanics aren’t explicitly stated. This appears to be a cross-border money laundering scheme with several notable characteristics:

Key Elements of the Scam

- International Operatives: The scam involved a Singaporean national (KHT) working with at least four Taiwanese locals, suggesting an organised international criminal network.

- Money Mule Operations: The Singaporean woman appears to have functioned as a money mule – someone who transfers illegally obtained money on behalf of others, often withdrawing cash to break the digital trail.

- Large Cash Withdrawals: She withdrew approximately NT$7.46 million (S$302,000) from ATMS, suggesting:

- The operation involved significant financial resources

- They were likely trying to convert electronic funds to untraceable cash

- Logistical Support Network: A local 54-year-old Taiwanese man provided transportation services, showing the organisation had local infrastructure.

- Concealed Identity: The woman attempted to conceal her identity while using an ATM (wearing a mask and hoodie), indicating awareness of surveillance systems.

- Short-Term Operation: The woman entered Taiwan on February 21 and was caught on March 7-8, suggesting these operations are designed to be brief before moving on.

Potential Scam Mechanics (Based on Similar Cases)

While not explicitly detailed in the article, this operation likely fits one of these common patterns:

- Phishing or Social Engineering: Victims are tricked into transferring money to bank accounts controlled by the criminal group.

- Love/Romance Scams: The article mentions a separate case where a Singapore student was saved from a love scammer, suggesting this might be a common tactic in the region.

- Investment Scams: Victims believe they’re investing in legitimate opportunities but funds are actually stolen.

- Business Email Compromise: Corporate accounts are compromised and fraudulent transfers are initiated.

- Money Laundering Service: The operation might be providing laundering services for other criminal enterprises.

Prevention Strategies

For Individuals

- Verify Financial Requests: Never transfer money based solely on calls, emails, or messages without independent verification.

- Be Wary of Urgent Requests: Scammers often create false urgency to prevent rational thinking.

- Research Investment Opportunities: Verify the legitimacy of any investment through official channels.

- Protect Personal Information: Be cautious about sharing personal or financial information online.

- Use Strong Authentication: Enable two-factor authentication on financial accounts.

- Monitor Accounts: Regularly check bank statements for unauthorized transactions.

- Be Skeptical of New Romantic Interests: Especially those who quickly develop intense relationships online and soon ask for financial assistance.

For Banks and Financial Institutions

- Enhanced Transaction Monitoring: Implement systems to detect suspicious withdrawal patterns.

- Customer Education: Provide clear information about common scams to customers.

- Withdrawal Limits: Enforce ATM withdrawal limits and additional verification for large withdrawals.

- Hold Periods: Implement hold periods for unusual transactions.

- Cross-Border Cooperation: Share information about scam patterns internationally.

Anti-Scam Resources in Singapore

- ScamShield App: A mobile application developed by the Singapore government that blocks known scam calls and messages.

- Anti-Scam Centre: Run by the Singapore Police Force, it coordinates anti-scam efforts and facilitates recovery of scammed funds.

- ScamAlert Website (www.scamalert.sg): Provides information on latest scams and prevention tips.

- Police Hotline: Call 1800-255-0000 to report scams.

- National Crime Prevention Council: Conducts anti-scam awareness campaigns.

- Anti-Scam Helpline: Call 1800-722-6688 for scam-related advice.

- Bank Fraud Hotlines: Each major bank in Singapore has dedicated fraud reporting hotlines.

- Community Support Groups: Various support groups exist for scam victims, offering emotional support and practical advice.

- Jaga Your Money Scams Campaign: A Singapore public education initiative to raise awareness about scams.

- Project OASIS: An online verification tool allowing users to check if a bank account or phone number has been linked to reported scams.

The case highlights the increasingly sophisticated nature of international scam operations and the importance of both individual vigilance and institutional safeguards. The fact that local authorities in Taiwan were able to detect suspicious ATM activity suggests that monitoring systems are working to some degree, but prevention remains the best protection.

Analysis of the Likely Money Laundering Operation

Based on the details in the news article, this case displays several hallmark characteristics of an organized money laundering operation rather than an isolated scam. Let’s examine the evidence that suggests this is part of a larger criminal syndicate:

Indicators of Syndicate Activity

1. International Structure and Division of Labour

The operation involves participants from at least two countries (Singapore and Taiwan) with clearly defined roles:

- The Singaporean woman (KHT) appears to be a specialized money mule

- The Taiwanese driver provided logistical support

- Three additional local accomplices were later arrested

- More unseen participants likely obtained the funds initially

This international structure with specialized roles is typical of sophisticated criminal syndicates rather than opportunistic scammers.

2. Large-Scale Financial Operations

The scale of the financial transactions (NT$7.46 million or S$302,000) suggests an established operation with significant resources. Individual scammers rarely handle such large sums.

3. Operational Security Measures

Several security-conscious behaviors indicate professional criminal activity:

- The woman concealed her identity at ATMs

- She planned to quickly enter and exit Taiwan (Feb 21 – Mar 8)

- The group likely used intermediary accounts to obscure the money trail

4. The Three-Phase Money Laundering Process

This operation exhibits classic signs of systematic money laundering:

- Placement: The initial funds were likely deposited into the banking system through various fraudulent schemes (not detailed in the article).

- Layering: The money was moved through multiple accounts to obscure its origin, eventually reaching accounts the Singaporean woman could access.

- Integration: By converting digital funds to cash, the operation was attempting to complete the laundering cycle, making the money untraceable and available for legitimate-appearing use.

5. Connection to Organized Crime Charges

Notably, the authorities are investigating charges of “fraud, money laundering and organised crime,” with the explicit mention of organized crime indicating law enforcement believes this is part of a larger criminal structure.

Syndicate Operations Model

This case likely represents what’s known as a “money laundering service” within the criminal ecosystem. Such operations:

- Provide Services to Other Criminals: They launder proceeds from various crimes (fraud, drug trafficking, etc.)

- Employ a Network of Mules: They recruit individuals (often with clean records) to move money across borders.

- Use Shell Companies/Accounts: They create legitimately business fronts.

- Operate Across Multiple Jurisdictions: They exploit differences in regulatory environments and complicate law enforcement cooperation.

The Singaporean woman may have been:

- A recruited mule who knew she was participating in illegal activity

- A professional money mule who travels to different countries for similar operations

- A mid-level operative with greater knowledge of the syndicate’s structure

Why Taiwan and Singapore?

This route is strategically advantageous for money laundering:

- Both have well-developed banking systems

- Strong economic ties create high transaction volumes that can mask illegal transfers

- Different legal jurisdictions complicate investigations

- Geographic proximity allows for quick travel

The fact that authorities in two countries are now involved suggests this may lead to the unraveling of a larger network extending beyond just these individuals. The case illustrates how modern money laundering syndicates operate across borders, using layers of participants to distance the criminal proceeds from their origins.

Methods to Prevent Money Muling in Singapore

Regulatory and Banking Measures

Transaction Monitoring Systems

- Real-time transaction monitoring utilizing AI to detect unusual patterns

- Intelligent systems flagging rapid deposits followed by withdrawals

- Automated alerts for transactions involving high-risk jurisdictions

- Velocity checks that identify unusual account activity rates

Account Opening Procedures

- Enhanced due diligence for new accounts, especially business accounts

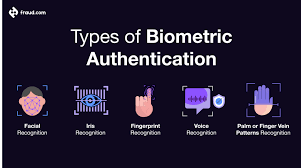

- Biometric verification requirements for both in-person and digital onboarding

- Document authentication technology to verify identification documents

- Risk-based approach with additional scrutiny for higher-risk profiles

Banking Controls

- Delayed processing for extensive transactions

- Mandatory cooling periods before new payees can receive large transfers

- Default transaction limits requiring additional verification to increase

- Call-back verification for transactions above certain thresholds

Public Education and Awareness

Targeted Campaigns

- “Don’t Be A Money Mule” awareness programs in schools and universities

- Community outreach focusing on vulnerable populations (students, elderly, job seekers)

- Multi-language campaigns reaching diverse communities

- Specific education on the legal consequences, including jail time

Warning Systems

- SMS alerts about standard money mule recruitment techniques

- In-app banking notifications about the risks of allowing account access

- Digital banking platform pop-up warnings about suspicious transaction patterns

- Community alerts when new money mule recruitment tactics are detected

Law Enforcement Strategies

Proactive Investigation

- Dedicated Anti-Scam Centre resources for money mule network detection

- Collaboration between police and financial intelligence units

- Data analytics to identify connected accounts and transaction patterns

- Regular auditing of newly formed companies with unusual transaction patterns

Deterrence Through Prosecution

- Publicized cases showing severe penalties for money mules

- Prosecution of all participants in the chain, not just ring leaders

- Asset recovery procedures to trace and seize criminal proceeds

- Clear communication that ignorance is not an acceptable legal defense

Industry Collaboration

Information Sharing Networks

- Bank consortium sharing intelligence on suspicious patterns

- Cross-industry collaboration between telcos, banks, and payment providers

- A centralized database of known mule accounts and recruitment techniques

- Public-private partnerships for faster response to emerging threats

Technology Solutions

- Shared fraud detection engines across multiple financial institutions

- Digital footprint analysis (device, location, and behavioral data)

- Blockchain analytics to trace fund movements across platforms

- API-based systems allowing real-time information exchange between institutions

Targeted Vulnerability Reduction

Job Seeker Protection

- Partnership with job platforms to detect and remove suspicious job listings

- Education about legitimate versus suspicious job offers

- Warning systems on employment platforms

- Verification processes for companies advertising “financial agent” positions

Student-Focused Programs

- Campus awareness campaigns highlighting the risks

- Financial literacy modules covering scams and money mule awareness

- University partnerships with financial institutions for education

- Peer-to-peer awareness programs led by students themselves

International Cooperation

Cross-Border Coordination

- Information sharing agreements with other jurisdictions

- Joint investigation teams for transnational cases

- Standardized reporting formats for suspicious transaction reporting

- Rapid freeze mechanisms for cross-border fund movements

Regional Intelligence Framework

- ASEAN-wide cooperation on money laundering typologies

- Coordinated action against known crime groups operating regionally

- Harmonized KYC standards across regional financial institutions

- Shared blacklists of suspicious entities across borders

The most effective prevention strategy combines these approaches with continuous adaptation as criminals evolve their tactics. Singapore’s multi-agency approach involving the MAS, Singapore Police Force, and private sector partners has shown promising results, but ongoing vigilance remains essential.

Essential Fraud Detection Strategies

1. Multi-layered Authentication Systems

Modern authentication must go beyond passwords. A robust system should incorporate:

Biometric Verification using fingerprints, facial recognition, or voice authentication adds a physical dimension to security that’s difficult to replicate.

Device Intelligence examines the devices used to access accounts, flagging suspicious logins from unfamiliar devices or locations.

Behavioral Biometrics analyzes patterns in how users interact with devices—how they type, swipe, or navigate—creating a behavioral fingerprint that’s hard for fraudsters to mimic.

2. Machine Learning and AI Detection Systems

Artificial intelligence has transformed fraud detection from rules-based systems to sophisticated pattern recognition:

Anomaly Detection algorithms establish baseline behaviours for users and flag deviations from standard patterns. For example, if a user who typically makes small, local purchases suddenly attempts large international transactions, the system can automatically flag this for review.

Predictive Analytics examines historical fraud patterns to forecast potential vulnerabilities. These systems become increasingly accurate over time as they process more data and fraud scenarios.

Adaptive Authentication dynamically adjusts security requirements based on risk assessment. Low-risk transactions might proceed with minimal friction, while high-risk activities trigger additional verification steps.

3. Real-time Transaction Monitoring

Modern fraud detection must operate at the speed of digital transactions:

Velocity Checks look for suspicious patterns in the frequency of activities, such as multiple account creation attempts or rapid-fire transactions.

Network Analysis examines connections between accounts, identifying clusters of potentially fraudulent activity that might indicate organized fraud rings.

Geolocation Verification checks whether transaction locations make logical sense given a user’s history and profile.

4. Data Integration and Cross-channel Analysis

Effective fraud detection requires a holistic view across all channels and touchpoints:

Unified Customer Profiles combine data from various sources—mobile apps, websites, call centres, and physical locations—to create a comprehensive view of customer behaviour.

Cross-channel Pattern Recognition identifies suspicious activities that might appear normal when viewed in isolation but reveal fraud patterns when examined across channels.

Third-party Data Enrichment augments internal data with external information such as device reputation databases, known fraud networks, and compromised credential lists.

5. Advanced Analytics Tools: Implementation Examples

Let’s look at how these strategies might be implemented in practice with code examples:

Machine Learning Fraud Detection System

Click to open the code

Tap to open

This code example demonstrates several key concepts in fraud detection:

- Feature Engineering: The system calculates derived features that are strong fraud indicators, such as distance from home location, unusual transaction amounts compared to user history, and temporal patterns.

- Risk-based Decision Making: Rather than a binary approve/decline decision, the system implements a spectrum of responses based on both the risk score and transaction context.

- Machine Learning Implementation: The Random Forest model can capture complex, non-linear relationships between features and fraud likelihood, making it practical for detecting sophisticated fraud patterns.

- Explainability: The system analyzes feature importance, providing insight into which factors most strongly indicate fraud—crucial for improving the system and explaining decisions to customers and regulators.

6. Behavioral Analytics

Beyond transaction details, modern fraud systems analyze how users behave:

Session Analysis examines user interaction patterns during a session, such as navigation paths, interaction speed, and hesitation points. Fraudsters often exhibit different behaviours than legitimate users when navigating financial interfaces.

Typing Patterns can reveal when a different person is using familiar credentials. Legitimate users develop consistent typing rhythms and patterns that are difficult to replicate.

Usage Consistency looks at whether behaviour matches patterns. For example, a user who constantly carefully reviews transaction details before confirming might raise flags if they suddenly rush through multiple high-value transactions.

carefully reviews transaction details before confirming might raise flags if they suddenly rush through multiple high-value transactions.

7. Collaborative Security Approaches

Fraud detection is strengthened through industry cooperation:

Consortium Data Sharing allows financial institutions to pool anonymized fraud data, creating a more comprehensive picture of emerging threats while preserving customer privacy.

Regulatory Cooperation enables institutions to work with government agencies to identify large-scale fraud operations and money laundering networks.

Vendor Integration leverages specialized third-party security services that focus exclusively on specific types of fraud detection, adding another layer of protection.

Implementation Challenges and Solutions

Implementing fraud detection systems comes with significant challenges:

False Positives create friction for legitimate customers and can damage trust. Solutions include:

- Implementing risk-based authentication that adds friction only when necessary

- Using ensemble models that combine multiple detection approaches for greater accuracy

- Continuously tuning systems based on customer feedback and false positive analysis

Data Privacy Regulations such as GDPR and CCPA restrict how customer data can be used. Consider:

- Implementing privacy-by-design principles in fraud systems

- Using anonymization and pseudonymization techniques

- Creating clear data governance frameworks with documented legitimate interest in fraud prevention

Integration Complexity across legacy and modern systems can impede effectiveness. Address this by:

- Using API-first approaches for system integration

- Implementing data transformation layers to normalize inputs from different systems

- Creating real-time event streams for fraud data rather than batch processing

Building a Fraud Prevention Culture

Technical solutions are only part of effective fraud prevention:

Employee Training should ensure that all staff members understand their role in preventing fraud, recognizing warning signs, and following security protocols.

Customer Education helps users protect themselves by recognizing phishing attempts, using strong authentication methods, and understanding how to report suspicious activities.

Regular Testing through penetration testing, red team exercises, and fraud simulations helps identify vulnerabilities before criminals can exploit them.

Measuring and Improving Your Fraud Detection System

Continuous improvement requires careful measurement:

Key Performance Indicators should include:

- False positive rate: Legitimate transactions incorrectly flagged

- False negative rate: Fraudulent transactions missed

- Detection speed: Time from fraud attempt to detection

- Customer impact metrics: Authentication success rates and friction points

A/B Testing allows you to compare different detection approaches and fine-tune systems based on real-world results rather than theoretical models.

Post-incident analysis should thoroughly examine confirmed fraud cases to identify how detection could have happened earlier or more efficiently.

Conclusion

As fintech continues to transform the financial landscape, fraud detection must remain a top priority for businesses. By implementing multi-layered approaches that combine advanced technologies with human expertise, fintech companies can protect both their customers and their bottom line.

Remember that effective fraud prevention is not a static solution but an ongoing process that must continuously evolve to address new threats. By staying vigilant and investing in robust detection systems, your business can build customer trust while minimizing losses in an increasingly digital financial world.

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in Adblock and anti-tracking software to enhance your browsing privacy.

By utilising the Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser is a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive web browser market.