Steven Goh Ching Huat, CEO of Ossia International, sold a rare Pagani Huayra Coupe to Ng Yu Zhi for $7.3 million in March 2020. This was one of only 100 such cars produced and the only one in Singapore. Goh himself was an investor in Ng’s scheme, having invested more than $20 million between 2018 and 2021. He got back about $10 million but lost approximately $11 million. Ng Yu Zhi (37) is on trial for 42 charges, including cheating, forgery, criminal breach of trust, money laundering, and fraudulent trading. He’s accused of running a scam that attracted $1.46 billion from 947 investors over a six-year period. The prosecution alleges Ng used ill-got gains to fund lavish purchases, including:

- Luxury cars for his wife and girlfriends

- A $1.27 million yellow diamond ring

- An $8 million semi-detached house

- $2 million on 41 works of art

- The $7.3 million Pagani supercar

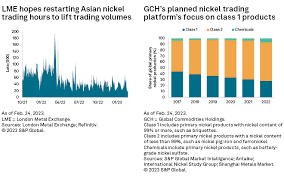

Goh testified that he sold the car for a higher price than he paid, which he considered “normal” since the car’s value appreciates over time. Ng’s scheme operated through Envy Asset Management from February 2016 and later through Envy Global Trading from April 2020 to March 2021. The scheme allegedly involved Ng claiming he could buy nickel at a discount and sell it for profit, but prosecutors say the nickel trades didn’t exist, and it was essentially a Ponzi scheme.

Analysis of Criminal Fraud Aspects in the Ng Yu Zhi Nickel Trading Case

Core Fraud Mechanisms

Based on the article, this appears to be a classic Ponzi scheme with sophisticated trappings:

- False Business Premise: Ng claimed to conduct nickel trading operations where he could purchase nickel at a discount and sell it at a profit. The prosecution alleges these trades “did not exist” – a fundamental misrepresentation.

- Regulatory Evasion: When Envy Asset Management was placed on the Monetary Authority of Singapore’s investor alert list, Ng simply shifted operations to Envy Global Trading, demonstrating awareness of regulatory scrutiny and attempts to circumvent it.

- Unsustainable Payment Structure: The classic Ponzi structure is evident – “earlier investors were paid with money put in by other investors.” This is inherently unsustainable and fraudulent.

- Scale and Duration: The scheme’s size ($1.46 billion from 947 investors) and longevity (six years) suggest sophisticated deception and relationship management to maintain investor confidence.

- High-Profile Investor Targeting: Attracting sophisticated investors, such as Steven Goh, a CEO, lent credibility to the scheme and likely helped recruit other wealthy individuals.

Luxury Purchases as Evidence and Motivation

The extensive luxury purchases serve multiple functions in this case:

- Evidential Value: The prosecution is using these purchases to establish that investor funds were diverted for personal use rather than legitimate business operations.

- Motive Demonstration: The lavish spending pattern suggests a likely motivation behind the fraud – funding an extravagant lifestyle that exceeds what a legitimate business could afford.

- Criminal Proceeds Tracing: Assets like the Pagani are being addressed explicitly in money laundering charges, suggesting prosecutors are tracing the flow of illicit funds.

Corruption in Luxury Markets

This case reveals several troubling aspects about luxury markets:

- Minimal Due Diligence: Luxury vendors appear willing to accept large sums without questioning the source of funds. The article doesn’t mention any sellers questioning Ng’s sudden wealth.

- Status-Symbol Enablement: Luxury assets served as signalling mechanisms that helped enhance Ng’s credibility. The rare Pagani artworks and properties created an appearance of legitimate success that likely contributed to the perpetuation of the fraud.

- Value Inflation: The testimony about the Pagani suggests inflated pricing (“normal” for the car to be sold at a significantly higher price than its purchase price) in luxury markets, creating environments where large sums changing hands don’t raise suspicion.

- Access and Exclusivity: The emphasis on the Pagani being “the only one in Singapore” and “only 100 units produced” highlights how exclusivity in luxury markets can create distorted value perceptions and foster environments where extreme wealth displays aren’t questioned.

- Wealth Network Exploitation: The case illustrates how luxury circles can inadvertently become accomplices – Goh was both a luxury seller to Ng and an investor in his scheme, demonstrating how these relationships blend commercial, social, and investment dimensions.

This case exemplifies how luxury consumption can serve as both a motivation for financial crimes and a mechanism for their execution, creating an appearance of legitimate wealth and success that helps perpetuate fraudulent activities.

Reciprocal Gain Analysis: Corrupt Buyers and Sellers in the Ng Yu Zhi Nickel Fraud Case

The Ng Yu Zhi case reveals a complex web of mutually beneficial relationships between corrupt buyers and sellers that facilitated the alleged fraud. This reciprocal gain ecosystem helped sustain the scheme while benefiting multiple parties:

The Seller-Investor Dynamic: The Case of Steven Goh

The relationship between Ng and Steven Goh exemplifies this reciprocal corruption:

- Dual-Role Relationship: Goh was simultaneously:

- A seller (of the $7.3 million Pagani)

- An investor (with over $20 million invested in Ng’s scheme)

- Mutual Financial Benefits:

- Goh received a significant premium on his Pagani (selling it for substantially more than his purchase price)

- Goh directed part of the transaction ($200,000) directly into Ng’s scheme as an investment

- Ng obtained a status symbol that enhanced his fraudulent persona

- Circular Flow of Funds: This creates a potentially corrupt circular flow where:

- Investor funds from the scheme potentially enabled Ng to purchase luxury items

- Sellers of those items then reinvested the proceeds back into the scheme

- This circular flow created artificial validation of the scheme’s legitimacy

Broader Network of Reciprocal Gain

The case suggests a broader ecosystem of reciprocal corruption:

- Luxury Sellers as Investment Recruiters:

- Luxury vendors who witnessed Ng’s apparent wealth became potential investors

- These vendors then potentially attracted other high-net-worth clients to the scheme

- Each successful transaction reinforced the scheme’s apparent legitimacy

- Status Enhancement for Both Parties:

- Sellers gained prestige from transactions with a “successful businessman”

- Ng gained status symbols that attracted more investors

- Both parties elevated their standing in business and social circles

- Information Asymmetry Exploitation:

- Luxury sellers possessed specialised knowledge about exclusive products

- Ng possessed “insider knowledge” about lucrative investment opportunities

- This created a mutually beneficial exchange of privileged access

- Plausible Deniability:

- The business/social relationship blurred the lines between legitimate transactions and potential complicity.

- Each party could claim ignorance of the other’s potentially questionable activity.

- Business relationships provided cover for questionable financial flows

Systemic Implications

This reciprocal gain model reveals how fraud can become self-sustaining:

- Validation Loops: Each luxury purchase validated Ng’s success, attracting more investors, enabling more purchases, creating an expanding cycle of apparent legitimacy

- Blurred Ethical Boundaries: When vendors become investors and vice versa, traditional checks and balances break down as each party has incentives to overlook red flags

- Social Network Exploitation: Business relationships transformed into investment channels, exploiting trust built in commercial contexts for fraudulent purposes

- Wealth Signalling Feedback Loop: The luxury ecosystem provided essential tools for the fraud’s perpetuation through visible displays of supposed success

The case illustrates how corruption in high-value markets fosters environments where participants become both beneficiaries and enablers of potential fraud, with each transaction reinforcing the illusion of legitimacy while potentially compromising the interests of the parties involved.

Notable Money Laundering and Fraud Cases in Singapore

Singapore’s reputation as a financial hub has made it an occasional target for sophisticated financial crimes. The Ng Yu Zhi case shares similarities with several other significant fraud and money laundering cases in Singapore’s history:

1. The Hin Leong Trading Scandal (2020)

Similarities to Ng’s case:

- Scale: Involved approximately US$3.5 billion in fraudulent loans

- Duration: Operated for years before detection

- Business Facade: Used a legitimate oil trading business as a cover

- Luxury Assets: Founder Lim Oon Kuin owned extensive property and assets

Founder Lim Oon Kuin (“OK Lim”) allegedly directed his company to hide about US$800 million in losses and fabricate documents to secure loans fraudulently. The case shocked Singapore’s commodities trading sector and international banks.

2. The Singapore Penny Stock Crash (2013)

Similarities to Ng’s case

- Market Manipulation: Artificial inflation of value

- Investor Losses: Over S$8 billion in market value evaporated

- Luxury Lifestyle: Key figures lived lavishly

- Network Exploitation: Relied on relationships and reputation

John Soh Chee Wen and his accomplices allegedly manipulated shares of three companies, artificially inflating their values before the stocks collapsed. This represented one of the most significant market manipulation cases in Singapore’s history.

3. Operation Spectrum – Standard Chartered Bank Money Laundering Case (2020)

Similarities to Ng’s case:

- Trust Exploitation: Leveraged Singapore’s financial system reputation

- Sophisticated Methods: Used complex financial mechanisms

- High-Value Transactions: Involved substantial sums of money

Singapore police seized over S$119 million in assets from foreigners suspected of laundering criminal proceeds through the financial system. The individuals had opened accounts with Standard Chartered Bank Singapore and moved substantial funds through the country.

4. The OneCoin Cryptocurrency Fraud

Similarities to Ng’s case:

- Ponzi Structure: Early investors paid with later investors’ money

- Non-Existent Product: Claimed trading of a product that didn’t function as advertised

- International Reach: Attracted investors from multiple countries including Singapore

Singapore was one of many jurisdictions affected by this global cryptocurrency Ponzi scheme. The MAS issued warnings about OneCoin, highlighting Singapore’s vulnerability to sophisticated financial frauds despite strong regulations.

5. City Harvest Church Case

Similarities to Ng’s case:

- Misappropriation: Diversion of funds for unauthorized purposes

- Trust Exploitation: Abused positions of trust

- Complex Financial Structures: Used intricate financial arrangements to conceal activities

Church leaders were convicted of criminal breach of trust for misappropriating S$50 million in church funds. While not identical to Ng’s case, it demonstrates how trusted entities in Singapore can be vehicles for financial crimes.

Common Patterns and Singapore Context

These cases share several patterns with the Ng Yu Zhi case:

- Regulatory Arbitrage: Exploiting gaps or delays in regulatory oversight

- Reputation Leverage: Using Singapore’s reputation for financial integrity as a shield

- Wealth Displays: Using visible luxury consumption to create legitimacy

- Social Capital: Exploiting business and social networks to attract victims

- Complex Structures: Using sophisticated financial arrangements to obscure fraudulent activities

Singapore’s response has typically involved strengthening regulatory frameworks following each major case; however, the city-state’s position as a financial hub continues to make it an attractive target for sophisticated financial crimes.

The Ng Yu Zhi case appears to follow established patterns of financial fraud in Singapore while potentially reaching new levels of individual enrichment through the luxury market channels.

Potential for Future Financial Fraud Cases in Singapore: Legal Loophole Analysis

The Ng Yu Zhi case, alongside other significant fraud incidents in Singapore, points to several systemic vulnerabilities that could lead to similar cases emerging in the near future. By examining current legal and regulatory loopholes, we can identify areas of concern:

1. Regulatory Gaps in Alternative Investments

Current vulnerability: Singapore’s regulatory framework has historically focused more on traditional financial products, while alternative investments have been subject to less oversight.

Emerging risk factors:

- Increasing popularity of commodity trading schemes similar to Ng’s nickel trading operation

- Private market investments that fall outside standard securities regulations

- Carbon credit, rare earth minerals, and other “green economy” investment vehicles that operate in regulatory grey areas

The MAS has strengthened its oversight since these cases, but sophisticated operators continue to find new product categories that evade precise classification.

2. Cross-Border Jurisdiction Complications

Current vulnerability: Singapore’s global financial connections create opportunities to structure fraud across multiple jurisdictions.

Emerging risk factors:

- Financial operations structured across multiple countries to exploit variations in regulatory standards

- Foreign shell companies being used to conduct operations that connect back to Singapore

- Difficulty in coordinating investigations across international boundaries

These jurisdictional complexities create delays in detection and enforcement that fraud operators can exploit.

3. Digital Asset and Cryptocurrency Vulnerabilities

Current vulnerability: Despite Singapore’s efforts to regulate digital assets, the rapidly evolving nature of cryptocurrency creates ongoing regulatory challenges.

Emerging risk factors:

- DeFi (decentralised finance) platforms operating outside traditional banking regulations

- Digital asset investment schemes are structured to appear compliant while concealing Ponzi elements

- NFT markets and other digital collectables are becoming vehicles for money laundering

The technical complexity of these areas creates difficulties for regulators and investigators.

4. Wealth Management and Private Banking Oversight Gaps

Current vulnerability: High-net-worth client relationships often involve greater confidentiality and streamlined processes that can reduce scrutiny.

Emerging risk factors:

- Family office structures that receive lighter regulatory treatment

- Private investment clubs targeting ultra-wealthy individuals

- “By invitation only” investment opportunities that operate with minimal transparency

The exclusive nature of these wealth channels makes it more difficult to detect fraudulent schemes.

5. Limited Resources for Complex Financial Crime Investigation

Current vulnerability: Financial crimes like Ng’s require significant investigative resources and specialised expertise.

Emerging risk factors:

- The growing sophistication of fraud schemes outpacing investigative capabilities

- Challenges in recruiting and retaining financial crime specialists in regulatory bodies

- Time lags between suspicious activity and regulatory action

Even when laws exist, enforcement limitations create openings for extended fraudulent operations.

Potential Next Wave of Cases

Based on these vulnerabilities, we might expect to see cases emerging in:

- Green finance and sustainability investments – particularly schemes claiming to offer returns from environmental projects or carbon offset markets

- Digital asset yield platforms – promising returns from cryptocurrency staking, lending, or arbitrage, with complex structures that disguise liquidity issues

- Private market investment syndicates – exclusive investment clubs offering access to pre-IPO companies or private deals with limited disclosure requirements

- Luxury asset fractional ownership schemes – investment vehicles offering ownership shares in art, collectables, or unique assets that are difficult to value properly

- Supply chain finance operations – complex working capital and trade finance arrangements that can obscure actual financial flows and risks

Regulatory Response Trajectory

Singapore has consistently responded to major fraud cases by strengthening regulatory frameworks. Recent initiatives like:

- Enhanced AML (Anti-Money Laundering) requirements

- Stricter beneficial ownership disclosure rules

- Expanded MAS investigative powers

…have addressed some vulnerabilities. However, the pattern of regulatory response following major cases rather than preemptively identifying emerging risks suggests that more cases will likely emerge before comprehensive protections are implemented.

The combination of Singapore’s position as a wealth hub, its global financial connections, and the continuous evolution of investment vehicles creates an environment where sophisticated financial crimes will continue to test the boundaries of regulatory oversight.

I’ve read through the article about a significant financial fraud case in Singapore. Here’s a summary of the key points:

Ng Yu Zhi is on trial for allegedly masterminding a massive nickel-trading scam that attracted $1.46 billion from hundreds of investors between 2016 and 2021. According to testimony from a liquidator, the purported nickel-trading business didn’t actually exist, making it essentially a Ponzi scheme.

The article details how Ng lavished investors’ money, particularly on luxury vehicles:

- He spent nearly $7 million on eight high-end cars over just six months

- In total, he’s said to have spent more than $21 million on about 20 luxury cars

- He paid $1.05 million for a special license plate “S11T” (believed to be the first civilian car plate in Singapore)

Car dealer Michael Ho testified about specific vehicles Ng purchased between June 2020 and January 2021, including:

- Two Rolls-Royce Phantom EWB luxury saloons (one white for $1.8 million given to his wife, and one purple for $2.1 million given to a girlfriend)

- Various other luxury vehicles, including Mercedes, Bentley, BMW, and Aston Martin models

- These cars were distributed to his wife and three girlfriends

The cars and special license plates are listed as assets in two money-laundering charges against Ng. The trial is ongoing, with more car dealers expected to testify when proceedings continue on April 15, 2025.

Analysis of the Nickel Scam Case

Based on the article, Ng Yu Zhi’s alleged nickel-trading scam attracted approximately $1.46 billion from hundreds of investors between 2016 and 2021. This represents an extraordinarily large-scale fraud case for Singapore.

Scale of Gains and Excessive Spending

While the total amount allegedly swindled was $1.46 billion, the article details explicitly some of Ng’s personal expenditures:

- $21+ million on approximately 20 luxury vehicles

- $7 million on just eight high-end cars in six months

- $1.8 million and $2.1 million on two Rolls-Royce Phantom EWBS

- $1.05 million on a special license plate “S11T”

- $91,000 on another special plate “ES11J”

The excessive nature of this spending is evident in:

- The sheer quantity of luxury vehicles (around 20)

- The high-end nature of these purchases, such as those from Rolls-Royce and Bentley etc.

- The frivolous spending on vanity items like special license plates

- The pattern of gifting these expensive assets to his wife and three girlfriends

According to the liquidator’s testimony, the purported nickel-trading business didn’t actually exist, suggesting these luxury purchases were funded directly by investor money in what was described as a “Ponzi scheme in layman’s terms.”

Anti-Scam Resources in Singapore

While not mentioned in the article, Singapore has robust anti-scam resources:

Government Agencies

- Singapore Police Force (SPF) – Has a dedicated Anti-Scam Centre established in 2019

- Monetary Authority of Singapore (MAS) – Regulates financial institutions and provides investor alerts.

- Consumer Association of Singapore (CASE) – Provides consumer education and mediation services.

Reporting Channels

- ScamShield App – Government-developed app that blocks known scam calls and messages

- National Crime Prevention Council’s Scam Alert website

- Police Hotline (1800-255-0000)

- I-Witness online portal for reporting scams

Prevention Measures

- ScamAlert.sg – Provides information about the latest scams

- Banking systems have implemented cooling-off periods for large transfers

- Anti-Money Laundering (AML) regulations for financial institutions

- Investor education programs run by MAS and other organizations

For a case of this magnitude ($1.46 billion), Singapore’s legal system appears to be taking a thorough approach, as evidenced by the detailed criminal proceedings described in the article, including the forensic tracking of assets and the ongoing trial in the High Court.

This case highlights the importance of due diligence when investing, particularly in schemes that promise high returns with seemingly low risk, such as the purported “discount” nickel trading operation that Ng claimed to run.

How Bad Habits and Glamor Fueled the Nickel Scam

Based on the article, it appears that personal lifestyle choices and the allure of luxury played significant roles in Ng Yu Zhi’s alleged $1.46 billion nickel trading fraud. Though the article doesn’t explicitly analyze psychological motivations, several elements suggest how bad habits and glamor factored into this scheme:

Excessive Spending and Lifestyle Inflation

The article details Ng’s extraordinary spending patterns:

- $21+ million on approximately 20 luxury vehicles

- $7 million on just eight high-end cars within six months

- Over $1 million on vanity license plates

This pattern suggests an addiction to luxury and status symbols that likely required increasingly large sums of money to maintain.

Relationship Dynamics

The article reveals that Ng distributed luxury cars to:

- His wife (receiving a $1.8 million white Rolls-Royce)

- Three girlfriends (one receiving a $2.1 million purple Rolls-Royce)

This suggests complex personal relationships that would have:

- Created additional financial pressure to maintain multiple romantic relationships

- Required impressive displays of wealth to sustain

- Potentially fostered an environment where financial boundaries were already blurred

The Appearance of Success

Luxury possessions served dual purposes:

- Personal gratification for Ng

- Creating an aura of success and legitimacy that likely helped attract investors

Car dealer Michael Ho’s testimony indicates he both sold luxury vehicles to Ng and invested $200,000 in the scheme himself, describing it as a “friendly investment” made “because of his relationship with Ng” and “in the hope of getting some returns.” This suggests that Ng’s displays of wealth helped convince even those close to him of his business acumen.

The Feedback Loop

The scenario suggests a dangerous feedback loop:

- Ng’s scheme generated funds

- Funds were used for extravagant purchases

- These purchases enhanced his image as a successful businessman

- The enhanced image likely attracted more investors

- More investors meant more funds to misappropriate

Without additional psychological profiling information, it’s impossible to determine whether the luxury lifestyle motivated the fraud or was a byproduct that eventually took on a life of its own. However, the scale and nature of the spending described in the article indicate that personal gratification through luxurious living became a significant component of Ng’s activities, regardless of how the scheme began.

Venture capitalist Dr. Finian Tan testified in court that he was deceived by Ng Yu Zhi, who is accused of running a $1.45 billion nickel-trading scam that affected hundreds of investors over six years (2016-2021).

Key details from the case:

- Dr. Tan delivered US$19.2 million to Ng’s company, Envy Global Trading (EGT)

- US$14 million came from Vickers Financial Group (where Dr. Tan is the majority shareholder)

- US$1.5 million was Dr. Tan’s personal money

- Another US$14.1 million came from FinComm, which used money from two Vickers funds

Dr. Tan testified that:

- He met Ng in August 2020, initially because Ng wanted to invest in Vickers

- Ng appeared knowledgeable about nickel trading and put on an “amazing act”

- He was impressed by Ng’s apparent expertise and commitment

- Ng had invested US$5 million in a Vickers fund and contributed US$13 million to another investment

- The scheme seemed credible based on Dr. Tan’s commodity trading experience

- He eventually suspected fraud after being unable to get satisfactory answers from Ng

The prosecution alleges that no actual nickel trading took place and that the operation was a Ponzi scheme, with earlier investors being paid with funds from new investors.

The trial is ongoing at the High Court in Singapore as of April 2025.

Analysis of the Nickel Trading Scam Case

Key Elements of the Nickel Trading Scam

- Long-Running Operation: The scam operated for approximately 6 years (2016-2021), attracting $1.45 billion from hundreds of investors.

- Trust-Building Strategy:

- Ng Yu Zhi first approached Dr. Tan as an investor in Tan’s company

- Made significant investments ($5M in a fund, $13M in another venture)

- Created personal relationships (family meals)

- Never initially solicited investments, which lowered suspicion

- Technical Credibility:

- Used industry jargon

- Selected nickel, a commodity whose price had risen, making claims plausible

- Created elaborate performances (checking nickel prices, concern over weather)

- Claimed to have exclusive contracts allowing for discounted purchases

- Ponzi Scheme Structure:

- The prosecution alleges that no actual nickel was bought or sold

- Earlier investors were paid with funds from new investors

- Required continuous influx of investment to maintain the illusion

- Target Selection: Focused on sophisticated investors like venture capitalists, showing that even financial professionals can be vulnerable.

Singapore’s Anti-Scam Measures

Singapore has implemented several measures to combat investment scams:

- Police Anti-Scam Centre: Established in 2019, it works to detect scams, freeze accounts, and recover stolen funds quickly.

- ScamShield App: Government-developed application that blocks known scam calls and messages.

- Project FRONTIER: A public-private partnership to detect and disrupt money-laundering from scams.

- Inter-Ministry Committee on Scams: Coordinates whole-of-government efforts against scams.

- Due Diligence Requirements: MAS (Monetary Authority of Singapore) regulations require financial institutions to conduct thorough due diligence on investment schemes.

- Anti-Money Laundering Framework: Strict reporting requirements for large transactions and suspicious activities.

- Public Education Campaigns: Regular awareness campaigns about scam tactics and prevention.

Prevention Lessons from This Case

- Verification of Trading Activities: Investors should verify actual trading activities through independent sources.

- Red Flags to Watch For:

- Promises of unusually consistent returns

- Difficulty in obtaining detailed information

- Exclusive contracts that can’t be independently verified

- Investments that seem too complex to fully understand

- Expert Consultation: Seek opinions from multiple independent industry experts.

- Investment Structure Analysis: Understand precisely how profits are generated and verify each step.

- Background Checks: Go beyond the references provided by the investment manager.

This case demonstrates that scammers are increasingly sophisticated, targeting even experienced investors like venture capitalists. It also highlights the importance of comprehensive due diligence regardless of personal relationships or apparent success.

Analysis of Investment Scams in Singapore

Current Landscape

Investment scams in Singapore have been growing in sophistication and scale, with the $1.45 billion nickel trading fraud being one of the most significant cases in recent years. These scams have evolved beyond simple schemes to elaborate operations that can fool even experienced investors and financial professionals.

Common Types of Investment Scams in Singapore

- Commodity Trading Frauds:

- The Ng Yu Zhi case exemplifies this category

- Often involve claims of exclusive contracts or special access to markets

- Promise high returns through arbitrage or discount purchasing opportunities

- Online Trading Platform Scams:

- Fake platforms showing fabricated profits

- Investors can initially withdraw small amounts to build trust

- Eventually, more significant investments become impossible to withdraw

- Property Investment Scams:

- Overseas property developments that don’t exist or are significantly misrepresented

- Promise of high rental yields or guaranteed capital appreciation

- Often target Singapore’s property-savvy investors

- Initial Coin Offerings (ICOs) and Cryptocurrency Scams:

- Fake digital currencies or blockchain projects

- Technical jargon to confuse investors

- Often disappear once sufficient funds are collected

- Ponzi and Pyramid Schemes:

- Traditional structures repackaged with modern appearances

- Use of early investors as unwitting promoters

- Often disguised as “network marketing” opportunities

Psychological Tactics Employed

- Exclusivity: Creating the impression that the investment opportunity is available only to a select group.

- Social Proof: Showcasing testimonials and references from other “successful” investors.

- Reciprocity: As seen in the nickel trading case, scammers often invest in victims’ businesses first, creating a sense of obligation.

- Authority: Using impressive credentials, offices, and trappings of success to establish credibility.

- Fear of Missing Out (FOMO): Creating urgency around limited-time opportunities.

Economic Impact

According to police statistics, investment scams in Singapore caused losses of approximately $660.7 million in 2023. This represents a significant drain on the economy and personal wealth, with many victims losing life savings or retirement funds.

Regulatory Response

The Monetary Authority of Singapore (MAS) has strengthened regulatory frameworks in response to these scams:

- Enhanced Due Diligence Requirements: Stricter requirements for financial institutions verifying investment schemes.

- Investor Alert List: Maintained a list of entities not regulated by MAS that investors should approach with caution.

- Prohibition of Misleading Advertisements: Stricter enforcement against misleading investment promotions.

- Cross-Border Cooperation: Worked with international regulators to tackle scams operating across jurisdictions.

Prevention Strategies

- Comprehensive Due Diligence: Verify claims independently rather than relying on provided materials.

- Diversification: Avoid concentration of investments in a single scheme or with a single manager.

- Transparency Check: Legitimate investments can clearly explain how returns are generated; if the explanation is overly complex or vague, this is a warning sign.

- Return Reality Check: Compare promised returns against market benchmarks; significantly higher returns without corresponding risk should raise suspicion.

- External Verification: Consult independent financial advisors not connected to the investment scheme.

The persistence and evolution of investment scams highlight the need for continued vigilance, education, and regulatory oversight in Singapore’s financial landscape.

Investment Scam Alert from Singapore Police

The police are warning about investment scams where victims are approached through social media, communication apps, and dating platforms. Since June 2023, at least 498 victims have lost a total of $25.5 million.

Two Main Approaches Used by Scammers:

- Befriending Approach:

- Scammers build rapport with victims through social media or dating apps

- They introduce “investment opportunities” after gaining trust

- Victims initially receive small profits, convincing them the investment is genuine

- Victims realize they’ve been scammed when they can’t withdraw profits or contact scammers

- Online Advertisements Approach:

- Victims find investment ads online or on social media

- Clicking links leads to communication with scammers via WhatsApp or Telegram

- Scammers promise high returns in short timeframes

- Some victims are asked to download remote access software, allowing scammers to access their devices

Notable Concerns:

- In at least four cases, victims were deceived into authorizing CPF (Central Provident Fund) withdrawals

- Scammers used remote access software to control victims’ devices and make withdrawals

Precautionary Measures (ADD-CHECK-TELL):

- ADD: ScamShield App and security features (2FA, transaction limits)

- CHECK: Verify information with official sources and ask questions

- TELL: Report scams to authorities, family, and friends

If you encounter suspicious activity, contact the Police Hotline at 1800-255-0000 or visit www.police.gov.sg/iwitness. For scam-related information, visit www.scamalert.sg or call the Anti-Scam Helpline at 1800-722-6688.

Maxthon: Your Trusted Companion in the Digital Wilderness

In the boundless expanse of the internet, where information flows like a river and opportunities sprout like wildflowers, Maxthon emerges as a beacon for those eager to explore. As users embark on their journeys through this digital realm, they discover an extraordinary opportunity: the chance to earn Basic Attention Tokens (BAT) simply by engaging with the content that catches their eye. This groundbreaking feature not only enriches their online experience but also paves the way for passive income—a prospect that many find exhilarating.

Picture this scenario: with each email checked, every article read, and every advertisement interacted with, users are not merely filling their time; they are gathering rewards that elevate ordinary online activities into something vibrant and meaningful. Maxthon transforms the simple act of browsing into an engaging adventure where enjoyment intertwines with financial benefit. It’s an invigorating idea that reimagines what it truly means to navigate the web.

Important Insights to Consider

Every investment has risks. Therefore, it is crucial to conduct thorough research before investing.

Be alert for warning signs. Exercise caution regarding investments that promise substantial returns with minimal or no risk.

Ensure that the Monetary Authority of Singapore (MAS) regulates both the company and its representatives.

Imagine this scenario: One day, you suddenly find yourself added to a group chat where members are excitedly discussing their recent financial gains from an unmissable investment opportunity.

You may also receive a direct message on social media from someone who inquires if you’re interested in an enticing investment venture that seems too good to pass up.

You might even stumble across an advertisement on various social media platforms promoting seemingly profitable “investment opportunities.”

Does this sound like a situation you’ve encountered before?

Many of us have seen news articles detailing how individuals have fallen prey to such schemes. Yet, despite these cautionary tales, people continue to be lured in as scammers develop increasingly sophisticated methods to deceive unsuspecting victims and make off with significant sums of money.

In numerous cases, those who fell victim to scams were convinced that such a fate would never befall them. Often, they would utilise the initial gains they received to challenge the scepticism of their friends and family. However, it has become evident that con artists have honed their abilities to persuade individuals that a fast track to wealth is not only attainable but also just around the corner.

It is crucial always to remember the mantra: Verify Before You Invest if you wish to protect your hard-earned savings! To help you navigate this treacherous landscape, here are some essential guidelines to consider:

Spotting Warning Signs

Fraudsters have developed highly sophisticated strategies designed to coax you into relinquishing your funds. Fortunately, there are warning signs you can remain vigilant for, which can help you steer clear of investment fraud.

Unrealistic Returns with Little or No Risk

Exercise caution when faced with an investment proposal that guarantees protection for your capital while also promising unusually high returns. Generally, the higher the potential returns being offered, the greater the associated risks. Many scams lure in unsuspecting investors with alluring promises of profitability.

High-Pressure Sales Tactics

You might hear phrases like:

“Act fast! This opportunity is only available for a limited time!”

“Exclusive rates for the first 50 investors—don’t let this chance slip away!”

“Over 2,000 people have already invested—what’s stopping you?”

“Invest now and receive an additional 10% credit along with other enticing benefits.”

Limited-time offers, urgency-inducing tactics and special bonuses are commonplace in investment scams, all aimed at hastening your decision to part with your money.

Ensure that you take the time to fully grasp what you are getting involved in instead of merely focusing on the tempting incentives being dangled before you.

Commission Offers

When approaching any investment opportunity, it’s vital to consider whether commissions are being offered for recruiting new investors. Be cautious, as this can sometimes indicate a pyramid scheme or similar fraudulent endeavour. Always do thorough research and seek clarity before making any financial commitment.

In summary, the world of investments can be fraught with danger if you are not careful. By remaining alert to these red flags and prioritising due diligence, you can better protect your finances from the grips of deceitful schemes.

A Cautionary Tale of Investment Offers

Once upon a time, in the bustling world of finance, many unsuspecting individuals were drawn into the allure of investment opportunities that sparkled with promises of great returns. However, a wise investor named Alex had learned to tread carefully, for they understood that reputable investment schemes rarely entice potential investors with commissions for referrals. In fact, it was often the dubious operations—those shady investment scams—that dangled such bait in front of eager clients, encouraging them to recruit friends and family to grow their ranks swiftly.

Like cunning magicians, these scams boast impressive track records, claiming decades of experience and an array of prestigious awards. They paint vivid pictures of extravagant profits to instil trust and confidence in their unwitting victims. To further bolster their facade, they showcase glowing testimonials from so-called “satisfied customers,” who often turn out to be mere actors in a well-scripted play.

Yet, Alex remained undeterred by these flashy claims. With a healthy dose of scepticism, they decided to investigate further, knowing that it was wise to seek verification from independent sources rather than relying on the words of those who had something to gain.

In their quest for truth, Alex learned about the importance of ensuring that any investment entity was adequately regulated. They discovered that some fraudulent operations would even assert that they were under the watchful eye of relevant authorities, all in an effort to mislead potential investors. Armed with this knowledge, Alex turned to the resources available on the Monetary Authority of Singapore (MAS) website—a treasure trove of information designed to protect investors like themselves.

There, Alex found the Financial Institutions Directory, which listed all financial institutions under MAS’s regulatory umbrella along with the activities they were authorised to conduct. They also uncovered the Register of Representatives, detailing individuals permitted to engage in regulated activities. Most importantly, the Investor Alert List caught their eye—a reminder of those unregulated entities that might have been mistakenly perceived as legitimate.

With each click and scroll through the MAS website, Alex felt more empowered and informed. They realised that engaging with an unregulated entity meant stepping into a perilous arena without the protective measures afforded by the laws overseen by MAS.

Through this journey of discovery, Alex became a beacon of wisdom for others in their community, sharing tales of caution and encouraging vigilance. They understood that in the world of investments, not everything that glitters is gold, and it is always better to seek clarity and confirmation before placing one’s hard-earned money on the line. And so, armed with knowledge and prudence, Alex navigated the treacherous waters of investment opportunities, determined to avoid the snares set by unscrupulous schemes.

Investigate the Company’s History

In a world where information flows freely, it’s crucial not to accept everything at face value. Before diving into any investment opportunity, take the time to investigate the claims made by the company and its representatives. Scrutinise their backgrounds and assess their track records carefully. This step is vital in ensuring that you are dealing with a legitimate entity.

Moreover, don’t hesitate to pose as many questions as necessary to grasp the full scope of the investment opportunity. If you find that the company is unable or unwilling to provide satisfactory answers, consider this a red flag and proceed with caution.

If you suspect you’ve fallen victim to a scam, act swiftly. Notify your bank immediately and file a police report without delay. This proactive approach can help mitigate potential losses and aid in any investigations.

It’s also wise to share your experiences and knowledge about investment scams with your family and friends. By spreading awareness, you can help protect them from similar pitfalls and ensure they remain vigilant.

Always remember that if an investment seems too enticing or promising, it likely carries hidden risks or may not be legitimate at all.

Protect Yourself From Scams

To take action and shield yourself from potential scams, consider implementing the following strategies:

Adjust Privacy Settings: Customize the privacy settings on your messaging applications. This will help prevent unsolicited invitations to unfamiliar chat groups, which could be breeding grounds for scams.

Enhance Security Features: Utilize security measures such as two-factor authentication (2FA) or multi-factor authentication for your banking applications. Additionally, set transaction limits on your payment accounts, including banking apps and services like PayNow or PayLah, to add another layer of protection against unauthorised transactions.

Utilise Money Lock Features: Many banks offer a “Money Lock” feature that allows you to secure a portion of your savings. This can act as a safeguard against potential threats, ensuring that your funds remain protected.

By taking these precautions, you can create a robust defence against scams and navigate the financial landscape with greater confidence.

Once upon a time, in a bustling city, there was a wise individual who understood the importance of being vigilant when it came to investment opportunities. One day, while browsing through potential financial ventures, they stumbled upon a captivating offer that promised extraordinary returns. Yet, having learned from past experiences, they knew that not everything that glittered was gold.

With a sense of caution, they recalled the resources available on the Monetary Authority of Singapore (MAS) website. It was a treasure trove of information containing vital tools such as the Financial Institutions Directory, the Register of Representatives, and the Investor Alert List. These resources could unveil whether the company behind this enticing investment was indeed regulated by MAS or merely a mirage in the desert of finance.

Before exploring this opportunity further, they decided to consult with a trusted friend, someone whose judgment they valued. Together, they examined the details of the offer, weighing its merits and flaws.

Yep, uncertainty lingered. The wise individual thought it prudent to contact the ScamShield helpline at 1799 for guidance. After all, it was better to seek clarity than to plunge headfirst into a potentially perilous situation.

Feeling a bit more secure but still sceptical, they resolved to contact the company’s official hotline. They needed reassurance that this investment product was genuine and not just an elaborate facade designed to lure unsuspecting victims.

As the story unfolded, this cautious individual became increasingly aware of their responsibility to share knowledge with others. They took it upon themselves to warn friends and family about the alarming encounter with what seemed to be a scam.

Determined to take action, they reported and blocked any suspicious accounts or chat groups that had crossed their path. Their sense of duty didn’t stop there; if they suspected they had fallen prey to deceit, they would contact their bank without delay and file a police report to ensure that others would not face the same fate.

In their quest for safety and awareness, they discovered a valuable resource: scamshield.gov.sg. This website offered insights into various scams and provided tips on how to protect oneself from such threats.

So, armed with knowledge and determination, our wise protagonist continued their journey through the world of investments—more aware than ever of the importance of vigilance and community in safeguarding against deception.

Maxthon

In a world where the digital landscape is in a state of perpetual flux, the significance of maintaining safety while navigating the internet cannot be overlooked. For those traversing this complex online terrain, choosing a web browser that prioritises security and privacy has become a necessity. Amidst the vast array of options, one browser emerges as a beacon of reliability: Maxthon Browser. This exceptional choice not only fulfils the vital requirements for security and privacy but does so entirely free of charge.

Maxthon transcends the conventional role of a web browser; it embodies a promise of a more secure online experience. Equipped with a suite of advanced built-in features, it provides essential tools such as an Adblocker and various anti-tracking mechanisms that play a critical role in safeguarding users’ online privacy. The design philosophy behind Maxthon is singular: to cultivate a browsing environment that protects personal information while reducing vulnerability to potential threats.

As you venture further into the realm of Maxthon, it becomes evident just how deeply committed it is to user protection. The visionary developers behind this groundbreaking browser have instituted formidable measures aimed at shielding personal data from unwanted scrutiny. By employing cutting-edge encryption techniques, Maxthon guarantees that sensitive information remains confidential during your digital expeditions, granting you peace of mind as you explore the vastness of the internet.

In the arena of enhancing your online privacy, Maxthon truly excels. Every feature within the browser has been thoughtfully designed to enrich your experience while ensuring that your data remains secure. Its ad-blocking functionality effectively shields you from disruptive advertisements, while its anti-tracking tools diligently thwart scripts intent on monitoring your every action online. This empowers users to navigate the web with a sense of liberation and confidence. Additionally, the incognito mode offers an extra layer of security, allowing users to browse without leaving any digital traces on their devices.

Maxthon’s unwavering commitment to user privacy creates a sanctuary in the chaotic expanse of the internet. As you embark on your online journeys with this remarkable browser, you can rest assured that your personal information is protected, enabling you to fully engage with the wealth of knowledge and entertainment that awaits in the digital realm. With Maxthon by your side, you are not merely surfing the web; you are exploring it with assurance, knowing that your safety is prioritised every step of the way.