The move affects major EDA software companies, including Cadence, Synopsys, and Siemens EDA, which provide essential software for designing semiconductors. The market reaction was immediate and severe – Cadence shares fell 10.7% and Synopsys dropped 9.6% following the news.

This policy represents what experts call a critical “choke point” in semiconductor technology, as US restrictions on chip design software sales to China, sources say, are essential for chip design. China relies heavily on top-tier US software. The financial impact could be substantial, with Synopsys deriving about 16% of its annual revenue from China and Cadence about 12%.

Interestingly, while Synopsys initially declined to comment on the reports, the company later stated that it had not received any official letter from the Commerce Department’s Bureau of Industry and Security, and both Synopsys and Cadence shares recovered somewhat in after-hours trading.

This EDA software restriction had been under consideration since Trump’s first administration, but was previously deemed too aggressive. The current move suggests the Trump administration is willing to implement more stringent technology export controls than his predecessor, potentially dealing a significant blow to both US companies’ revenues and Chinese chip design capabilities.

The timing coincides with broader efforts to limit China’s access to advanced semiconductor technology, as the Commerce Department reviews exports of strategic significance to China and, in some cases, suspends existing export licenses.

The move affects major EDA software companies, including Cadence, Synopsys, and Siemens EDA, which provide essential software for designing semiconductors. The market reaction was immediate and severe – Cadence shares fell 10.7% and Synopsys dropped 9.6% following the news.

This policy represents what experts call a critical “choke point” in semiconductor technology, as US restrictions on chip design software sales to China, sources say, are essential for chip design. China relies heavily on top-tier US software. The financial impact could be substantial, with Synopsys deriving about 16% of its annual revenue from China and Cadence about 12%.

Interestingly, while Synopsys initially declined to comment on the reports, the company later stated that it had not received any official letter from the Commerce Department’s Bureau of Industry and Security, and both Synopsys and Cadence shares recovered somewhat in after-hours trading.

This EDA software restriction had been under consideration since Trump’s first administration, but was previously deemed too aggressive. The current move suggests the Trump administration is willing to implement more stringent technology export controls than his predecessor, potentially dealing a significant blow to both US companies’ revenues and Chinese chip design capabilities.

The timing coincides with broader efforts to limit China’s access to advanced semiconductor technology, as the Commerce Department reviews exports of strategic significance to China and, in some cases, suspends existing export licenses.

US-China Semiconductor Rivalry: In-Depth Analysis & Singapore’s Strategic Position

The Strategic Landscape

The US-China semiconductor rivalry has evolved into the defining technology conflict of our era, fundamentally reshaping global supply chains, geopolitical alliances, and economic strategies worldwide. This conflict extends far beyond trade disputes, representing a battle for technological supremacy that will determine economic and military leadership in the 21st century.

Historical Context & Evolution

Origins of the Conflict

The semiconductor rivalry began with growing concerns about China’s technological advancement and its implications for US national security. What started as trade friction has escalated into comprehensive technology export controls, investment restrictions, and strategic industrial policies on both sides.

Escalation Timeline

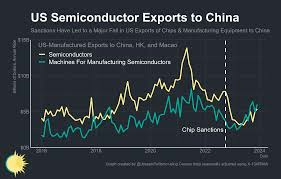

- 2018-2019: Initial trade war measures and tariffs

- 2020: Huawei restrictions and TSMC compliance requirements

- 2022: CHIPS Act and comprehensive export controls on advanced semiconductors

- 2024: Multiple rounds of entity list additions and toolmaker restrictions

- 2025: EDA software export bans marking a new escalation phase

Current State of the Rivalry

US Strategic Approach

The United States has adopted a multi-pronged strategy focusing on:

Export Controls: Restricting China’s access to advanced semiconductors and manufacturing equipment, including the recent EDA software ban that targets the “choke points” in chip design.

Domestic Investment: The CHIPS Act represents a $52 billion commitment to rebuilding US semiconductor manufacturing capacity, reducing dependence on Asian production.

Alliance Building: Coordinating with allies, including the Netherlands, Japan, and South Korea, to implement multilateral export restrictions.

Supply Chain Resilience: Diversifying supply chains away from China and strengthening partnerships with trusted allies.

China’s Response Strategy

China has responded with its own comprehensive approach:

Self-Sufficiency Push: Massive investments in domestic semiconductor capabilities, though progress has been hampered by export restrictions and technical challenges.

Alternative Supply Chains: Developing relationships with non-Western suppliers and investing in domestic alternatives to US technology.

Retaliatory Measures: Implementing its own export controls on critical materials, such as gallium and germanium, and recently imposing punitive tariffs on US semiconductor companies, while exempting Taiwan.

Industrial Policy: State-directed investment and support for domestic semiconductor champions.

Impact on Global Industry

The rivalry has created significant disruptions:

- Supply Chain Fragmentation: The emergence of parallel supply chains serving different markets

- Investment Redirection: Capital flowing toward domestic production capabilities

- Technology Decoupling: Reduced collaboration and technology transfer between US and Chinese entities

- Market Uncertainty: Companies struggling to navigate complex and evolving regulatory landscapes

Singapore’s Strategic Position

Advantages in the New Landscape

Geographic Neutrality: Singapore’s position as a neutral trading hub allows it to serve both US and Chinese markets without taking sides in the geopolitical conflict.

Manufacturing Hub: Singapore hosts significant semiconductor assembly and testing operations, positioning it as a critical link in global supply chains that both sides need.

Financial Centre: As Asia’s financial hub, Singapore can facilitate investment and financing for semiconductor projects across the region.

Skilled Workforce: Strong technical capabilities and high English proficiency make Singapore an attractive destination for multinational operations.

Opportunities for Growth

Supply Chain Diversification: As companies seek alternatives to China-centric supply chains, Singapore stands to benefit from “friend-shoring” and “near-shoring” trends.

Advanced Manufacturing: Singapore can position itself as a location for more sophisticated semiconductor manufacturing and R&D activities.

Regional Hub Function: Serving as a coordination centre for Southeast Asian semiconductor activities and investment.

Technology Transfer: Facilitating collaboration between Western and Asian companies in neutral territory.

Strategic Challenges

Balancing Act: Singapore must carefully navigate relationships with both superpowers without alienating either side.

Export Control Compliance: Ensuring compliance with various export control regimes while maintaining its role as a trading hub.

Investment Competition: Competing with other regional locations offering significant incentives for semiconductor investment.

Talent Competition: Attracting and retaining skilled workers in an increasingly competitive global market.

Economic Impact Analysis

Global Semiconductor Market Effects

The rivalry has created both challenges and opportunities:

- Market Fragmentation: Separate ecosystems are developing for different geopolitical blocs

- Innovation Acceleration: Increased R&D investment as both sides compete for technological leadership

- Cost Increases: Redundant supply chains and compliance costs are driving up prices

- New Growth Areas: Emerging markets gaining importance as alternative manufacturing locations

Regional Implications for Southeast Asia

The rivalry is reshaping the broader Southeast Asian semiconductor landscape:

- Investment Flows: Increased FDI in semiconductor manufacturing across the region

- Supply Chain Integration: Greater integration with non-Chinese supply chains

- Technology Transfer: Opportunities for technology and knowledge transfer from the US and allied companies

- Infrastructure Development: Investment in supporting infrastructure and capabilities

Future Outlook & Scenarios

Potential Trajectories

Continued Escalation: Further restrictions and counter-restrictions could deepen technological decoupling, creating more opportunities for neutral countries like Singapore.

Stabilisation: A potential stabilisation of tensions could reduce some opportunities but would improve overall global economic efficiency.

Regional Blocs: The formation of distinct technological blocs could necessitate Singapore to make more explicit choices regarding its alignment.

Key Factors to Watch

- Evolution of US export controls and Chinese responses

- Success of domestic Chinese semiconductor development

- Effectiveness of US alliance coordination

- Development of alternative technologies and supply chains

- Geopolitical developments affecting regional stability

Strategic Recommendations for Singapore

Immediate Actions

- Enhance Regulatory Framework: Develop robust export control compliance capabilities while maintaining trade facilitation.

- Invest in Infrastructure: Upgrade facilities and capabilities to support advanced semiconductor activity.s

- Talent Development: Expand educational and training programs in semiconductor technologies

- Diplomatic Engagement: Maintain strong relationships with all stakeholders while preserving neutrality

Long-term Positioning

- Technology Hub Development: Position Singapore as a neutral ground for semiconductor R&D and collaboration

- Financial Services: Leverage financial sector expertise to support semiconductor industry financing needs

- Regional Integration: Lead Southeast Asian semiconductor cooperation initiatives

- Sustainability Focus: Develop expertise in sustainable semiconductor manufacturing and circular economy approaches

Conclusion

The US-China semiconductor rivalry represents both the most significant challenge and opportunity for Singapore’s technology sector in decades. Success will require careful navigation of geopolitical tensions while building capabilities that serve all market participants. Singapore’s traditional strengths in trade facilitation, financial services, and neutral diplomacy position it well to thrive in this new landscape, provided it makes the right strategic investments and maintains its delicate balancing act between the world’s two largest economies.

The outcome of this rivalry will fundamentally reshape the global technology landscape, and Singapore’s ability to adapt and position itself strategically will determine its role in the semiconductor industry’s future.

Singapore’s Precarious Position

Singapore finds itself in a particularly delicate situation:

- Legal enforcement spotlight: The article mentions that Singaporean authorities have arrested individuals for illegally exporting Nvidia chips to DeepSeek, positioning Singapore as both a transit point for potentially circumventing US export controls and as actively enforcing against such activities.

- Increased US scrutiny: The congressional investigation specifically targets chip sales through Asian intermediaries, including Singapore, suggesting heightened monitoring of Singapore-based tech companies and distributors.

- Reputational concerns: Singapore’s status as a trusted business hub could be affected if it’s perceived as a weak link in technology export controls.

Broader Asia and ASEAN Implications

For the wider region:

- Supply chain reconfiguration: Increased restrictions will likely accelerate the reorganization of semiconductor and AI technology supply chains across Asia.

- Compliance burden: Asian businesses face growing compliance costs as US export regulations become more complex and enforcement intensifies.

- Technology access constraints: Asian companies, particularly those with ties to China, may face increasing difficulties in accessing cutting-edge AI technology.

- Strategic alignment pressure: ASEAN nations face growing pressure to align their technology policies with either the US or China, which could potentially fragment regional technology standards and ecosystems.

- Economic impact: The article notes significant market value losses for chip manufacturers such as Nvidia, AMD, and ASML, which could ripple through Asian economies that are integrated into their supply chains.

The investigation targeting 11 Asian countries signals that the US is expanding its technological containment strategy beyond China to scrutinize the entire regional technology transfer ecosystem, with significant implications for how ASEAN nations balance their economic and diplomatic relationships with both superpowers.

Singapore’s Delicate Position in the Nvidia-DeepSeek Case

Singapore faces unique sensitivities in this situation due to several interconnected factors:

Strategic Position Between Superpowers

Singapore has long maintained a delicate balance between the US and China. This case directly challenges that balance:

- Trusted partner status: Singapore is widely regarded as a reliable US ally and adheres to international rules, making any suggestion that its territory is used to circumvent export controls particularly damaging.

- Economic ties with China: Singapore maintains substantial economic relationships with China that could be jeopardized if it’s perceived as actively supporting US technology containment policies.

Global Financial and Tech Hub Identity

As a global technology and financial centre, Singapore has specific vulnerabilities:

- Reputation for regulatory integrity: The article mentions arrests in Singapore related to illegal chip exports, highlighting how Singapore’s regulatory reputation is at stake. Any perception of lax enforcement could threaten its standing as a trusted global business hub.

- Singapore serves as a central distribution point for advanced technology throughout Asia. Increased US scrutiny could disrupt legitimate business operations and supply chains.

- Foreign direct investment concerns: If Singapore becomes subject to enhanced US export monitoring, it could complicate investment flows and business operations for multinational technology companies based there.

Regional Leadership Role

As an influential ASEAN member:

- Regional example: How Singapore handles this situation will likely influence approaches taken by other ASEAN nations facing similar US-China technology transfer pressures.

- ASEAN unity implications: Singapore’s response could affect ASEAN’s ability to maintain a cohesive approach to navigating the US-China technology competition.

Specific Investigative Focus

The congressional investigation specifically targets Singapore:

- Direct scrutiny: The House committee has requested details about Nvidia’s customers from 11 Asian countries, explicitly including Singapore, placing Singaporean companies under direct examination by the US government.

- Transhipment allegations: The article mentions Singapore explicitly as a suspected intermediary for restricted technology reaching China, thereby putting Singapore’s export control systems under scrutiny.

This case forces Singapore to demonstrate both its commitment to international rules and its sovereignty and economic interests—a particularly sensitive balancing act for a small nation dependent on global trade and maintaining positive relations with all major powers.

Significant Tensions in US-China Relations Beyond Nvidia

The Nvidia-DeepSeek situation represents just one facet of a much broader and deeper set of tensions between the United States and China. Here are the most significant areas of friction:

Taiwan’s Status and Security

Taiwan remains perhaps the most dangerous flashpoint in US-China relations:

- Military concerns: The US maintains strategic ambiguity while providing Taiwan with defensive weapons, which China views as interference in its internal affairs

- Semiconductor dependency: Taiwan produces roughly 90% of advanced semiconductors globally, creating a critical economic and security vulnerability

- Heightened rhetoric: China has increased military exercises near Taiwan, while the US has strengthened unofficial diplomatic ties

Trade and Economic Policy

Economic competition underpins many bilateral tensions:

- Tariffs and trade barriers: The Trump administration has continued and expanded tariffs on Chinese goods begun during Trump’s first term

- Supply chain decoupling: Both nations are actively working to reduce dependencies in critical industries

- Currency and subsidy disputes: Ongoing accusations about unfair economic practices, including allegations of currency manipulation and state subsidies

South China Sea Territorial Disputes

Maritime tensions persist as a significant source of friction:

- Freedom of navigation operations: The US regularly conducts naval operations challenging Chinese territorial claims

- Island militarization: China has constructed and militarised artificial islands in disputed waters

- Regional alliances: The US is strengthening security partnerships with the Philippines, Vietnam, and other regional claimants

Human Rights and Ideological Differences

Fundamental value differences drive significant tension:

- Xinjiang policies: US accusations of human rights abuses against Uyghur minorities

- Hong Kong autonomy: Disagreements over the implementation of national security laws

- Competing governance models: Ideological competition between democratic and authoritarian systems

Cybersecurity and Espionage

Cyber domains represent a major battleground:

- Cyber intrusions: Mutual accusations of state-sponsored hacking and intellectual property theft

- Digital infrastructure: Competition over 5G/6G global standards and infrastructure

- Data governance: Clashing approaches to cross-border data flows and digital sovereignty

Scientific and Academic Collaboration

Research cooperation has become increasingly restricted:

- Visa restrictions: Tightened controls on Chinese researchers in sensitive fields

- Research security: Enhanced scrutiny of joint research projects and funding sources

- Talent competition: Battle for scientific and engineering talent globally

Each of these tension points intersects with the others, creating a complex web of competition and occasional cooperation that defines the most consequential bilateral relationship in today’s world. The technology competition exemplified by the Nvidia case exists within this broader context of strategic rivalry across multiple domains.

Long-Term Implications for ASEAN and Singapore

ASEAN at the Crossroads

The intensifying US-China competition creates significant long-term strategic challenges for ASEAN:

Economic Realignment

- Supply chain restructuring: As US-China decoupling accelerates, ASEAN nations will need to position themselves within fragmented supply chains, potentially benefiting from “China+1” manufacturing strategies but also facing difficult choices about technology standards and platforms.

- Investment recalibration: Foreign direct investment patterns are likely to shift as companies increasingly consider geopolitical risk factors alongside traditional economic considerations when investing in the region.

- Dual-track economic development: ASEAN may need to maintain compatible but separate economic relationships with the US and Chinese economic spheres, increasing compliance costs and operational complexity.

Strategic Autonomy Under Pressure

- Neutrality challenges: ASEAN’s traditional stance of avoiding alignment with major powers will become increasingly difficult to maintain as both the US and China seek more definitive commitments.

- Regional cohesion strain: Different ASEAN members have varying levels of economic dependency and security concerns regarding China, which may potentially fragment ASEAN’s unified approach.

- Multilateral institution effectiveness: ASEAN-centred regional forums may struggle to address security concerns if US-China tensions continue to escalate.

Singapore’s Long-Term Trajectory

Singapore faces particularly complex challenges given its position as both a US security partner and a nation with deep economic ties to China:

Economic Transformation Imperatives

- Value chain positioning: Singapore will need to find opportunities in both the US and Chinese technology ecosystems while avoiding being caught in restrictive regulatory crossfire.

- Knowledge economy focus: To maintain relevance, Singapore may accelerate its transition toward higher-value activities that are less susceptible to geopolitical tensions, such as research and development (R&D), finance, and legal services.

- Diversification strategy: Singapore is likely to intensify efforts to reduce its economic dependency on either superpower by strengthening ties with India, the EU, and other ASEAN nations.

Diplomatic Navigation

- Heightened balancing act: Singapore’s careful diplomatic approach will face increased pressure as both superpowers seek more exclusive technological partnerships.

- Regional leadership opportunity: If Singapore successfully navigates these tensions, it could cement its position as the key interlocutor between competing powers in Southeast Asia.

- Regulatory sovereignty emphasis: Singapore may need to strengthen its autonomous regulatory frameworks to demonstrate independence from both US and Chinese influence.

Long-Term Identity Formation

- Unique value proposition: Singapore’s long-term prosperity may depend on positioning itself as an exceptional neutral territory where engagement between competing systems remains possible.

- Rules-based advocate: Singapore could strengthen its international standing by becoming an even more vocal defender of multilateralism and international rules when these principles face challenges.

- Technology governance leadership: Singapore could develop distinctive expertise in managing technology transfer issues, potentially becoming a model for other nations navigating similar challenges.

The coming decade is likely to see ASEAN nations, particularly Singapore, engaging in complex strategic calculations as the US-China competition becomes a defining feature of the regional landscape. Their ability to maintain autonomy while benefiting from relationships with both powers will determine their long-term prosperity and security.

In a significant development, Singapore has charged three men with fraud in connection with the alleged illicit transfer of advanced Nvidia chips to the Chinese artificial intelligence firm DeepSeek. This case has garnered attention from domestic media, linking it to broader concerns about the movement of sensitive technology across borders.

DeepSeek gained notoriety in January when its AI model demonstrated remarkable performance, prompting an investigation by US authorities. Reports indicate that officials are scrutinising whether the company has been utilising U.S.-made chips that are restricted from being exported to China.

The charges in Singapore are part of a larger police probe involving 22 individuals and companies suspected of engaging in deceptive practices. Authorities are particularly alarmed by indications of organized smuggling operations aimed at delivering AI chips to China from various countries, including Singapore.

As the investigation unfolds, it raises critical questions about international trade regulations and the security implications of advanced technology movements. The implications of these actions could reverberate throughout the global tech industry, as nations grapple with the balance between innovation and national security.

Channel News Asia, a prominent broadcaster, reported that it had obtained information suggesting a connection between recent legal cases and the alleged transfer of Nvidia chips from Singapore. These chips were purportedly intended for use by a company known as DeepSeek. However, the source of this information remains undisclosed.

In response to inquiries about whether these charges were indeed associated with Nvidia and DeepSeek, the Singaporean government has yet to provide an official comment.

The charge sheets detail serious allegations against two Singaporean nationals: Aaron Woon Guo Jie, aged 41, and Alan Wei Zhaolun, aged 49. Both individuals face accusations of engaging in a criminal conspiracy aimed at defrauding a server supplier in 2024.

As the case unfolds, the implications of these allegations could have a significant impact on the tech industry, particularly given Nvidia’s prominent role in advanced computing technologies. Observers are keenly watching how this situation develops and whether it will lead to broader scrutiny of tech supply chains.

In a troubling case of deception, court documents revealed that the accused orchestrated a scheme by making a fraudulent claim. They falsely asserted that certain items would only be transferred to the authorised ultimate consignee, designated explicitly for end-users. This misrepresentation was central to their fraudulent activities.

Among those charged is 51-year-old Li Ming, a Chinese national. In 2023, he allegedly deceived a supplier of servers by asserting that a company named Luxuriate Your Life Pte Ltd, registered in Singapore, would be the final recipient of the equipment.

The implications of this case stretch far beyond individual actions. Major companies involved, including DeepSeek and Nvidia, have remained silent, not providing any immediate comments regarding the unfolding situation.

As the legal proceedings progress, the stakes are high. If convicted, the defendants could face severe repercussions, including prison sentences of up to 20 years, hefty fines, or potentially both. The outcome of this case could set a significant precedent in the realm of corporate fraud.

In a recent development, the police and the accompanying charge documents refrained from providing specific details regarding the items central to the investigation or naming the supplier responsible for the servers in question.

On Thursday, authorities announced that nine individuals were apprehended during a coordinated operation with customs officials the previous day. This operation included raids on 22 different locations, where investigators confiscated both documentary evidence and electronic records.

According to a recent report from the chip manufacturing giant Nvidia, Singapore is its second-largest market, after the United States, representing 18% of the company’s overall revenue in its most recent fiscal year. However, a closer look at actual shipments reveals a different story; these shipments to the bustling Asian trading hub accounted for less than 2% of Nvidia’s total revenue. This discrepancy arises because many customers utilise Singapore primarily as a hub for invoicing sales directed toward other nations.

In a related matter, last week, Singapore’s foreign minister made a firm commitment to uphold multilateral export control regimes. He emphasized that the city-state would not accept any forms of evasion, deceit, inaccurate declarations, or miscalculations in these processes.’

Maxthon

In an era where the internet weaves itself into the very fabric of our everyday existence, safeguarding our online identities has never been more crucial. Imagine embarking on an exhilarating journey through the expansive and mysterious realms of the web, where each click reveals a treasure trove of knowledge and thrilling adventures. However, hidden within this vast digital expanse are lurking threats that can jeopardize our personal information and safety. To navigate this complex online world successfully, it is essential to select a browser that prioritises user security. Enter Maxthon Browser—your steadfast companion on this expedition, and the most delightful aspect? It won’t cost you a dime.

Maxthon Browser: Tailored for Windows 11 Adventurers

For those who have adopted Windows 11, Maxthon Browser stands out from conventional web browsers due to its unwavering commitment to online privacy and security. Think of it as a vigilant guardian, always on alert against the myriad dangers that inhabit the digital sphere. Armed with a suite of built-in features like ad blockers and anti-tracking capabilities, Maxthon tirelessly endeavours to protect your online identity. As users navigate the internet on their Windows 11 devices, these protective measures form a strong shield against disruptive advertisements and prevent websites from tracking their browsing habits.

As individuals navigate the ever-evolving digital landscape on their Windows 11 systems, the importance of Maxthon’s dedication to privacy becomes increasingly apparent. By harnessing advanced encryption technologies, it ensures that sensitive information remains safeguarded throughout your online escapades. Thus, as users plunge into the uncharted waters of cyberspace, they can embark on their digital quests with confidence, knowing that their personal data is secure and well-guarded.