Building a Scam-Resilient Singapore Through Empathy-Led Education

In this article, Gabriel Tan, Founder of Bamboo Builders, a Singapore-based social enterprise that aims to #BuildChangeBetter. They close gaps in traditional education by equipping individuals with real-world skills to tackle real-world problems. He sheds light on how Singapore can create a more scam-resilient society through empathetic education.

This article builds on the report “Strengthening Scam Readiness in Singapore”, click here to read.

By Gabriel Tan, Founder at Bamboo Builders

Central Issues in Singapore’s Scam Preparedness:

- Low Response Preparedness:

- Two-thirds of Singaporeans don’t know how to respond effectively to scams

- Parents especially lack strategies for handling scams involving their children

- Over-reliance on family and friends for scam information rather than official sources

- Overconfidence Problem:

- 84% believe they can spot scams, but tests show only 40% can identify phishing emails

- Nearly 50% of digital natives (18-34) have fallen victim to scams

- 98% of teenagers claim they can detect scams despite limited exposure

- The AI Challenge:

- Modern scams use AI-generated deepfakes and sophisticated personalization

- Only 5% of Singaporeans are confident in detecting AI-generated fraud

- The elderly particularly struggle with these advanced techniques

Recommended Solutions:

The article proposes the SGScamWISE program (supported by Google.org), which focuses on:

- Empathy-Led Education: Understanding both scammer tactics and psychological techniques

- Real World Learning: (Details were incomplete in the article)

- Community Empowerment: (Details were incomplete in the article)

The article emphasizes that addressing scams requires a whole-of-society approach, with Bamboo Builders working alongside government agencies like the Singapore Police Force and IMDA.

Scams in Detail

While the article doesn’t enumerate specific scam types, it highlights several important characteristics of modern scams:

Evolution of Scam Sophistication

- Scams have evolved beyond “poorly worded emails from Nigerian princes” into a sophisticated industry.

- Modern scams leverage advanced technology and deep psychological manipulation.

- They operate as a shadow economy that extracts billions globally.

AI-Enhanced Scam Techniques

- Deepfake Videos: AI-generated video content that can convincingly impersonate trusted figures

- Hyper-personalized Phishing: Targeted attacks using personal information to increase credibility

- Social Engineering with AI: Using machine learning to mimic voices and writing styles with precision

- The detection challenge has shifted from spotting grammatical errors to recognizing sophisticated psychological manipulation.

Target Demographics

- Contrary to stereotypes, young professionals (18-34) are highly vulnerable (nearly 50% victimization rate)

- Digital natives are frequently targeted due to their constant online presence and financial activity.

- Teenagers represent a high-risk group due to increasing financial independence coupled with overconfidence.

- The elderly still struggle, particularly with digital literacy challenges.

Prevention Measures

The article outlines several approaches to improving scam readiness:

Educational Framework (SGScamWISE)

- Well-Informed, Secured, and Empowered program supported by Google.org

- Empathy-Led Education: Understanding both the tactics and psychological techniques of scammers

- Real-World Learning: Though details were incomplete, this suggests practical, experience-based training

- Community Empowerment: Building collective defense mechanisms within communities

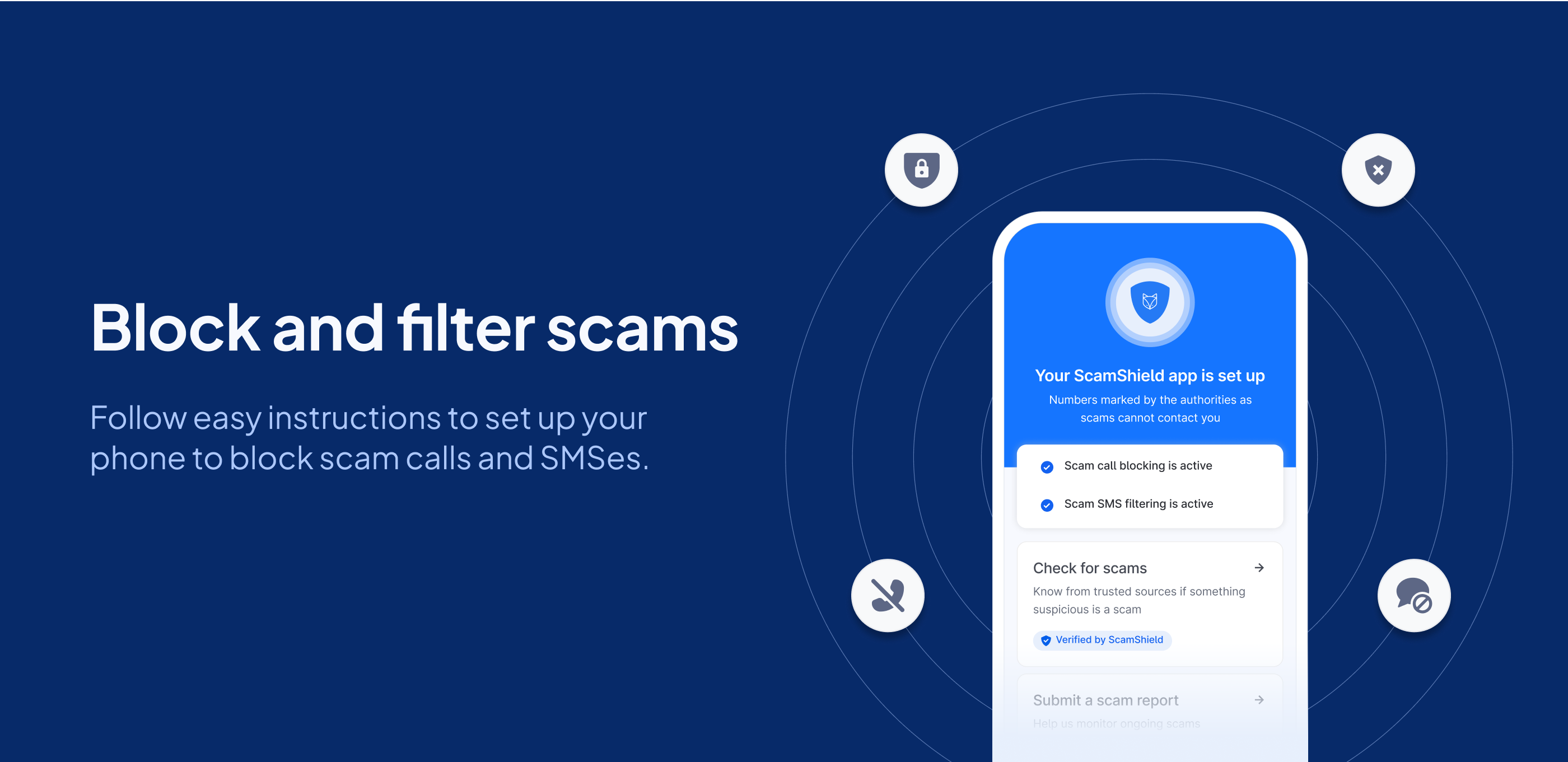

Technological Countermeasures

- SATIS (Scam Analytics and Tactical Intervention System): Developed by GovTech to identify and neutralize malicious websites

- Leveraging AI as a protective tool rather than just viewing it as a threat

Collaborative Approach

- Partnerships between social enterprises (like Bamboo Builders), government agencies (Singapore Police Force, IMDA), and community organizations

- Support from the national Digital for Life movement

- Emphasis on a whole-of-society response rather than individual solutions

Legal Aspects

While the article doesn’t delve deeply into legal frameworks, it mentions:

- Government agencies’ involvement suggests regulatory oversight

- The collaborative approach indicates a coordinated response between public and private sectors

- The emphasis on response preparedness suggests that legal reporting mechanisms exist but may be underutilized

Emotional Impact and Psychology

The emotional dimensions of scams receive significant attention:

Psychological Vulnerability

- Scammers exploit fundamental human psychology, not just technological gaps

- Overconfidence creates vulnerability (84% believe they can spot scams; only 40% actually can)

- Social trust is leveraged when scammers mimic trusted relationships

Emotional Support Gaps

- Two in three citizens lack effective response strategies, creating anxiety and helplessness.

- Parents feel particularly vulnerable regarding protecting their children

- Reliance on family and friends for information creates emotional dependencies that may spread misinformation

Empathy as a Solution

- Understanding both victims’ and scammers’ psychology is emphasized as critical.

- Community support frameworks are positioned as emotional safeguards

- Building resilience is framed as not just technical but emotional preparation

Gaps in the Current Approach

Reading between the lines, several challenges remain:

- Measurement Gap: How to objectively assess scam resilience beyond self-reporting

- Technology-Psychology Intersection: Need for a deeper understanding of how AI exploits human psychology

- Educational Effectiveness: Ensuring that empathy-led education translates to behavioral change

- Demographic Customization: Different approaches are needed for various vulnerable populations

The article presents scam resilience not just as technical knowledge but as a holistic capability involving emotional intelligence, community support, and practical response strategies, suggesting that effective prevention requires simultaneously addressing technological and human factors.

How Empathy Deters Scams

Based on the article, empathy functions as a scam deterrent in several sophisticated ways:

Understanding the Psychology of Scammers

The article suggests that empathy-led education helps potential victims understand not just the tactical aspects of scams but also the psychological techniques scammers employ. This deeper understanding works as a deterrent by:

- Recognizing Manipulation Patterns: When people understand the emotional triggers scammers use (urgency, fear, greed, trust), they become less susceptible to these tactics.

- Anticipating Psychological Pressure: Empathy allows potential victims to recognize when they’re being pushed into emotional states that compromise rational decision-making.

Creating Community Resilience

The empathy approach extends beyond individual protection to building community defenses:

- Collective Vigilance: The article states, ” We can build a collective shield through education and empathy,” suggesting that empathy creates shared responsibility for scam prevention.

- Reducing Stigma: When communities approach scam victimization with empathy rather than judgment, victims are more likely to report incidents quickly, helping authorities respond faster.

Improving Response Effectiveness

The SGScamWISE program emphasizes being “Well-Informed, Secured, and Empowered,” with empathy playing a crucial role in the response phase:

- Faster Recovery: The article identifies that two-thirds of Singaporeans wouldn’t know how to respond effectively to scams. Empathy-based education addresses this by helping people understand appropriate emotional and practical responses.

- Breaking Isolation: Scam victims often feel shame and isolation. Empathetic community responses help break this cycle, potentially preventing repeat victimization.

Countering Overconfidence

One of the most interesting aspects is how empathy might address the overconfidence problem:

- Self-awareness: Understanding one’s own psychological vulnerabilities (through empathy for oneself) helps counter the dangerous overconfidence the article identifies (84% believing they can spot scams when only 40% actually can).

- Realistic Risk Assessment: Empathy for victims helps others recognize that “it could happen to me too,” countering the false security that makes digital natives especially vulnerable.

The article frames empathy not as a soft skill but as a practical defensive tool that helps people better understand scammers’ psychological tactics and their own vulnerabilities. Thus, empathy creates a more comprehensive and effective approach to scam prevention than purely technical solutions.

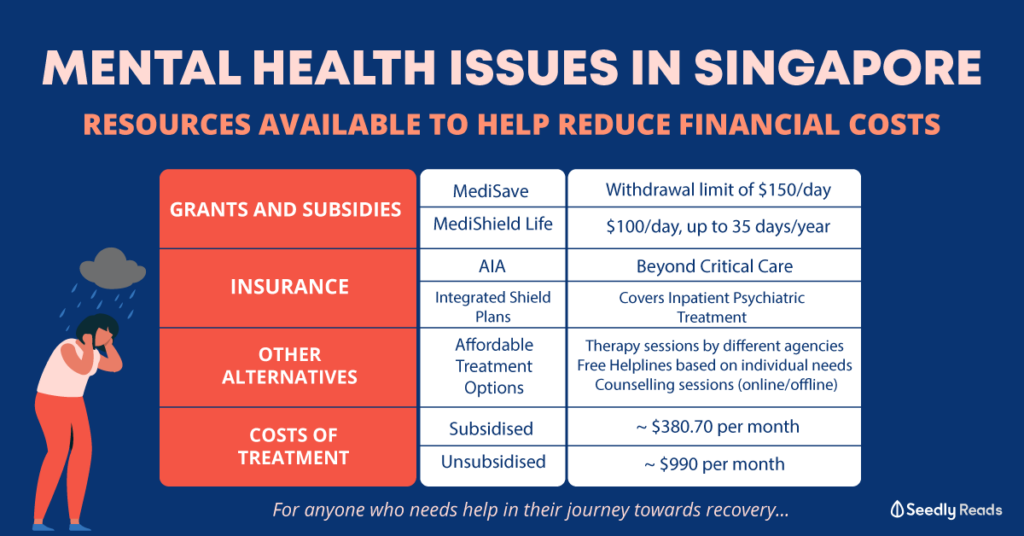

Mental Health Impact on Scam Victims

- Victims often experience shame, fear, guilt, and severe emotional trauma

- Some develop serious conditions like depression or anxiety disorders

- Sleep problems, paranoia, loss of trust, and low self-esteem are common

- The psychological recovery process can take weeks to six months

Case Examples

- Ms. Lie, 52, lost approximately S$111,000 in a malware scam after downloading a third-party app for what she thought was a tour ticket.

- She experienced insomnia, emotional distress, and severe self-blame (“I ask myself why I’m so stupid”)

- Ms. Khoo, 58, lost S$44,487 in a similar malware scam and became extremely distrustful and fearful afterward.

Mental Health Expert Insights

- Dr. Lim Boon Leng notes victims typically go through stages including denial, anger, and “bargaining” (trying to recover losses)

- Dr. Annabelle Chow points out that older victims may particularly struggle with “loss of face” in Asian cultures.

- Experts emphasize that recovery requires time to grieve, acceptance, and moving forward.

How to Support Scam Victims

- Listen without judgment and validate their emotions

- Help with practical matters like reporting to authorities

- Avoid telling them to “just move on” or downplaying their experience

- Never blame or shame the victim, as they’re already suffering

The article concludes with helpline resources for those experiencing mental health challenges.

Analysis of Scams and Their Impact

Types of Scams Mentioned

- Malware Scams: The primary scam highlighted in the article involves victims downloading third-party apps that give scammers control over financial accounts. Both Ms. Lie and Ms. Khoo fell victim to this type of scam.

- Social Media Advertisement Scams: Ms. Lie was initially lured by a Facebook advertisement for an inexpensive durian day-tour ticket to Malaysia (S$28), which turned out to be fraudulent.

Scale and Impact

Financial Impact

- Over 1,400 victims fell prey to malware scams between January and August

- Total losses amounted to at least S$20.6 million

- Individual losses were substantial:

- Ms. Lie: US$81,000 (approximately S$111,000)

- Ms. Khoo: S$44,487 from multiple credit cards and bank accounts

Psychological Impact

- Emotional Trauma: Shame, fear, guilt, and self-blame

- Sleep Disturbances: Insomnia and irregular sleep patterns

- Trust Issues: Paranoia and difficulty trusting others

- Self-Esteem: Severe decline in self-worth and confidence

- Long-term Conditions: Potential development of depression and anxiety disorders

- Social Withdrawal: Victims become wary of everyday activities (like using social media or answering phone calls)

- Family Burden: Family members take turns to provide care and supervision

Prevention Strategies

Individual Protection Measures

- Verify Sources: Be skeptical of unusually low-priced offers or deals, especially on social media.

- App Downloads: Only download apps from official app stores (Google Play, Apple App Store)

- Link Verification: Never click on suspicious links, mainly those promising deals or requiring immediate action

- Two-factor authentication: Enable this for all financial accounts

- Regular Monitoring: Check bank statements and credit card transactions frequently

- Credit Limits: Keep default credit limits lower and only increase them temporarily when needed

- Secure Banking: Use banking apps that have additional security features

- App Permissions: Review what permissions you grant to apps, especially financial access

Systemic Prevention

- Education Campaigns: Target vulnerable populations with awareness programs

- Financial Institution Safeguards: Banks could implement additional verification for unusual transactions

- Rapid Response Systems: Improve mechanisms for quickly freezing accounts when scams are reported

- Social Media Platform Responsibility: Stricter verification of advertisers and monitoring of potential scam content

Recovery Support

- Financial Counseling: Help victims manage the aftermath of financial losses

- Mental Health Services: Specialized psychological support for scam victims

- Community Support Groups: Create spaces where victims can share experiences and healing strategies

- Legal Aid: Assistance in navigating reporting procedures and potential recovery options

Cultural Considerations

The article specifically mentions that in Asian cultures, the concept of “loss of face” can make recovery particularly challenging. Prevention and support strategies should be culturally sensitive, acknowledging that shame may prevent victims from seeking help promptly.

Implementing these preventative measures could significantly reduce the likelihood of falling victim to such scams, while improving support systems would help mitigate the long-term psychological impact on those who do become victims.

Steps to Prevent Sophisticated Scams

Before Any Potential Scam Occurs

1. Develop a verification protocol

Create your personal verification procedure for any unexpected financial communication. This could include hanging up and calling the official number, checking through official apps, or visiting a physical branch. Make this your non-negotiable habit for all financial matters.

2. Familiarize yourself with official communication channels

Know precisely how legitimate organizations like banks, government agencies, and financial institutions typically contact you. Most will never call from mobile numbers, use video calls, or transfer you directly to other agencies.

3. Establish personal security questions

For your accounts that allow it, set up personalized security questions that only you and the institution would know. If a caller can’t verify these, it’s likely fraudulent.

4. Enable two-factor authentication

Activate this security feature on all your important accounts, particularly those connected to financial services and digital identity systems like Singpass.

5. Register for scam alerts

Subscribe to official scam alert services from police, financial authorities, and banks to stay informed about current scam techniques being used in your area.

During a Suspicious Call

6. Pause and breathe

When receiving unexpected calls about security issues, take a moment to calm yourself. Scammers rely on creating a panic that clouds judgment.

7. Question the context

Ask yourself: “Was I expecting this call?” “Have I recently applied for this service?” “Does this situation make logical sense?”

8. Verify the caller independently

If someone claims to represent an organization, tell them you’ll call back through official channels. Never use the number they provide – look up the official contact information yourself.

9. Be wary of pressure tactics

Legitimate organizations will not pressure you into making immediate decisions. If you feel pressured with artificial urgency, it’s likely a scam.

10. Watch for information asymmetry

Be suspicious when someone has extensive information about you but you know very little about them. Request their full name, employee ID, and department – details you can verify later.

11. Notice technical inconsistencies

Pay attention to call quality, background noises, or switching between different “representatives” on the same phone number. These often indicate scam operations.

Red Flags to Remember

12. Be alert to emotional manipulation

Recognize when someone is trying to provoke fear, urgency, or excitement – these emotional states make critical thinking difficult.

13. Question unusual procedures

Be highly suspicious if asked to transfer money to “safe accounts,” purchase gift cards, or download unfamiliar software for “verification.”

14. Guard against authority imposters

Government agencies and banks never demand immediate payments or transfers during the first point of contact.

15. Beware of the “hanging question”

Scammers often ask if you’ve recently clicked suspicious links or been involved in unusual activity – designed to make you feel vulnerable and reactive rather than analytical.

Long-term Protection Strategies

16. Regularly monitor your accounts

Schedule weekly checks of your financial accounts to catch unauthorized activity early.

17. Use credit monitoring services

Consider services that alert you to changes in your credit report or when your personal information appears in unusual places.

18. Limit your digital footprint

Regularly audit what personal information is publicly available about you online and take steps to minimize it.

19. Keep learning about new scam techniques

Scammers constantly evolve their approaches. Stay informed about new tactics through official sources.

20. Share knowledge with vulnerable networks

Discuss scam prevention with family members, especially those who might be more susceptible, like elderly relatives or those less familiar with technology.

Remember that even the most vigilant person can be caught off guard by sophisticated scams. The key is creating systems and habits that protect you even when your emotional defences might be compromised.

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in Adblock and anti-tracking software to enhance your browsing privacy.

By utilising the Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser is a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive web browser market.