I’ll analyze this article about preparing personal finances for potential economic challenges related to Trump’s tariff policies.

Key Financial Resilience Strategies from the Article

The article “Can you Trump-proof your finances?” outlines several essential strategies to strengthen your financial position during uncertain economic times:

- Manage Cash Flow

- Build an emergency fund covering 3-6 months of expenses (more if you have dependents)

- Track spending with digital tools

- Reduce discretionary spending (meal delivery, unused subscriptions, etc.)

- Consider budget travel options.

- Handle Credit Wisely

- Pay credit card bills in full before due dates

- Select cards aligned with your spending habits

- Be cautious with buy-now-pay-later schemes, which can lead to overspending

- Consider debt consolidation if necessary

- Increase Income Sources

- Upskill using SkillsFuture credits to remain employable

- Explore side hustles

- Consider part-time work, especially for retirees

- Maintain Investments

- Avoid panic selling during market downturns

- Use dollar-cost averaging rather than timing the market

- Stay invested long-term (data shows missing even 10 best trading days significantly reduces returns)

- Maintain a diversified portfolio with quality equities and investment-grade bonds

- Optimize Home Loans

- Watch for refinancing opportunities after lock-in periods end

- Consider penalty-free partial repayments

- Use CPF Ordinary Account strategically, maintaining at least 12 months of mortgage payments as a buffer.

- Special Advice for Gig Workers

- Build more significant emergency funds (12 months recommended)

- Contribute to CPF

- Consider moving savings from the Ordinary Account to the Special Account for higher interest.

- Ensure adequate insurance coverage.

The article emphasizes focusing on what you can control during uncertain times, particularly as Singapore navigates economic impacts from global trade tensions and inflation concerns.

Analysis of Financial Prudence Options with Digital Transformation and Anti-Scam Measures

Financial Prudence Options from the Article

1. Cash Flow Management

The article emphasizes creating a financial buffer through emergency savings of 3-6 months of expenses. Digital transformation has enhanced this through budgeting apps and automated savings tools that make tracking expenses easier. These tools provide real-time insights into spending patterns, allowing for quicker adjustments during economic uncertainty.

2. Credit Management

Wise credit usage is emphasized, with recommendations to pay bills in full and select cards matching spending habits. Digital banking innovations have introduced spending alerts, automatic payment reminders, and real-time credit monitoring, which help consumers better manage their credit usage and avoid late fees.

3. Income Diversification

The article suggests upskilling and side hustles. Digital platforms have revolutionized income diversification through:

- Remote work opportunities

- Gig economy platforms connecting workers to temporary assignments

- Online learning platforms for affordable skill development

- Digital marketplaces for selling products/services

4. Investment Strategy

Long-term investment with dollar-cost averaging is recommended rather than market timing. Digital transformation has democratized investing through:

- Low-cost robo-advisors

- Fractional share investing

- Automated rebalancing tools

- Real-time portfolio monitoring

5. Mortgage Optimization

Strategically managing home loans and using CPF effectively. Digital transformation helps through:

- Automated refinancing alerts

- Digital mortgage comparison tools

- Online application processes

- Self-service partial repayment options

6. Gig Worker Protections

The article notes gig workers’ particular vulnerability. Digital solutions now offer:

- Specialized financial planning apps for inconsistent income

- Micro-insurance products

- Automated CPF contribution tools

- Income smoothing services

How Digital Transformation Enhances Financial Prudence

- Accessibility: Financial services are now available 24/7 through mobile applications, reducing barriers to financial management.

- Automation: Recurring savings transfers, bill payments, and investment contributions can be automated, reducing human error and procrastination.

- Financial Education: Digital platforms provide personalized financial literacy content, helping consumers make more informed decisions.

- Data Analytics: AI-powered insights help identify spending patterns and suggest personalized optimization strategies.

- Reduced Transaction Costs: Digital platforms have reduced fees for many financial services, increasing returns on savings and investments.

Anti-Scam Centers and Financial Protection

While not directly mentioned in the article, anti-scam centers provide crucial protection within this digital financial ecosystem:

- Real-time Fraud Detection: Advanced algorithms can identify suspicious transactions before money leaves accounts.

- Public Education: Anti-scam centers run awareness campaigns about emerging financial threats.

- Rapid Response: Quick-reaction teams can sometimes freeze funds and reverse transactions when scams are reported promptly.

- Cross-Border Collaboration: International partnerships help address the global nature of many financial scams.

- Regulatory Engagement: Anti-scam centers inform policy development to strengthen the financial system against emerging threats.

Integration of Financial Prudence and Security

Financial prudence now requires both traditional saving/investing discipline and digital vigilance. The most effective financial strategies integrate:

- Sound financial principles (emergency savings, diversification, etc.)

- Digital tools for efficiency and optimization

- Security awareness to protect assets

- Regular financial education to keep pace with changing markets and scam tactics

This comprehensive approach to financial management helps individuals navigate both economic uncertainty and the evolving digital financial landscape.

Optimizing Prudent Spending with E-commerce

E-commerce offers numerous tools and strategies that can help enhance financial prudence while still meeting your needs. Here’s how to optimize your spending while using online shopping platforms:

Strategic E-commerce Shopping Approaches

1. Price Comparison and Tracking

- Browser extensions: Tools like Honey, CamelCamelCamel, or Keepa track price history and automatically apply coupons

- Price alert notifications: Set up alerts for desired items to purchase only when prices drop to your predetermined threshold

- Comparison shopping engines: Use dedicated price comparison sites rather than visiting individual retailers

2. Timing Your Purchases

- Seasonal sales cycles: Plan major purchases around predictable sales events (Black Friday, end-of-season clearances)

- Flash sale memberships: Join notifications for time-limited deals but set strict spending limits beforehand

- Off-peak shopping: Purchase winter items in summer and vice versa for substantial discounts

3. Subscription and Membership Optimization

- Strategic Subscriptions: Calculate the breakeven point for any membership (e.g., Amazon Prime, Costco) based on your actual usage

- Subscription tracking apps: Use services that monitor your recurring payments and identify unused subscriptions

- Subscription sharing: Where permitted, share family plans to reduce per-person costs

4. Digital Shopping Psychology Safeguards

- Wishlist cooling period: Place desired items on wishlists with a mandatory 48-hour waiting period before purchasing

- Virtual envelope system: Use separate digital payment methods for different spending categories

- Cart abandonment strategy: Deliberately abandon carts with non-essential items; retailers often send discount codes to encourage completion

Leveraging E-commerce Data and Technology

1. Cashback and Rewards Optimization

- Cashback portals: Route purchases through services like Rakuten or ShopBack

- Credit card rewards alignment: Use cards offering enhanced rewards for online purchases

- Points stacking: Combine store rewards, credit card points, and cashback portal benefits on the same purchase

2. Digital Budgeting Integration

- Shopping app spending limits: Set maximum monthly spending caps within payment apps

- Budget-linked accounts: Connect shopping accounts to specific pre-funded accounts rather than main credit cards

- Receipt scanning: Use apps that automatically categorize online purchases into your budget categories

3. Community-Powered Savings

- Group buying platforms: Join collective purchasing groups for bulk discounts

- Review mining: Read user reviews, specifically focusing on durability and value to identify truly cost-effective products

- Deal forums: Participate in community forums where members share exceptional deals

Practical Implementation Tips

- Create a digital purchase framework:

- Necessity rating (1-5)

- Waiting period based on rating

- Maximum acceptable price

- Required discount percentage

- Implement digital boundaries:

- Remove saved payment information from regular shopping sites

- Use virtual card numbers with spending limits for online purchases

- Schedule specific “shopping hours” rather than browsing continuously

- Quality-focused approach:

- Research cost-per-use for durable items

- Check repair policies and parts availability before purchasing

- Prioritize items with substantial secondhand resale value

By combining these strategies, you can leverage e-commerce’s convenience and competitive pricing while maintaining financial discipline. The key is creating intentional friction in your digital shopping experience—enough to prevent impulse purchases but not so much that you abandon the convenience of online shopping entirely.

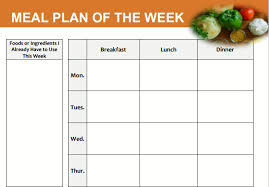

- Meal Planning Approach

- The article emphasizes the importance of thoughtful meal planning:

- Plan 4-5 dinners for the week

- Be realistic about what you’ll actually cook

- Consider your weekly schedule and meal needs

- Plan for potential takeout or dining out

- Pre-Shopping Preparation The Key steps before grocery shopping include:

- Take inventory of what you already have

- Check your fridge, freezer, and pantry

- Eliminate expired items

- Cross-reference your meal plan with existing ingredients

- List Organization Strategies The author recommends:

- Organize your grocery list by store sections (produce, dairy, meat, etc.)

- Arrange items in the order you’ll walk through the store

- Reduce backtracking and unnecessary wandering

- Shopping Smart Tips for Cost-Effective Shopping:

- Check weekly store ads before planning meals

- Look for sales and adjust meal plans accordingly

- Be flexible with ingredient substitutions

- Avoid unnecessary bulk purchases

- Stick to your planned list

- Flexibility and Simplicity The article suggests:

- Keep meal planning simple

- Use versatile ingredients that work across multiple meals

- Have backup ingredient options

- Build adaptability into your planning

The overall message is that effective grocery shopping involves strategic planning, careful inventory management, and a flexible approach to meal preparation.

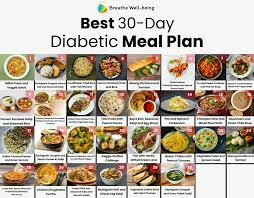

Comprehensive Grocery Shopping and Meal Planning Guide

1. Meal Planning Strategy

Foundational Principles

- Plan for 4-5 dinners per week

- Allow flexibility for unexpected events

- Recognize that you’ll likely eat out or order takeout occasionally

Detailed Meal Planning Process

- Weekly Schedule Assessment

- Evaluate your upcoming week’s commitments

- Identify:

- Busy nights requiring quick meals

- Nights with more cooking time

- Potential social gatherings or family dinners

- Workload and energy levels

- Meal Selection Criteria

- Choose recipes that:

- Match your skill level

- Use overlapping ingredients

- Provide potential leftovers

- Align with your nutritional goals

- Avoid aspirational cooking (e.g., complex recipes on busy weeknights)

- Choose recipes that:

- Strategic Ingredient Selection

- Prioritize versatile ingredients:

- Rotisserie chicken (multiple meal uses)

- Staples like eggs, rice, pasta

- Canned beans

- Frozen vegetables

- Look for ingredients that can be repurposed across different meals.

- Prioritize versatile ingredients:

2. Inventory Management

Pre-Shopping Inventory Check

- Comprehensive Inventory Sweep

- Systematically check:

- Refrigerator

- Freezer

- Pantry

- Spice cabinet

- Systematically check:

- Inventory Audit Steps

- Remove and discard expired items

- Organize existing ingredients

- Create a clear view of current stock

- Note items running low

- Inventory Tracking Techniques

- Use a dedicated inventory app or spreadsheet

- Take photos of your pantry/fridge

- Maintain a running list of staple items

- Consider using shelf-life tracking methods

3. Smart Shopping Strategies

Preparation

- Research and Planning

- Review weekly store advertisements

- Compare prices across different stores

- Identify best deals and sales

- List Creation

- Organize list by store sections:

- Produce

- Dairy

- Meat

- Pantry

- Frozen foods

- Arrange in logical store layout order

- Include estimated quantities

- Organize list by store sections:

In-Store Tactics

- Disciplined Purchasing

- Stick to your prepared list

- Avoid impulse purchases

- Be cautious of bulk sale traps

- Have flexible ingredient substitutions ready

- Sales and Savings

- Adapt meal plans to incorporate sale items

- Substitute similar ingredients based on pricing

- Example:

- Chicken thighs instead of drumsticks if cheaper

- Kale instead of spinach when on sale

4. Flexibility and Adaptation

Meal Plan Flexibility

- Build in 1-2 “wildcard” meals

- Prepare backup recipe options

- Allow for spontaneity

- Be ready to adjust based on:

- Ingredient availability

- Time constraints

- Energy levels

5. Additional Tips

- Use technology (apps, digital lists)

- Batch cook when possible

- Learn to repurpose leftovers

- Continuously refine your strategy

Conclusion

Effective grocery planning is an art of balance—combining preparation, flexibility, and strategic thinking to optimize your time, budget, and nutrition.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

Maxthon private browser for online privacyThis meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.