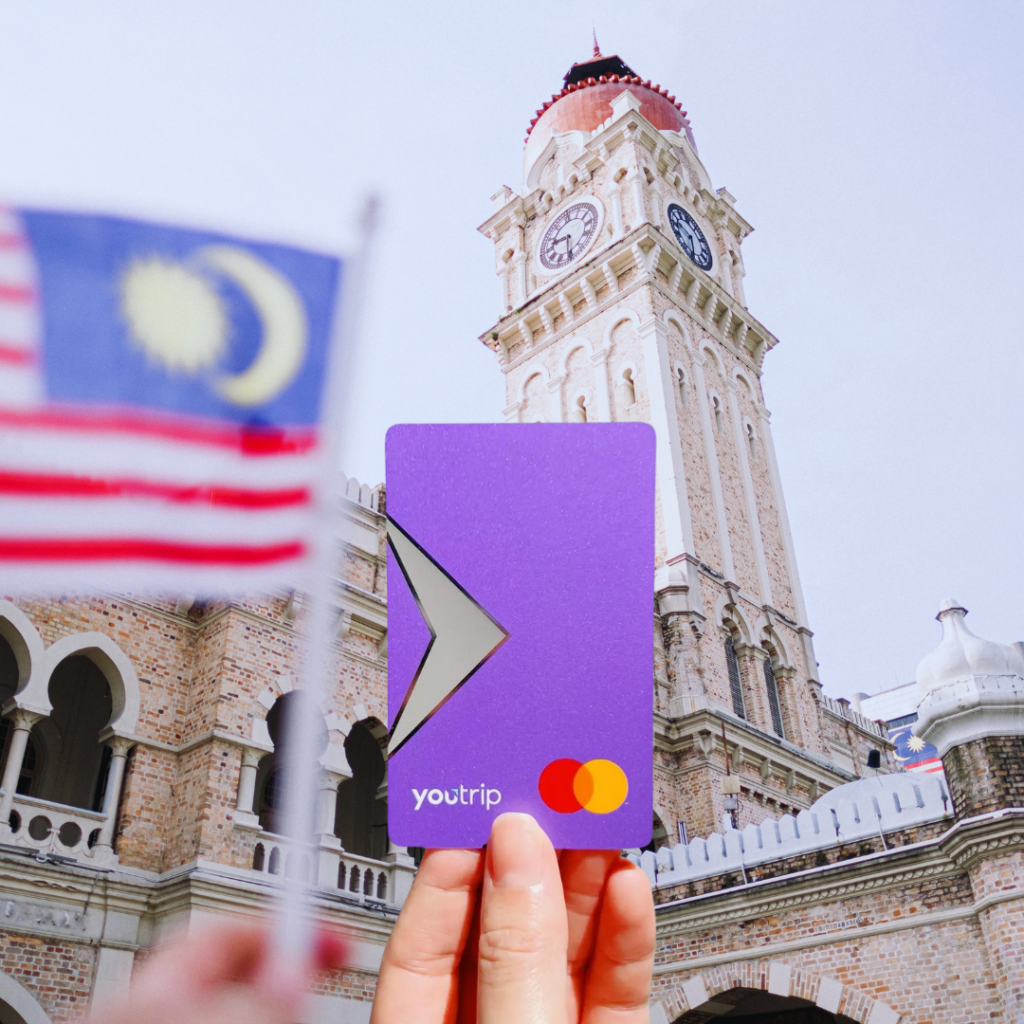

YouTrip’s recent launch of the Malaysian ringgit wallet adds significant convenience for Singaporean travellers heading to Malaysia. The new feature allows users to exchange and store ringgit directly in the app without hidden charges or foreign exchange mark-ups.

The company is promoting this launch with several attractive perks:

- Free shuttle bus service between Kranji MRT and Mid Valley Southkey (JB) over four weekends (April 19 – May 11)

- 3% cashback on all ringgit spending for the first 5,000 users who spend at least S$200

- Up to 10% cashback at selected Malaysian retailers until June 17

The timing seems strategic, as YouTrip noted a 130% increase in ringgit conversions on April 9 when the exchange rate hit 3.33 against the Singapore dollar.

Licensed by MAS, YouTrip operates in Singapore and Thailand and has been profitable since April 2023. It processes over US$10 billion in annual transactions across both markets.

Analysis of YouTrip’s Malaysian Ringgit Wallet Addition

Key Features and Payment Functionality

- Dedicated Ringgit Wallet

- Users can now exchange and store Malaysian Ringgit (MYR) directly in the app.

- Eliminates hidden charges and foreign exchange mark-ups

- Allows users to capitalise on favourable exchange rates when they appear (as evidenced by the 130% spike in conversions when MYR weakened to 3.33 against SGD)

- Cross-Border Payment Efficiency

- Streamlines the payment process for Singaporeans travelling to Malaysia

- No need to carry physical cash or use traditional money changers

- Reduced transaction friction across the Singapore-Malaysia border

- Promotional Strategy

- Strategic use of cashback incentives (3% for early adopters, up to 10% at partner retailers)

- Complementary transportation service (free shuttle) directly addresses a pain point in cross-border travel.

- Time-limited promotions create urgency and encourage rapid adoption.

Market and Business Implications

- Singapore-Malaysia Payment Corridor

- Strengthens YouTrip’s position in one of Southeast Asia’s busiest cross-border corridors

- Addresses a specific high-frequency use case (Singaporeans traveling to JB/Malaysia)

- Reduces dependency on cash in a traditionally cash-heavy market

- Competitive Landscape

- Direct challenge to traditional forex services and money changers

- Position YouTrip against other fintech rivals in the multi-currency wallet space

- Creates differentiation through targeted features rather than just general currency support

- Business Model Enhancement

- Likely to increase transaction volume and user engagement

- Helps convert occasional users to regular users through the dedicated wallet feature

- Creates new partnership opportunities with Malaysian retailers

- Financial Inclusion and Digital Adoption

- Encourages digital payment adoption across borders

- Simplifies financial management for frequent travellers

- Reduces reliance on potentially expensive credit card foreign transaction fees

Strategic Significance

- Market Expansion Strategy

- Uses the high-traffic Singapore-Malaysia corridor as a potential blueprint for other regional expansions

- Demonstrates YouTrip’s ability to create localised solutions rather than generic offerings

- Builds on the company’s profitability (since April 2023) to fund strategic growth

- User Acquisition and Retention

- The promotional bundles (transportation + cashback) create multiple touchpoints with users.

- Addresses both the payment process and the travel experience

- Creates habitual usage patterns that may persist after promotions end

- Future Potential Developments

- Could lead to additional country-specific wallets if successful

- Potential for expansion into remittance services for Malaysian workers in Singapore

- May signal future interoperability with Malaysian payment systems

This targeted approach to the Malaysian market demonstrates YouTrip’s understanding of regional payment needs. It suggests a strategy focused on solving specific cross-border payment friction points rather than just offering generic multi-currency capabilities.

Analysis of YouTrip as a Payment Mode

Core Payment Functionality

- Multi-Currency Wallet System

- Its primary function is as a digital wallet that supports multiple currencies.

- Now includes a dedicated Malaysian Ringgit wallet alongside other currencies.

- Allows users to exchange, store, and spend various currencies through a single interface

- Payment Processing Infrastructure

- Utilises a physical card linked to the digital wallet for point-of-sale transactions

- Enables online payment capabilities for e-commerce transactions

- Processes transactions through established payment networks (likely Mastercard/Visa)

- Exchange Rate Mechanism

- Offers wholesale exchange rates without mark-ups typically charged by traditional banks

- Allows users to exchange currencies at their discretion, enabling strategic timing of conversions

- Creates transparency in the foreign exchange process

User Experience Aspects

- Transaction Flow

- Two-step process: currency exchange within the app, followed by payment using stored value

- A single interface for managing multiple currencies reduces cognitive load for users.

- Immediate transaction confirmation and balance updates

- Accessibility

- Requires smartphone and app access, potentially limiting accessibility for non-digital users

- Physical card provides wider merchant acceptance than mobile-only solutions.

- The registration process likely includes KYC requirements due to financial regulations.

- Fee Structure

- Appears to operate on a low/no-fee model for basic transactions

- Likely generates revenue through currency exchange spread and merchant fees

- Transparent fee structure compared to traditional banking alternatives

Technical and Security Considerations

- Security Features

- Presumably offers standard fintech security measures (encryption, authentication)

- Card can be locked/unlocked via app for added security

- Transaction monitoring for fraud detection

- Integration Capabilities

- Functions primarily as a standalone payment system rather than an integrated platform

- Limited information on API availability for third-party integration

- May offer some integration with travel booking platforms, given its travel focus

- Offline Functionality

- A physical card provides payment capabilities even when internet connectivity is unavailable.

- Limited offline functionality within the app itself

- Pre-loading of funds is necessary before travelling to areas with limited connectivity

Competitive Position

- Market Differentiation

- Specialized in cross-border payments and travel-focused financial services

- Distinguished from traditional banks by offering better exchange rates and lower fees

- Differs from general-purpose e-wallets by emphasising multi-currency capabilities

- Regulatory Compliance

- Licensed by the Monetary Authority of Singapore, providing regulatory legitimacy.

- Operates within established financial frameworks rather than disrupting them

- Compliance requirements may influence product features and limitations

- Competitive Advantages

- Profitability achieved since April 2023 suggests a sustainable business model.

- Processing over US$10 billion annually indicates substantial transaction volume.

- Focus on the Singapore-Thailand-Malaysia corridor leverages strong regional trade relationships.

Limitations and Challenges

- Dependency on Traditional Payment Rails

- Still relies on established payment networks rather than creating new infrastructure.

- Subject to existing payment processing limitations and fees

- Limited ability to revolutionise underlying payment processes

- Geographic Restrictions

- Currently only available in Singapore and Thailand, with expansion into Malaysia

- Limited utility for users outside these geographic regions

- Growthis is constrained by regulatory approvals in new markets

- Scaling Challenges

- May face increasing competitive pressure as more prominent fintech players enter the market

- Dependent on continued user acquisition to maintain the growth trajectory

- Needs to balance promotional costs against long-term profitability

YouTrip represents an evolution of traditional payment methods rather than a revolutionary new approach. Its strength lies in simplifying cross-border payments for frequent travellers while reducing associated costs and friction points.

YouTrip vs. Airwallex: Comparative Analysis

Core Business Focus

YouTrip:

- Consumer-focused multi-currency wallet and payment card solution

- Primary emphasis on retail travellers and cross-border shoppers

- Geographically concentrated in the Singapore-Thailand-Malaysia corridor

- Mainly addresses personal foreign exchange and travel payment needs

Airwallex:

- Business-focused global financial platform with B2B orientation

- Emphasis on international business payments, treasury, and corporate expense management

- Global operations across major financial centres (Australia, Hong Kong, UK, US)

- Addresses comprehensive business financial needs beyond payments

Product Offerings

YouTrip:

- Multi-currency wallet with dedicated currency pockets (including MYR)

- Physical prepaid card linked to digital wallet

- In-app currency exchange at wholesale rates

- Limited to consumer use cases

- Simple fee structure focused on transparency

Airwallex:

- Global business accounts with local banking details in multiple countries

- Multi-currency wallet infrastructure for businesses

- International money transfers and FX services

- Borderless cards for business expenses

- API-driven payment infrastructure for integration

- Complex enterprise-grade services, including mass payouts and collection solutions

Market Position

YouTrip:

- Regional player with strong presence in Southeast Asia

- Focused on specific high-traffic corridors (Singapore-Malaysia)

- Processing approximately US$10 billion annually

- Profitable since April 2023

- Serving primarily individual consumers and travellers

Airwallex:

- Global financial infrastructure company with a multi-billion dollar valuation

- Operations across APAC, Europe, and North America

- Significantly larger transaction volumes (estimated in tens of billions)

- Serving primarily SMES, online businesses, and enterprises

- Backed by major institutional investors with substantial funding rounds

Technical Integration

YouTrip:

- Primarily a standalone app with limited integration capabilities

- Card-based approach for merchant acceptance

- Limited API offerings for third-party developers

- Consumer-friendly interface prioritising simplicity

Airwallex:

- Extensive API suite for enterprise integration

- Payment infrastructure that can be embedded in business workflows

- Developer-focused approach with comprehensive documentation

- Customizable solutions for complex business needs

Pricing and Revenue Model

YouTrip:

- Likely generates revenue through exchange rate spreads (though smaller than banks)

- Limited or no monthly fees for basic consumers

- Promotional cashback and incentives to drive usage

- Simple consumer pricing model

Airwallex:

- Tiered pricing models based on business size and volume

- Transaction fees for international transfers and payments

- FX margins (though competitive compared to traditional banks)

- Subscription models for advanced features

- Enterprise pricing for larger clients

Strategic Positioning

YouTrip:

- Targeting the gap between traditional banks and cash-based travel money

- Creating loyalty through travel-specific promotions and partnerships

- Focusing on deepening penetration in existing markets

- Expanding feature set for existing user base (like the MYR wallet)

Airwallex:

- Positioning as a comprehensive financial infrastructure provider

- Building end-to-end global payment and banking solutions

- Expanding into adjacent financial services (issuing, lending)

- Targeting global expansion and market share growth

Summary

YouTrip and Airwallex operate in fundamentally different segments of the payment ecosystem despite some surface similarities in their multi-currency capabilities. YouTrip serves individual consumers with a travel-focused payment solution optimized for specific regional corridors, while Airwallex provides comprehensive global financial infrastructure for businesses with complex international payment needs.

For individual travelers within Southeast Asia, particularly those frequently crossing between Singapore and Malaysia, YouTrip offers a more tailored solution with consumer-friendly features. For businesses conducting international operations with complex payment requirements, Airwallex provides the more comprehensive toolkit with greater integration capabilities and global reach.

Maxthon

To safeguard your smartphone effectively, the first step is to download and install the Maxthon Security application. Begin by accessing your device’s app store and searching for Maxthon Security. Once you find it, proceed with the download. After installation is complete, open the app to enhance your phone’s security measures. Upon launching the application, you’ll be prompted to set up a strong password or PIN. It’s crucial to select one that incorporates a mix of letters, numbers, and symbols for better protection. After confirming your choice, you’ll be ready to move on.

If your smartphone supports biometric features such as fingerprint scanning or facial recognition, go to the app settings and activate this option. This adds a layer of defence against unauthorised access attempts. The next step involves enabling real-time protection; locate and turn on this feature within Maxthon Security’s settings menu. It actively monitors potential threats and sends immediate alerts if any suspicious activities are detected.

The Maxthon Security app must be updated regularly to maintain high-security standards. You can enable automatic updates in your device settings so that you always benefit from the latest security enhancements designed to counter newly identified vulnerabilities. Maxthon browser Windows 11 support

Another critical action is performing a comprehensive scan of your device using the app’s scanning functionality. This will thoroughly examine your smartphone for malware or other cyber threats. Follow any prompts provided by the app to resolve any issues discovered during this scan without delay.

Moreover, take time to manage application permissions on your device thoughtfully. Review all installed apps and adjust their permissions through Maxthon Security and your phone’s settings interface. Do not grant access to sensitive information unless necessary.

Data backups should also not be overlooked. Regularly backing up essential files is vital for recovery in case data loss or breaches occur. Use cloud storage solutions or external drives for these backups, and ensure they are encrypted for added safety.

Lastly, make it a priority to educate yourself about best practices in mobile security; staying informed will empower you to protect not only your device but also the personal information stored within it.