The Slowdown That Signals a New Economic Era

The International Monetary Fund’s latest forecast paints a sobering picture of the global economic landscape. The projection of 2.9% growth for G20 economies by 2030 represents more than just a statistical decline—it marks the weakest medium-term outlook since the 2009 global financial crisis and signals a fundamental shift in the trajectory of global prosperity.

This isn’t merely a temporary dip. The IMF’s assessment reveals structural challenges that will reshape how nations compete, cooperate, and prosper over the coming decade. For Singapore, a small, open economy deeply integrated into global trade networks, these trends carry profound implications that demand both careful analysis and strategic adaptation.

Understanding the Two-Speed Global Economy

The Advanced Economy Slowdown

The forecast reveals a stark divergence between the world’s economic centers. Advanced G20 economies—including the United States, United Kingdom, Australia, Canada, France, Germany, Italy, Japan, and South Korea—face a particularly challenging outlook with projected growth of just 1.4% by 2030.

This anemic growth rate reflects multiple converging pressures. Aging populations in these economies are shrinking workforces and increasing dependency ratios, placing enormous strain on social security systems and healthcare budgets. Japan and South Korea face particularly acute demographic challenges, with some of the world’s oldest populations and lowest birth rates.

Beyond demographics, these economies are grappling with “stretched public coffers”—a diplomatic way of describing debt levels that have ballooned following the COVID-19 pandemic, previous financial interventions, and ongoing fiscal pressures. The space for traditional fiscal stimulus has narrowed considerably, limiting governments’ ability to jumpstart growth during downturns.

Emerging Markets: Relative Strength, Absolute Concerns

Emerging market G20 members—Argentina, Brazil, China, India, Indonesia, Mexico, Russia, Saudi Arabia, South Africa, and Turkey—are forecast to achieve 3.9% growth by 2030. While this substantially outpaces advanced economies, it still represents a moderation from the breakneck expansion many of these countries experienced in previous decades.

China’s economic transformation is particularly significant. The world’s second-largest economy is transitioning from investment-led growth to consumption-driven expansion, a shift that inevitably brings lower but more sustainable growth rates. India, meanwhile, is positioned to partially offset this slowdown, but faces infrastructure and institutional challenges that constrain its potential.

The Near-Term Deceleration

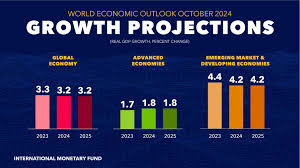

The trajectory toward 2030’s sluggish growth begins immediately. G20 output is expected to expand by 3.2% in 2025—down from 3.3% in 2024—before further moderating to 3.0% in 2026. This steady deceleration reflects an economic environment where momentum is consistently weakening rather than building.

This pattern differs fundamentally from typical business cycles, where periods of below-trend growth are followed by robust recoveries. Instead, we’re seeing trend growth itself decline, suggesting deeper structural issues rather than cyclical weakness.

The Protectionist Threat: Trade Wars and Economic Fracturing

Trump’s Trade Agenda and Global Ripple Effects

The report explicitly identifies protectionism as a major headwind to growth, with particular attention to U.S. policies under President Donald Trump. The administration’s pursuit of re-shoring domestic manufacturing through tariff increases and trade restrictions represents a fundamental challenge to the post-war liberal trading order that has underpinned global prosperity for decades.

The absence of both President Trump and Chinese President Xi Jinping from the G20 summit in South Africa is symbolically significant. It suggests a diminished commitment to multilateral cooperation at precisely the moment when such cooperation is most needed. The leaders of Argentina and Mexico are also skipping the summit, further undermining its effectiveness.

Trump’s approach—characterized by bilateral deals with purchase commitments and quantitative restrictions—directly contradicts the IMF’s recommendations for transparent trade policy roadmaps and open markets. These deals create inefficiencies, distort markets, and generate uncertainty that depresses business investment.

The Uncertainty Tax on Growth

Policy uncertainty acts as a hidden tax on economic growth. When businesses cannot predict trade policies, regulatory frameworks, or market access conditions, they delay investments and hiring. This uncertainty is reflected in the IMF’s forecast and represents a significant departure from the relatively stable policy environment of previous decades.

The “high-frequency indicators” mentioned in the report—showing rising producer prices in the U.S. and climbing core inflation—suggest that protectionist policies are already feeding through to real economic outcomes. Tariffs raise input costs for manufacturers, reduce competition, and ultimately increase prices for consumers.

The Inflation Conundrum: Persistent Price Pressures

Disinflation’s Slow Progress

While inflation is declining from pandemic-era peaks, it remains elevated at around 3.5% for G20 countries in 2025. More concerning is the inflation outlook for the United States, where core inflation—which excludes volatile food and energy prices—is not expected to return to the Federal Reserve’s 2% target until 2027.

This two-year delay from previous IMF projections is significant. It suggests that inflationary pressures are more entrenched than policymakers initially believed, possibly reflecting labor market tightness, deglobalization pressures, and the price effects of protectionist policies.

The Central Bank Dilemma

Persistent inflation keeps central banks in a difficult position. They must maintain relatively restrictive monetary policies—keeping interest rates higher for longer—even as economic growth weakens. This reduces the policy space available to respond to economic downturns and increases the risk of policy errors.

Higher interest rates also exacerbate fiscal pressures by increasing government debt servicing costs, creating a vicious cycle where fiscal constraints limit growth potential while weak growth worsens fiscal positions.

Singapore’s Exposure: A Small Economy in Turbulent Waters

The Vulnerability of Openness

Singapore’s economic model is predicated on openness. Trade exceeds 300% of GDP, making it one of the world’s most trade-intensive economies. Financial services, logistics, and manufacturing for export are all deeply integrated into regional and global value chains. This integration has been Singapore’s greatest strength, but in an era of protectionism and fragmentation, it becomes a source of vulnerability.

The G20 represents Singapore’s largest trading partners and investment sources. A sustained growth slowdown in these economies directly impacts demand for Singapore’s exports, from electronics and pharmaceuticals to financial and business services. The divergence between advanced and emerging markets creates additional complexity, as Singapore must navigate different growth trajectories across its key markets.

The China Factor

China remains Singapore’s largest trading partner and a crucial node in regional supply chains. Any moderation in Chinese growth—whether from domestic structural adjustments or external trade pressures—flows directly through to Singapore’s economy via reduced trade volumes, lower investment flows, and diminished demand for Singapore’s role as a regional hub.

The U.S.-China trade tensions add another layer of complexity. Singapore benefits from stable Sino-American relations and suffers when tensions escalate. As a small state, Singapore cannot influence this dynamic but must adapt to its consequences.

Financial Services Under Pressure

Singapore’s status as a global financial center depends on cross-border capital flows and international trade financing. Protectionism and deglobalization naturally reduce these flows. Additionally, if global growth remains subdued, asset returns decline, reducing demand for sophisticated financial services and wealth management.

The stretched public finances mentioned in the IMF report may also trigger regulatory responses—such as financial repression or capital controls—that could disrupt Singapore’s role as a neutral, efficient financial hub.

Strategic Implications for Singapore

Diversification as Defense

Singapore must intensify efforts to diversify its economic partnerships beyond traditional G20 markets. ASEAN, with its younger demographics and faster growth potential, represents a natural focus. Strengthening intra-ASEAN trade and investment can provide partial insulation from G20 weakness.

Beyond ASEAN, Singapore should deepen engagement with emerging markets in Africa, the Middle East, and South Asia. These markets face challenges but offer growth potential that mature economies cannot match.

Moving Up the Value Chain

In a low-growth global environment, competition for economic activity intensifies. Singapore must continue moving up the value chain into activities where it can maintain competitive advantages despite higher costs. This means doubling down on innovation, research and development, advanced manufacturing, and high-value services.

The government’s focus on areas like artificial intelligence, biotechnology, clean energy, and digital services aligns with this imperative. These sectors offer higher productivity growth potential and are less vulnerable to protectionist pressures than traditional manufacturing.

Fiscal Prudence and Resilience

While many G20 members face stretched public finances, Singapore’s fiscal position remains strong. This is a crucial strategic asset. Maintaining fiscal discipline while others are forced into austerity provides Singapore with policy flexibility to respond to shocks and invest in long-term competitiveness.

However, Singapore cannot be complacent. An aging population—similar to advanced G20 economies—will increase fiscal pressures over time. The government must balance immediate growth support with long-term sustainability, making difficult choices about taxation, spending priorities, and social programs.

The Inequality Challenge

As Prime Minister Lawrence Wong noted at the Bloomberg New Economy Forum, Singapore must manage inequality through varied policy tools beyond taxation. In a low-growth global environment, inequality pressures typically intensify as returns to capital exceed returns to labor and high-skill workers capture disproportionate gains.

Singapore’s social compact depends on broadly shared prosperity. If global growth remains weak while inequality rises, maintaining social cohesion becomes more challenging. This requires proactive policies in education, skills development, progressive taxation, and social support systems.

Infrastructure and Connectivity

The new SGX-Nasdaq partnership for dual listings, announced by the Monetary Authority of Singapore, exemplifies the kind of strategic initiative Singapore needs. By enhancing connectivity between markets and offering unique value propositions, Singapore can maintain relevance even as overall global activity moderates.

Similar investments in physical infrastructure—the expansion of Changi Airport, port facilities, and digital infrastructure—position Singapore to capture a larger share of reduced global flows. When growth slows, being the most efficient, reliable, and attractive hub becomes even more important.

Regional Dynamics: ASEAN in a Changing World

The G20’s weakness creates both challenges and opportunities for ASEAN. On one hand, reduced demand from major economies affects the entire region. On the other, a multipolar world with fragmented supply chains may push companies to diversify production across multiple ASEAN locations, with Singapore serving as the coordinating hub.

ASEAN’s GDP growth rates generally exceed the G20 forecast, offering a relative bright spot. However, ASEAN members also face challenges—political instability in some countries, infrastructure gaps, and varying degrees of institutional development. Singapore’s role in helping to address these challenges through investment, expertise, and advocacy for regional integration becomes more valuable.

The war on scams and cybersecurity challenges, as highlighted in recent reporting on Myanmar’s scam centers, reflects the darker side of rapid digitalization in the region. Singapore’s relative stability and strong institutions position it to lead on regional governance issues, building trust that attracts legitimate investment even as growth slows.

Policy Recommendations: Navigating the New Normal

Embrace Trade Agreements

The IMF’s call for transparent trade policy roadmaps and reduction of trade barriers should resonate strongly in Singapore. The government should continue pursuing bilateral and multilateral trade agreements, even as others retreat into protectionism. Being a champion of free trade when others abandon it can yield strategic advantages.

The Regional Comprehensive Economic Partnership (RCEP) and Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) provide frameworks for maintaining open trade even if the global system fragments. Singapore should work to deepen these agreements and bring in new members.

Invest in Human Capital

In a knowledge economy facing structural growth headwinds, human capital becomes the decisive competitive factor. Singapore must continue investing heavily in education, lifelong learning, and skills adaptation. The rapid pace of technological change—particularly in artificial intelligence—requires continuous workforce upgrading.

This isn’t just about formal education. It includes immigration policies that attract global talent, exchange programs that give Singaporeans international experience, and support systems that help workers transition between sectors as the economy evolves.

Maintain Monetary Credibility

The Monetary Authority of Singapore’s exchange rate-centered policy framework has served the economy well. Maintaining this framework’s credibility—through transparent communication, consistent policy implementation, and demonstrated commitment to price stability—becomes even more important when global inflation proves persistent.

Singapore’s low inflation relative to many peers is a competitive advantage. It preserves purchasing power, reduces business uncertainty, and enhances the attractiveness of Singapore as an investment destination.

Climate and Sustainability as Growth Drivers

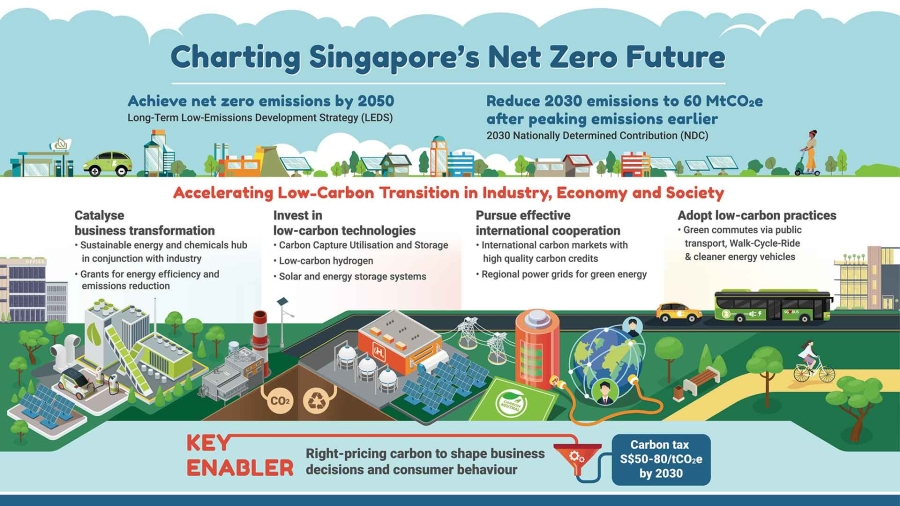

Singapore’s Minister for Sustainability and the Environment Grace Fu’s concerns about lack of consensus on adaptation at COP30 climate talks reflects a broader challenge. Climate change represents both a threat and an opportunity.

As a low-lying island nation, Singapore faces direct physical risks from climate change. But the global transition to sustainability also creates economic opportunities in green finance, renewable energy technology, carbon markets, and sustainable urban development. Positioning Singapore as a green finance hub and sustainability leader can open new growth avenues as traditional sectors mature.

The Path Forward: Adaptation in an Age of Limits

The IMF’s forecast of 2.9% G20 growth by 2030 represents more than an economic projection—it’s a reality check for an era of limits. The decades of rapid globalization, expanding trade, and consistently strong growth may be giving way to a more constrained environment characterized by political fragmentation, demographic headwinds, and structural challenges.

For Singapore, this new reality demands strategic clarity and operational excellence. The country cannot control global trends but can control its response. Success will require:

Realism about constraints: Acknowledging that external growth drivers will be weaker than in past decades and planning accordingly.

Flexibility in adaptation: Maintaining the ability to pivot quickly as global conditions shift, rather than being locked into rigid strategies.

Investment in resilience: Building buffers—fiscal, economic, and social—that provide stability during inevitable shocks.

Commitment to openness: Resisting the temptation toward protectionism even when others embrace it, recognizing that openness remains Singapore’s fundamental advantage.

Focus on quality over quantity: When growth rates decline, the quality of growth—whether it’s inclusive, sustainable, and productivity-driven—becomes more important.

Conclusion: Small State, Strategic Choices

The IMF’s warning of the weakest G20 growth outlook since 2009 arrives at a pivotal moment. The post-pandemic world is revealing itself to be structurally different from what came before—more fragmented, more uncertain, and more challenging for small, open economies.

Singapore has navigated difficult periods before, from the Asian Financial Crisis to the Global Financial Crisis to the COVID-19 pandemic. Each time, strategic leadership, pragmatic policies, and social cohesion enabled the country to not just survive but emerge stronger.

The challenge ahead may be more sustained than previous crises. Rather than a sharp shock followed by recovery, Singapore faces a decade or more of subdued global growth and heightened uncertainty. This demands a different kind of resilience—not just weathering storms, but thriving in a permanently altered climate.

The government’s toolkit extends beyond taxes, as PM Wong noted. It includes education policy, industrial strategy, foreign policy, social policy, and countless other levers. The key is deploying these tools coherently toward a clear vision: maintaining Singapore’s prosperity and relevance in a low-growth world.

For Singapore’s citizens and businesses, the message is equally clear. The era of tailwinds from rapid global growth is ending. Success will increasingly depend on individual and collective adaptability, continuous learning, and the ability to create value in more competitive conditions.

The IMF’s forecast is sobering, but it need not be discouraging. Understanding the challenge is the first step toward meeting it. Singapore has proven time and again that strategic thinking, disciplined execution, and social solidarity can overcome structural disadvantages. The decade ahead will test whether these qualities remain sufficient in an age of limits—but if any small nation is positioned to meet this test, it is Singapore.

The G20’s weakness is not Singapore’s destiny. But it will shape the context in which Singapore must chart its course. How the nation responds to this moment of structural change will determine whether the next decade brings continued prosperity or difficult adjustment. The choice, as always, lies in the decisions made today.

IMF’s Economic Growth Forecast Update

The International Monetary Fund (IMF) has significantly reduced its global growth forecasts:

- Global output growth for 2025 cut to 2.8% (down from January’s 3.3% forecast)

- This would be the slowest expansion since the 2020 pandemic and the second-worst since 2009

- 2026 forecast reduced to 3% (a 0.3 percentage point drop)

Key Factors

The primary driver is President Trump’s tariff policies, which the IMF warns could trigger a global trade war:

- US effective tariff rates have reached century-high levels

- IMF Chief Economist Pierre-Olivier Gourinchas described this as “entering a new era” where “the global economic system of the last 80 years is being reset”

Country-Specific Impacts

- United States: Growth forecast cut to 1.8% for 2025 (down 0.9 percentage points) and 1.7% for 2026

- China: Growth projected at 4% for both years (down 0.6 and 0.5 percentage points)

- Mexico: Now expected to contract by 0.3% in 2025 (a dramatic 1.7 percentage point reduction)

- Canada: Sharp reduction in growth outlook

- Japan: Growth cut to just 0.6% for both years

- Euro area: Cut to 0.8% in 2025 and 1.2% in 2026

- Germany: No growth expected in 2025

The IMF warns that while growth would improve if trade tensions ease, the immediate risk is further escalation. They’ve cut their forecast for global trade growth in 2025 by 1.5 percentage points.

Financial markets have responded negatively, with the S&P 500 losing around 12% since the end of 2024.

Analysis of IMF Forecasts and Implications for Singapore, ASEAN, and Asia

Based on the article, the IMF has significantly downgraded global growth forecasts primarily due to escalating trade tensions from Trump’s tariff policies. While the article doesn’t specifically mention Singapore or ASEAN forecasts, we can analyze the broader implications for these regions.

IMF Forecast Summary

- Global growth: Cut to 2.8% for 2025 (from 3.3%)

- United States: Down to 1.8% (2025) and 1.7% (2026)

- China: Reduced to 4% for both 2025 and 2026

- Europe: Euro area cut to 0.8% (2025) and 1.2% (2026)

- Japan: Sharply cut to 0.6% for both years

Implications for Singapore

Singapore’s highly trade-dependent economy would likely face significant challenges:

- Trade Vulnerability: As one of the world’s most trade-dependent economies (trade is ~300% of GDP), Singapore is particularly exposed to global trade disruptions.

- Re-export Impact: Singapore’s role as a trade hub means that reduced China-US trade flows would directly impact its re-export business.

- Financial Services Sector: Volatility in global markets (like the 12% S&P 500 drop mentioned) could affect Singapore’s financial services industry.

- Foreign Direct Investment: Uncertainty might cause companies to delay investment decisions in Singapore as a regional headquarters.

- Strategic Positioning: Singapore may need to further diversify trade relationships beyond the US and China to mitigate risks.

Implications for ASEAN Region

- Supply Chain Realignment: The trade tensions will likely accelerate the “China+1” strategy, potentially benefiting Vietnam, Indonesia, Malaysia, and Thailand as manufacturing alternatives.

- Export Challenges: ASEAN’s export-oriented economies face headwinds as global demand slows.

- Mexico’s Contraction: The steep 1.7 percentage point reduction for Mexico (a similar export-oriented economy) serves as a warning for ASEAN countries heavily integrated into global supply chains.

- Regional Integration: RCEP and intra-ASEAN trade may become more important as external markets become less reliable.

Broader Asian Implications

- China Slowdown: The 4% growth forecast for China (down 0.6 percentage points) would have ripple effects throughout Asia, as China is the largest trading partner for most Asian economies.

- Inflation Concerns: The IMF’s projection of higher US inflation (3% in 2025) could influence monetary policy across Asia.

- Japan’s Challenges: The weak 0.6% growth forecast for Japan further limits a key market for many Asian exporters.

- Trade Reorientation: Asian economies may accelerate efforts to reduce dependence on US markets and deepen intra-Asian trade networks.

Strategic Considerations

For Singapore and ASEAN economies, this new environment suggests several strategic responses:

- Diversification: Reducing dependence on any single market, especially the US and China.

- Regional Integration: Strengthening ASEAN economic community mechanisms.

- Domestic Resilience: Building stronger domestic consumption bases to reduce export dependence.

- Digital Economy: Accelerating digital transformation to find new growth drivers less susceptible to tariff barriers.

- Currency Management: Preparing for potential currency volatility as trade patterns shift.

The IMF’s assessment that “the global economic system of the last 80 years is being reset” has profound implications for Singapore and ASEAN, suggesting this is not merely a cyclical downturn but a structural shift requiring strategic adaptation.

Singapore’s Vulnerability to IMF’s Downgraded Global Growth Forecasts

The IMF’s sharply reduced global growth forecasts present significant challenges for Singapore’s open economy. Let me analyze the specific impacts Singapore is likely to face:

Direct Economic Impacts

- Export Vulnerability: Singapore’s exports account for approximately 150-200% of GDP, making it exceptionally exposed to global trade disruptions. The IMF’s projection of significantly slower global trade growth (cut by 1.5 percentage points for 2025) would directly impact Singapore’s manufacturing and export sectors.

- Key Trading Partner Slowdowns: The forecasts show sharp declines in Singapore’s critical markets:

- China (4%, down 0.6 points) – Singapore’s largest trading partner

- US (1.8%, down 0.9 points) – a significant export destination

- Europe (0.8%, down significantly) – essential for high-value exports

- Japan (0.6%, sharp reduction) – key regional partner

- Re-export and Transhipment Challenges: Singapore’s role as a trade hub means that reduced global trade volumes would impact the Port of Singapore’s operations and the logistics sector.

- Financial Services Pressure: As a financial centre, market volatility (like the 12% S&P 500 drop mentioned) could affect Singapore’s banking, investment, and insurance sectors. Wealth management services might see reduced activity.

Sectoral Analysis

- Manufacturing: Particularly electronic components and precision manufacturing that feed into global supply chains would face headwinds.

- Shipping and Logistics: Reduced container volumes would affect PSA terminals and associated logistics services.

- Financial Services: Volatility could dampen investment banking activity while potentially increasing demand for risk management products.

- Tourism: A global slowdown typically affects business travel and premium tourism, which Singapore relies on.

- Property Market: Potential pressure on commercial real estate if multinational corporations scale back regional operations.

Policy Implications for Singapore

- Monetary Policy: The Monetary Authority of Singapore may need to reconsider its stance on the Singapore dollar’s appreciation path to balance inflation concerns against growth support.

- Fiscal Response: The government might need to deploy targeted fiscal support from its reserves, similar to crisis response measures used during previous global downturns.

- Labor Market Adjustments: Potential pressures on employment in trade-dependent sectors may require worker retraining and support programs.

- Strategic Economic Positioning: The new trade environment described by the IMF as “a global economic system reset” may require Singapore to accelerate its economic transformation plans.

Potential Mitigating Factors

- Diversification Efforts: Singapore’s ongoing economic diversification strategy may provide some buffer.

- Regional Agreements: RCEP and other trade agreements could help offset some US-China trade tensions.

- Strong Fiscal Position: Singapore’s substantial reserves allow for countercyclical spending if needed.

- High-Value Services: The continued shift toward high-value services may be less directly impacted by tariffs than goods trade.

Conclusion

The severity of impact on Singapore will largely depend on:

- Whether trade tensions escalate further (as the IMF warns they might)

- How effectively Singapore can pivot to less-affected markets and sectors

- The government’s policy response speed and scale

Given Singapore’s historical resilience during previous economic challenges, it has the tools to weather this storm. Still, the IMF’s forecasts suggest 2025-2026 will likely be challenging years requiring active economic management and possibly structural adjustments to Singapore’s economic model.

C

Long-Term Impacts of IMF Forecasts on Singapore’s Economic Future

The IMF’s dramatic growth forecast reductions signal potential structural changes in the global economy that could have profound long-term implications for Singapore beyond the immediate cyclical downturn. Here’s an analysis of these potential long-term impacts:

Structural Shifts in Singapore’s Economic Model

- Reduced Trade Dependency: The IMF Chief Economist’s statement that “the global economic system that has operated for the last 80 years is being reset” suggests Singapore may need to fundamentally reconsider its trade-dependent growth model, which has been central to its development since independence.

- Supply Chain Reconfiguration: The persistent trade tensions could accelerate the permanent reorganisation of global supply chains, potentially diminishing Singapore’s traditional hub role while creating opportunities in new networks.

- Services-Manufacturing Balance: The vulnerability of goods trade to tariffs may accelerate Singapore’s shift away from manufacturing toward advanced services, potentially changing the country’s economic composition.

- Investment Patterns: Foreign direct investment flows may permanently redirect, requiring Singapore to develop new value propositions beyond its traditional position as an Asia-Pacific headquarters location.

Strategic Economic Positioning

- Regional vs. Global Orientation: Singapore may need to rebalance its economic focus more toward ASEAN and regional integration as global trade becomes less reliable.

- China Relationship Recalibration: With China’s growth trajectory permanently lowered (4% in the forecast), Singapore’s economic ties with China may need recalibration, particularly regarding investments and financial services.

- New Growth Sources: The tariff-driven trade environment could accelerate Singapore’s push into new growth areas like digital economy, green technology, biomedical sciences, and advanced services less affected by traditional trade barriers.

- Currency and Financial Strategy: Singapore’s role as a financial hub may need adjustment in a more fragmented global economy with potentially reduced dollar dominance.

Labor Market and Social Implications

- Workforce Transformation: Accelerated sectoral shifts may require more aggressive workforce retraining and education system adjustments to develop skills aligned with the new economic realities.

- Immigration Policy: Singapore’s reliance on foreign talent may need reassessment in a more protectionist global environment.

- Social Safety Nets: The potential for increased economic volatility may require strengthening social security systems beyond current models.

- Income Inequality: Structural economic shifts often exacerbate inequality, potentially requiring more robust redistributive policies.

Infrastructure and Development Priorities

- Digital Infrastructure: The need to excel in digital and service-oriented areas may require reallocating resources from traditional trade infrastructure to digital capacity.

- Urban Planning: Commercial real estate needs could shift if regional headquarters functions decline, affecting Singapore’s urban development strategy.

- Energy Strategy: The economic reset could affect Singapore’s energy security planning and green transition timetable.

- Research and Innovation Focus: R&D priorities may need reorientation toward areas less vulnerable to trade disruptions.

Geopolitical and Strategic Positioning

- Diplomatic Balancing: Singapore may need to recalibrate its careful balancing between the US and China in a more fragmented global order.

- Regional Leadership: Opportunities may emerge for Singapore to play an enhanced role in ASEAN integration as a buffer against global volatility.

- Economic Security: Concepts of economic security and resilience may become more prominent in policy planning, potentially affecting trade openness.

- New Partnerships: Singapore might develop deeper ties with mid-sized economies and alternative partners less central to the US-China conflict.

Conclusion

The IMF’s forecast doesn’t just indicate a temporary slowdown but potentially signals a fundamental shift in the global economic architecture that has underpinned Singapore’s development model. While Singapore has successfully navigated previous structural shifts, the potential “deglobalization” trend implied by the IMF’s analysis represents a particularly challenging adjustment for an economy built on global trade openness.

Singapore’s long-term resilience will depend on how effectively it can transform its economic model while preserving its core strengths in a more fragmented global economic landscape. This may require reimagining some fundamental aspects of Singapore’s economic strategy that have remained relatively consistent since independence.

Strategic Solutions for Singapore’s Long-Term Economic Resilience

Economic Diversification & Structural Transformation

1. Beyond Traditional Hub Model

- Transition from pure trade intermediary to value-adding node in new supply chains

- Develop specialized expertise in supply chain resilience consulting and risk management

- Create platforms for secure, verifiable trade in a fragmented global system

2. Future Growth Engines

- Deepen investments in biomedical sciences, from research to manufacturing

- Position as the leading Asian hub for sustainable finance and green technology

- Accelerate quantum computing and advanced AI capabilities development

- Establish leadership in space commerce and satellite technology

3. Regional Integration

- Champion “ASEAN Economic Community 2.0” with deeper integration mechanisms

- Develop complementary specializations with ASEAN neighbors rather than competition

- Create Singapore-led regional innovation clusters in strategic sectors

- Establish regional financing mechanisms for cross-border infrastructure

Human Capital & Social Resilience

1. Education System Transformation

- Redesign education for lifetime adaptability rather than initial qualification

- Integrate humanities, technology and business skills across disciplines

- Create seamless transitions between education, work, and retraining

- Develop world-leading expertise in adult learning methodologies

2. Future-Ready Workforce

- Implement mid-career transformation programs targeting vulnerable sectors

- Create labor market models that accommodate portfolio careers and gig work

- Develop expertise matching systems connecting skills to emerging opportunities

- Design portable benefits systems supporting worker mobility

3. Social Cohesion

- Strengthen social safety nets while preserving work incentives

- Implement progressive wealth-sharing mechanisms beyond current models

- Develop new metrics beyond GDP for measuring societal progress

- Create community resilience hubs integrating social services, lifelong learning and community building

Infrastructure & Physical Assets

1. Critical Infrastructure

- Redesign port and logistics infrastructure for smaller, more diverse trade flows.

- Develop advanced urban manufacturing zones for high-value production

- Create digital infrastructure sovereign wealth capabilities

- Implement circular economy systems throughout the physical economy

2. Energy & Sustainability

- Accelerate the transition to renewable energy through regional partnerships.

- Develop expertise in climate adaptation technologies exportable to similar region.s

- Create resource security through technology rather than stockpiling

- Position as a test bed for advanced urban sustainability solutions

3. Smart Nation Enhancement

- Expand digital twin capabilities to enable policy simulation and optimisation

- Create seamless digital identity and services spanning the government and private sector

- Develop cyber resilience consulting expertise as an export service

- Implement predictive urban management systems reducing operating costs

Governance & International Positioning

1. Adaptive Governance

- Create regulatory sandboxes incentivizing innovation in strategic sectors

- Develop scenario planning capabilities embedded throughout government

- Implement agile governance methods allowing rapid policy adjustment

- Create citizen participation mechanisms for complex policy challenges

2. Global Positioning

- Develop new multilateral coalitions around specific capabilities rather than geography

- Create specialized diplomatic expertise in economic security

- Position as neutral ground for US-China cooperation in specific domains

- Develop alternative international payment and settlement mechanisms

3. Financial & Fiscal Strategy

- Create new sovereign wealth strategies focused on strategic capabilities

- Develop counter-cyclical fiscal mechanisms that operate automatically

- Implement progressive taxation balanced with growth incentives

- Create financial instruments monetizing Singapore’s stability premium

Timeline & Implementation

Near-Term (1-3 Years)

- Establish Economic Transformation Council with public-private leadership

- Launch vulnerability assessments for trade-dependent sectors

- Initiate pilot programs in highest-potential new growth areas

- Develop economic scenario models for different trade environments

Medium-Term (3-7 Years)

- Implement major education system reforms

- Create the infrastructure for new growth sectors

- Establish regional integration mechanisms with ASEAN partners

- Launch new social resilience programs

Long-Term (7-15 Years)

- Complete transition to new growth model

- Establish leadership in selected strategic sectors

- Fully implement new social contracts and safety nets

- Create lasting diplomatic architecture for a fragmented world

Implications for Singapore’s Trade and Labor Relations in the Global Context

Trade Relations Transformation

Immediate Trade Adjustments

- Diversification Imperative: Singapore faces urgent pressure to reduce its vulnerability to US trade unpredictability by expanding and deepening trade relationships with alternative partners.

- Strategic Recalibration: The US-Singapore Free Trade Agreement (USSFTA), historically a cornerstone of Singapore’s trade policy, may diminish in relative importance as Singapore seeks more reliable arrangements.

- Export Market Reprioritization: Singapore will likely accelerate efforts to increase export market share in regions showing more excellent trade stability, particularly within ASEAN, EU, and select emerging markets.

Industry-Specific Trade Impacts

- Pharmaceutical Sector Adaptation: With pharmaceuticals identified as vulnerable to US tariffs, Singapore may intensify efforts to diversify export markets for pharmaceutical products, particularly toward Europe, Japan, and emerging markets in Asia and the Middle East.

- Semiconductor Supply Chain Realignment: The semiconductor industry may pursue strategies including:

- Repositioning within global value chains to reduce US-facing exposure

- Developing deeper integration with non-US technology ecosystems

- Exploring new specializations in emerging technology areas less affected by tariffs

New Trade Partnership Development

- Enhanced Regional Integration: Acceleration of implementation and utilization of RCEP and CPTPP benefits to offset US market uncertainties.

- Strategic Bilateral Deals: Potential pursuit of strengthened bilateral trade agreements with stable middle powers (UK, Canada, Australia) and emerging economies (India, Gulf states).

- Service Trade Focus: Emphasis on Singapore’s strengths in service exports (financial, legal, consulting), which may be less vulnerable to traditional tariff barriers.

Labor Market Implications

Workforce Impacts

- Vulnerable Employment Sectors: The 60,000+ jobs in pharmaceuticals and semiconductors face varying degrees of risk, potentially requiring workforce transitions.

- Skills Adaptation Programs: Singapore may need to expand its skills development programs to help workers in affected industries transition to adjacent or emerging sectors.

- Labor Mobility Challenges: Workers in highly specialized roles may face particular difficulties if industry contractions occur, necessitating targeted support.

Labor Market Policy Responses

- Anticipatory Workforce Planning: Expansion of programs like SkillsFuture and Workforce Singapore initiatives focused on affected sectors.

- Industry Transformation Maps 2.0: Accelerated implementation of next-generation industry transformation strategies to manage employment transitions.

- Strategic Foreign Talent Policy: Potential adjustments to immigration policies to address emerging skills gaps or support growth in alternative sectors.

Global Labor Integration

International Labor Mobility

- Talent Flow Adjustment: Changes in global talent flows as manufacturing and high-tech workers respond to shifting opportunity landscapes.

- Singapore as Talent Hub: Opportunity to position Singapore as a regional or global talent hub for professionals affected by US trade uncertainty.

- Remote Work Dimension: Increased leverage of Singapore’s digital infrastructure and business environment to attract “digital nomads” and remote workers.

Labor Standards and Relations

- Trade-Labor Linkages: Greater emphasis on harmonizing labor standards in new trade agreements as Singapore pursues diversification.

- Tripartite Collaboration: Enhanced importance of Singapore’s tripartite model (government, employers, unions) in developing rapid responses to trade-induced labor market changes.

- Global Best Practices Exchange: Potential leadership role for Singapore in facilitating international dialogue on managing trade volatility impacts on labor markets.

Strategic Positioning for the Future

New Growth Paradigms

- Green Economy Transition: Accelerated focus on green growth sectors with more diversified global demand, reducing vulnerability to single-market volatility.

- Digital Trade Leadership: Expanded emphasis on digital trade frameworks where Singapore has competitive advantages and tariff impacts are less direct.

- Innovation Ecosystem Development: Strategic investment in emerging technologies and startups that can more flexibly adapt to changing global trade patterns.

Long-Term Resilience Building

- Supply Chain Resilience: Development of more robust supply chains with multiple redundancies to withstand geopolitical and trade disruptions.

- Strategic Reserves: Potential expansion of strategic reserves beyond traditional areas like food and energy to include critical industrial inputs.

- Economic Planning Recalibration: Adjustments to Singapore’s long-term economic planning to account for a world of higher trade volatility and reduced US economic predictability.

This analysis suggests that while Singapore faces significant challenges from US tariff volatility, its traditional adaptability and forward-looking economic planning offer pathways to navigate these changes. The city-state’s historical success in economic reinvention provides a foundation for managing these new trade and labor relations challenges, though the adjustment process may involve significant short-term disruption in affected sectors.

Coordinated Policy Recommendations

- Trade Agreement Enhancement

- Accelerate negotiations on existing trade agreements with non-US partners

- Pursue trade agreements with emerging markets

- Strengthen ASEAN economic integration to create more resilient regional markets

- Fiscal Support Measures

- Implement targeted tax breaks for tariff-affected sectors

- Create special economic zones with enhanced incentives for export-oriented businesses

- Provide wage support for affected industries to maintain employment levels

- Skills Development

- Retrain workers from affected sectors for industries with stronger growth prospects

- Develop specialized skills in supply chain optimization and trade compliance

- Create education programs focused on emerging global trade patterns

- Information and Advisory Services

- Establish a dedicated trade intelligence unit to monitor tariff developments

- Provide customized advisory services on tariff mitigation strategies

- Create industry-specific working groups to share best practices

By implementing these coordinated strategies, MAS and EDB can help Singapore businesses navigate the challenges posed by US tariffs while building more resilient business models for the future. The focus should be not just on short-term mitigation but on transforming this challenge into an opportunity to strengthen Singapore’s position in global value chains.

Potential MOF and Ministry of Community Collaboration to Address Tariff Impacts

While there isn’t specific information in the provided article about Ministry of Finance (MOF) and Ministry of Community Development plans, I can analyze how these ministries might collaborate to address the economic pressures from US tariffs:

MOF’s Potential Fiscal Interventions

Short-term Relief Measures

- Targeted tax rebates for businesses most affected by the 10% US tariffs

- Enhanced tax deductions for costs related to supply chain restructuring

- GST vouchers or cash payouts for lower-income households affected by price increases

- Enterprise financing schemes with favorable terms for tariff-impacted SMEs

Medium to Long-term Fiscal Planning

- Budget reallocation to strengthen domestic demand and reduce export dependency

- Infrastructure investment to improve logistics efficiency and reduce trade costs

- R&D tax incentives focused on developing higher-value products less sensitive to tariffs

- Funding for trade diversification initiatives to reduce US market dependency

Ministry of Community Development’s Potential Role

Social Support Systems

- Enhanced financial assistance for workers displaced by tariff-induced business restructuring

- Expanded ComCare schemes to support households affected by price increases

- Community outreach programs to identify and assist vulnerable groups

- Housing and utility subsidies for affected families

Skills Development and Employment Support

- Targeted job retraining programs for workers in heavily impacted sectors

- Employment facilitation services focused on growth sectors less affected by tariffs

- Education subsidies for upskilling in areas with strong future demand

- Community-based entrepreneurship programs to create alternative income sources

Coordinated Inter-Ministry Approaches

Joint Economic-Social Impact Monitoring

- Establish a cross-ministry task force to track combined economic and social impacts

- Create integrated data systems to identify emerging vulnerability hotspots

- Develop coordinated response protocols based on specific impact metrics

Community-Business Integration Programs

- Business adoption of community support initiatives as part of CSR

- Localized economic development plans that connect affected businesses with community resources

- Public-private partnerships to create resilient local economic ecosystems

Public Communication and Education

- Joint public education campaigns about navigating the economic changes

- Community workshops on household financial management during price fluctuations

- Information sessions about available government support programs

Policy Coordination Framework

- Synchronized policy implementation to ensure fiscal and social measures complement each other

- Regular inter-ministry review sessions to adapt strategies as tariff impacts evolve

- Shared accountability metrics that combine economic and social welfare indicators

These coordinated approaches would help Singapore manage both the economic challenges of US tariffs and their social impacts, ensuring that fiscal measures are aligned with community needs and that vulnerable populations receive appropriate support during this period of trade uncertainty.

Long-Term Diplomatic and Labor Shifts Projections

Diplomatic Realignment

Diversification of Trade Partnerships

- Singapore will likely accelerate efforts to diversify economic partnerships beyond the US

- Increased focus on strengthening ties with:

- ASEAN neighbors (Malaysia, Indonesia, Vietnam)

- Traditional allies that maintain free trade principles (UK, EU)

- Emerging markets like India and Middle Eastern economies

- Greater emphasis on digital and green economy partnerships, as mentioned by PM Wong

Regional Integration Acceleration

- ASEAN economic integration may deepen as a defensive strategy against protectionism

- Singapore could take a leadership role in establishing stronger intra-ASEAN supply chains.

- Potential for expanded ASEAN+3 cooperation (with China, Japan, South Korea)

- Development of more robust regional trade frameworks less dependent on US market access

US-Singapore Relations Evolution

- More transactional relationships likely to emerge after decades of strategic partnership

- Singapore may maintain security cooperation while reducing economic dependence.

- A diplomatic approach will balance maintaining US ties while pursuing alternative markets.

- Long-term positioning as a neutral intermediary between competing major powers

Labor Market Structural Shifts

Industry Transformation

- Accelerated restructuring away from US-dependent manufacturing segments

- Growth in sectors serving regional markets rather than global exports

- Increased focus on:

- Digital services that face fewer tariff barriers

- Regional headquarters functions for multinational companies

- Advanced manufacturing serving ASEAN markets

Skills Development Priority Areas

- The government is likely to prioritize workforce development in:

- Digital economy skills (software development, data analytics)

- Green economy expertise (sustainable development, carbon management)

- Services that support regional integration (logistics, finance)

- Enhanced emphasis on language skills for regional markets (Bahasa, Thai, Vietnamese)

Labor Mobility Patterns

- Potential brain drain of talent to markets with stronger growth prospects

- Counterbalanced by Singapore’s positioning as a safe haven amid global uncertainty

- More Singaporean professionals may work regionally rather than globally

- Increased competition for specialized technical talent with regional neighbors

Long-Term Economic Strategy Shifts

Supply Chain Reconfiguration

- Companies will likely reorganize supply chains to minimize tariff impacts

- Potential for “tariff-optimization” manufacturing where final assembly occurs in lower-tariff nations

- Singapore may position itself as a coordination hub rather than a manufacturing center

- More complex, regionally integrated production networks likely to emerge

Economic Identity Evolution

- Gradual shift from export-oriented economy to service/coordination hub

- Enhanced focus on being a financial and logistics center for Southeast Asia

- Development of Singapore as an innovation testbed for regional market solutions

- Increased emphasis on self-reliance in strategic sectors (food, energy, technology)

Investment Approach

- More selective FDI strategy targeting companies seeking regional access

- Greater focus on developing local enterprises with regional expansion potential

- Investment in strategic infrastructure supporting regional connectivity

- Accelerated development of Singapore as the regional headquarters location

Long-Term Challenges and Opportunities

Challenges

- Managing economic transition while maintaining employment levels

- Navigating the increasing complexity of fragmented trade rules

- Balancing relationships with competing major powers

- Maintaining relevance in a more protectionist global environment

Opportunities

- Position as neutral, stable hub in a fractured global system

- Development of new expertise in navigating complex trade frameworks

- Leadership role in regional economic integration

- Potential to emerge stronger through forced economic diversification

The long-term impact will significantly depend on whether the current protectionist trend represents a temporary shift or a fundamental restructuring of the global economic order. Singapore’s historical adaptability and strategic foresight will be crucial in navigating this uncertain environment.

Scams and Anti-Scam Measures in Singapore’s Economic Context

Current Scam Landscape Amid Economic Uncertainty

Potential Increase in Scam Activities

- Economic uncertainty from US tariffs could create fertile ground for scams targeting:

- Anxious job seekers amid potential layoffs

- Businesses seeking alternative revenue streams

- Investors looking for “safe havens” during economic turbulence

- Scammers may exploit the situation by offering:

- Fake job opportunities claiming to be “tariff-proof”

- Fraudulent investment schemes promising protection from the economic downturn

- Phishing attempts impersonating government assistance programs

Common Scam Types Likely to Proliferate

- Job scams targeting workers in vulnerable sectors (manufacturing, trade)

- Investment scams promising unrealistic returns during economic uncertainty

- Business email compromise targeting companies restructuring international payments

- Government impersonation scams related to economic assistance programs

- Supply chain fraud exploiting businesses seeking new suppliers due to trade disruptions

Impact on Anti-Scam Efforts

Resource Allocation Challenges

- The government may face competing priorities between:

- Economic stabilization measures

- Anti-scam enforcement and education

- Police resources could be stretched if economic crime increases while budgets tighten

- Financial intelligence units may need to monitor new patterns of fraud related to trade diversification

Opportunities for Enhanced Cooperation

- Regional anti-scam coordination may strengthen as part of broader ASEAN cooperation

- Public-private partnerships could expand to protect vulnerable businesses and workers

- Financial institutions may develop enhanced monitoring for unusual patterns related to tariff avoidance schemes

Strategic Anti-Scam Approaches for Singapore

Targeted Education Campaigns

- Focused awareness programs for:

- Workers in sectors most affected by tariffs and potential job displacement

- Businesses exploring new markets and suppliers

- Investors seeking alternatives during market volatility

Regulatory and Enforcement Adaptations

- Enhanced monitoring of funds flowing through alternative payment channels

- Strengthened verification requirements for new business relationships

- Updated fraud detection systems to identify scams exploiting economic concerns

- Cross-border enforcement cooperation, particularly within ASEAN

Technology Solutions

- AI-powered detection of new scam narratives exploiting economic uncertainty

- Enhanced digital identity verification for government assistance programs

- Blockchain solutions for supply chain verification as businesses seek new suppliers

Business and Labor Implications

Business Protection Measures

- Companies may need to implement:

- Enhanced due diligence for new international business relationships

- Improved payment verification processes as supply chains shift

- Employee training focused on recognizing economic anxiety-based scams

Worker Protection Considerations

- Financial literacy programs focusing on economic uncertainty periods

- Job transition support with scam awareness components

- Community support networks to share information about emerging scams

Long-Term Outlook

The intersection of economic uncertainty from US tariffs and scam prevention presents both challenges and opportunities for Singapore:

- Challenges: Resource constraints, new sophisticated scam types, cross-border enforcement difficulties

- Opportunities: Enhanced regional cooperation, improved public-private partnerships, development of new anti-fraud technologies

C