by chung chinyi | Jan 24, 2026 | Uncategorized

Restaurant Overview One Prawn & Co represents Chef Gwyneth’s evolution from her Michelin Bib Gourmand prawn noodle heritage (now Zhup Zhup) into sophisticated modern Asian cuisine. Located at New Bahru, this contemporary seafood grill showcases her expertise...

by chung chinyi | Jan 24, 2026 | Uncategorized

Title: Political Sovereignty and External Intervention: Haiti’s Leadership Defies U.S. Pressure in the Proposed Removal of the Prime Minister AbstractThis paper examines the recent political maneuver by two Haitian leaders to proceed with the removal of the Prime...

by chung chinyi | Jan 24, 2026 | Uncategorized

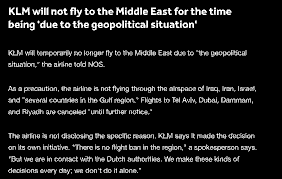

Air France‑KLM Halts Dubai, Riyadh Flights on Geopolitical Risks: A Multi‑Level Case Study of Civil Aviation Vulnerability to Middle‑East Tensions Abstract In January 2026, Air France‑KLM announced the temporary suspension of flights to Dubai, Riyadh, Dammam and...

by chung chinyi | Jan 24, 2026 | Uncategorized

Ukraine’s Two Largest Cities Under Russian Attack: An Assessment of Recent Hostilities, Civilian Harm, and Urban Resilience Author: [Your Name]Affiliation: Department of International Security Studies, [University]Date: 24 January 2026 Abstract Since the escalation of...

by chung chinyi | Jan 24, 2026 | Uncategorized

Title:From the “Trump Route” to Regional Realignment: U.S. Vice‑Presidential Engagement in Azerbaijan and Armenia and Its Implications for Asian Geopolitics Abstract On 23 January 2026 former President Donald Trump announced that U.S. Vice‑President J.D. Vance would...

by chung chinyi | Jan 23, 2026 | Uncategorized

Executive Summary Singapore consistently ranks among the world’s most expensive cities, yet this reputation requires context. In 2026, Singapore’s housing market has stabilized with HDB rentals averaging $3,500–$5,300 for a 4-room flat in central areas,...