by chung chinyi | Jan 28, 2026 | Uncategorized

Explainer: What to Know About the Nipah Virus After Cases Emerge in India – An Academic Analysis of Epidemiology, Transmission, and Public Health Preparedness in Asiactious Diseases Abstract The emergence of two confirmed cases of Nipah virus (NiV) infection in West...

by chung chinyi | Jan 28, 2026 | Uncategorized

Title:The Third Man in Singapore’s Fake‑Gold Scam: Legal, Criminological and Policy Implications of a Cheating and Weapon‑Posession Conviction Involving Caning Abstract In January 2026, the Singaporean High Court sentenced Wilderic Chan Weibin (24) to a term of...

by chung chinyi | Jan 28, 2026 | Uncategorized

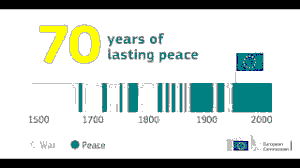

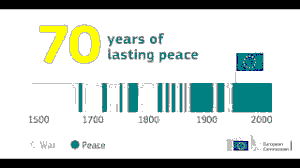

Title: Germany’s Strategic Push for a “Two-Speed” Europe: Implications for EU Integration and Transatlantic Relations AbstractThe European Union (EU) stands at a crossroads as Germany, its largest economy, advocates for a “two-speed...

by chung chinyi | Jan 28, 2026 | Uncategorized

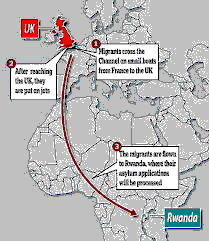

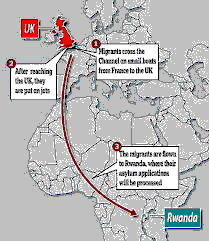

Rwanda Seeks Arbitration over the Cancellation of the United Kingdom‑Rwanda Asylum Deal: An Interdisciplinary Legal‑Political‑Economic Analysis Abstract In January 2026 the Government of Rwanda formally lodged a notice of arbitration with the Permanent Court of...

by chung chinyi | Jan 28, 2026 | Uncategorized

Title:Leadership Resignations and Interim Succession at PropertyLimBrothers (PLB): A Critical Examination of Corporate Governance, Crisis Communication, and Stakeholder Management in Singapore’s Real‑Estate Sector Abstract In late January 2026, PropertyLimBrothers...

by chung chinyi | Jan 28, 2026 | Uncategorized

Title:Tariff Threats, Diplomatic Rhetoric, and the Future of U.S.–South Korea Trade Relations: An Analysis of President Trump’s “We’ll Work Something Out” Statement in the Context of Asia’s Rapidly Evolving Economic Landscape Abstract In early 2025, President Donald...